Vintage luxury handbags funds offer a unique investment opportunity by capitalizing on the rising demand and scarcity of iconic designer pieces from brands like Hermes and Chanel. Stamps investment funds, on the other hand, provide exposure to rare and historically significant postage stamps, leveraging their enduring value and collector interest. Explore the comparative benefits and risks of vintage luxury handbags funds versus stamps investment funds to enhance your portfolio diversification.

Why it is important

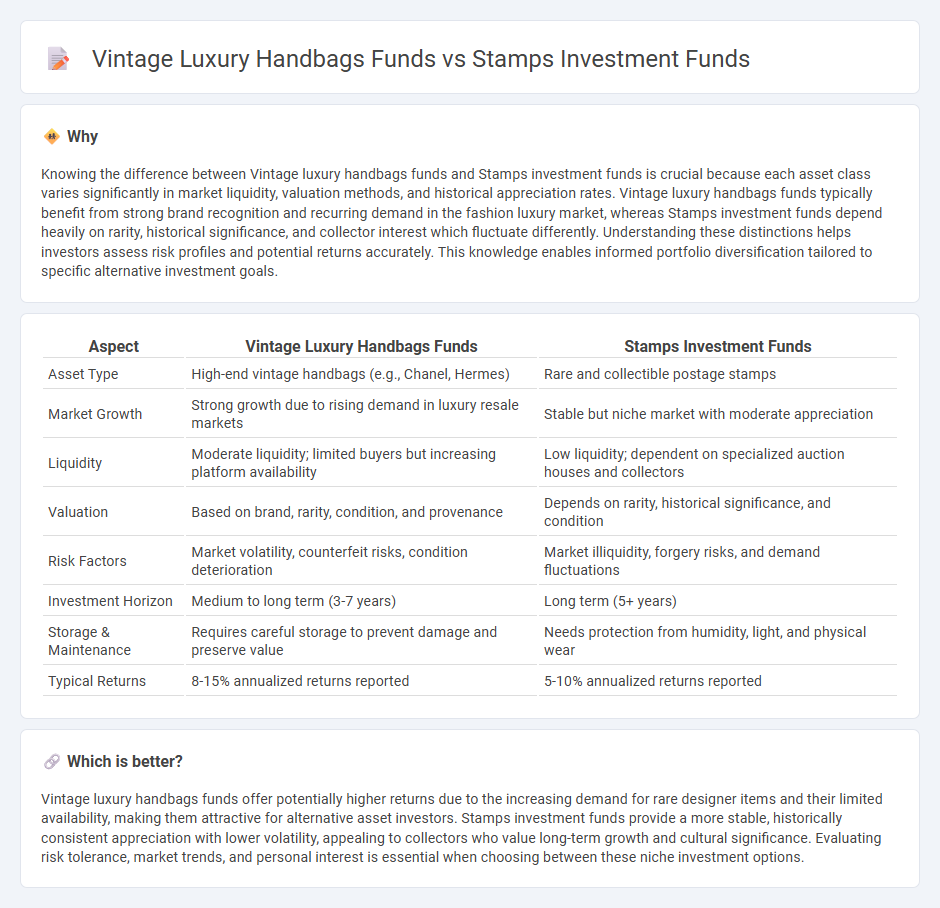

Knowing the difference between Vintage luxury handbags funds and Stamps investment funds is crucial because each asset class varies significantly in market liquidity, valuation methods, and historical appreciation rates. Vintage luxury handbags funds typically benefit from strong brand recognition and recurring demand in the fashion luxury market, whereas Stamps investment funds depend heavily on rarity, historical significance, and collector interest which fluctuate differently. Understanding these distinctions helps investors assess risk profiles and potential returns accurately. This knowledge enables informed portfolio diversification tailored to specific alternative investment goals.

Comparison Table

| Aspect | Vintage Luxury Handbags Funds | Stamps Investment Funds |

|---|---|---|

| Asset Type | High-end vintage handbags (e.g., Chanel, Hermes) | Rare and collectible postage stamps |

| Market Growth | Strong growth due to rising demand in luxury resale markets | Stable but niche market with moderate appreciation |

| Liquidity | Moderate liquidity; limited buyers but increasing platform availability | Low liquidity; dependent on specialized auction houses and collectors |

| Valuation | Based on brand, rarity, condition, and provenance | Depends on rarity, historical significance, and condition |

| Risk Factors | Market volatility, counterfeit risks, condition deterioration | Market illiquidity, forgery risks, and demand fluctuations |

| Investment Horizon | Medium to long term (3-7 years) | Long term (5+ years) |

| Storage & Maintenance | Requires careful storage to prevent damage and preserve value | Needs protection from humidity, light, and physical wear |

| Typical Returns | 8-15% annualized returns reported | 5-10% annualized returns reported |

Which is better?

Vintage luxury handbags funds offer potentially higher returns due to the increasing demand for rare designer items and their limited availability, making them attractive for alternative asset investors. Stamps investment funds provide a more stable, historically consistent appreciation with lower volatility, appealing to collectors who value long-term growth and cultural significance. Evaluating risk tolerance, market trends, and personal interest is essential when choosing between these niche investment options.

Connection

Vintage luxury handbags funds and stamps investment funds both represent alternative asset classes that appeal to collectors and investors seeking diversification beyond traditional markets. These funds leverage the scarcity, historical significance, and aesthetic value of tangible collectibles to generate long-term appreciation. Their performance is often influenced by rarity, condition, provenance, and market trends within luxury goods and philately sectors.

Key Terms

Rarity

Stamp investment funds capitalize on the rarity of limited edition and historical postage stamps, often featuring unique print errors or discontinued series that appreciate over time. Vintage luxury handbags funds focus on scarce, iconic models from brands like Hermes, Chanel, and Louis Vuitton, where provenance and limited production runs drive value increases. Discover more about how rarity influences these niche alternative investments.

Authentication

Authentication in stamps investment funds relies heavily on expert verification and historical provenance to confirm rarity and condition, which directly impact market value and investment returns. Vintage luxury handbags funds emphasize authenticity through detailed craftsmanship analysis and serial number checks, often involving brand-specific experts to prevent counterfeit risks. Explore how authentication protocols differ and influence investment strategies in alternative asset markets.

Market Liquidity

Market liquidity in stamps investment funds tends to be higher due to a broader collector base and established auction markets, enabling quicker transactions and price discovery. Vintage luxury handbags funds face lower liquidity as these assets require niche expertise, longer holding periods, and depend heavily on auction cycles and private sales. Explore more about how liquidity affects your alternative investment portfolio and risk management.

Source and External Links

Investing in Stamps: The Ultimate Guide for 2025 - Benzinga - Some stamp sellers offer capital-protected investment (CPI) stamp collections, where investors share a percentage of profit if stamps appreciate or get their money back if the value declines.

The Ultimate Guide To Investing In Stamps In 2025 - Vinovest - There are no dedicated stamp investment funds; individual rare, well-preserved, and certified stamps are typically purchased for portfolio diversification, but the stamp market generally underperforms other alternative assets over time.

How to Invest - Philosophy - Stamp Market Index - Stamp investing is currently done by acquiring individual stamps directly rather than through mutual funds or pooled investment vehicles, and typically requires deep specialized knowledge and patience.

dowidth.com

dowidth.com