Tax lien certificates offer investors a secured debt investment with potentially high returns from property tax payments and foreclosure rights, often requiring detailed local government knowledge. Real Estate Investment Trusts (REITs) provide diversified exposure to income-generating real estate assets with liquidity and dividend income, appealing to investors seeking passive investment options. Explore the key differences, benefits, and risks of tax lien certificates versus REITs to determine the best fit for your investment strategy.

Why it is important

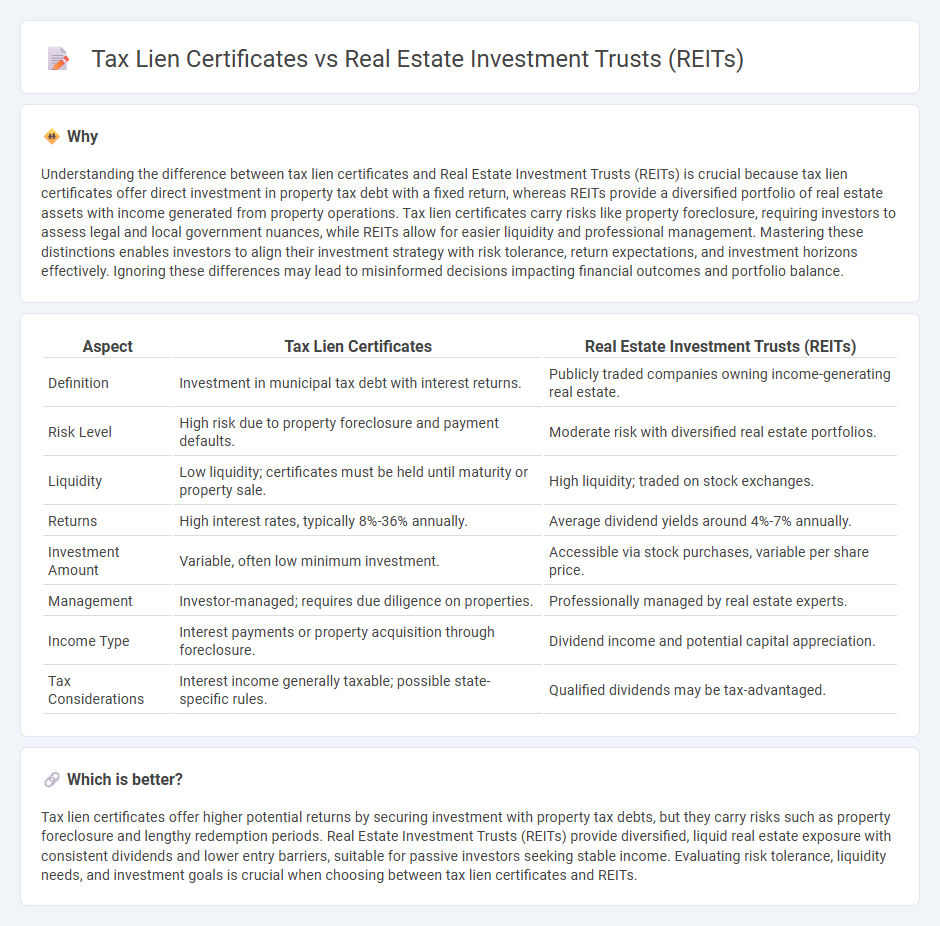

Understanding the difference between tax lien certificates and Real Estate Investment Trusts (REITs) is crucial because tax lien certificates offer direct investment in property tax debt with a fixed return, whereas REITs provide a diversified portfolio of real estate assets with income generated from property operations. Tax lien certificates carry risks like property foreclosure, requiring investors to assess legal and local government nuances, while REITs allow for easier liquidity and professional management. Mastering these distinctions enables investors to align their investment strategy with risk tolerance, return expectations, and investment horizons effectively. Ignoring these differences may lead to misinformed decisions impacting financial outcomes and portfolio balance.

Comparison Table

| Aspect | Tax Lien Certificates | Real Estate Investment Trusts (REITs) |

|---|---|---|

| Definition | Investment in municipal tax debt with interest returns. | Publicly traded companies owning income-generating real estate. |

| Risk Level | High risk due to property foreclosure and payment defaults. | Moderate risk with diversified real estate portfolios. |

| Liquidity | Low liquidity; certificates must be held until maturity or property sale. | High liquidity; traded on stock exchanges. |

| Returns | High interest rates, typically 8%-36% annually. | Average dividend yields around 4%-7% annually. |

| Investment Amount | Variable, often low minimum investment. | Accessible via stock purchases, variable per share price. |

| Management | Investor-managed; requires due diligence on properties. | Professionally managed by real estate experts. |

| Income Type | Interest payments or property acquisition through foreclosure. | Dividend income and potential capital appreciation. |

| Tax Considerations | Interest income generally taxable; possible state-specific rules. | Qualified dividends may be tax-advantaged. |

Which is better?

Tax lien certificates offer higher potential returns by securing investment with property tax debts, but they carry risks such as property foreclosure and lengthy redemption periods. Real Estate Investment Trusts (REITs) provide diversified, liquid real estate exposure with consistent dividends and lower entry barriers, suitable for passive investors seeking stable income. Evaluating risk tolerance, liquidity needs, and investment goals is crucial when choosing between tax lien certificates and REITs.

Connection

Tax lien certificates and real estate investment trusts (REITs) are connected through their involvement in real estate financing and investment. Tax lien certificates provide a way to generate income from delinquent property taxes, while REITs pool investor capital to own, operate, or finance income-generating real estate, including properties with tax liens. Both investment vehicles offer distinct risk-return profiles and liquidity levels, making them complementary options for diversifying a real estate-focused investment portfolio.

Key Terms

Equity Ownership

Real Estate Investment Trusts (REITs) offer investors equity ownership in diversified real estate portfolios, providing regular dividend income and potential for capital appreciation. Tax lien certificates represent a secured interest against a property for unpaid taxes, enabling investors to earn interest but without direct ownership rights or control. Explore the differences further to determine which investment aligns with your financial goals.

Income Distribution

Real estate investment trusts (REITs) typically distribute at least 90% of their taxable income to shareholders as dividends, providing a steady income stream backed by property assets. Tax lien certificates generate income through interest payments on delinquent property taxes, often yielding higher returns but with increased risk and variability in payment timing. Explore the nuances of income distribution in REITs and tax lien certificates to optimize your investment income strategy.

Risk Profile

Real estate investment trusts (REITs) typically offer lower risk due to diversified property portfolios and professional management, providing steady income through dividends. Tax lien certificates involve higher risk as returns depend on property owners repaying delinquent taxes or the potential acquisition of foreclosed properties, which can be unpredictable and require extensive legal knowledge. Explore the nuances of REITs and tax lien certificates to determine which investment aligns with your risk tolerance and financial goals.

Source and External Links

Real estate investment trust - Wikipedia - REITs are companies that own and operate income-producing real estate like office buildings, apartments, and shopping centers and are classified as equity, mortgage, or hybrid, often offering tax advantages and paying most of their income as dividends.

What's a REIT (Real Estate Investment Trust)? - Nareit - Modeled after mutual funds, REITs allow investors to earn regular income and achieve diversification by owning shares in portfolios of income-generating real estate assets, typically trading on major exchanges.

Real Estate Investment Trusts (REITs) - Investor.gov - REITs enable individuals to invest in large-scale commercial properties without direct ownership, with most structured as publicly traded companies but some available as non-traded or private entities.

dowidth.com

dowidth.com