Fine art micro-shares allow investors to buy fractional ownership in valuable artworks, providing access to a traditionally exclusive market with potential for appreciation and portfolio diversification. Startup equity crowdfunding enables investors to purchase stakes in early-stage companies, offering opportunities for high growth alongside higher risk and longer holding periods. Explore the key differences and benefits of these investment options to determine which aligns best with your financial goals.

Why it is important

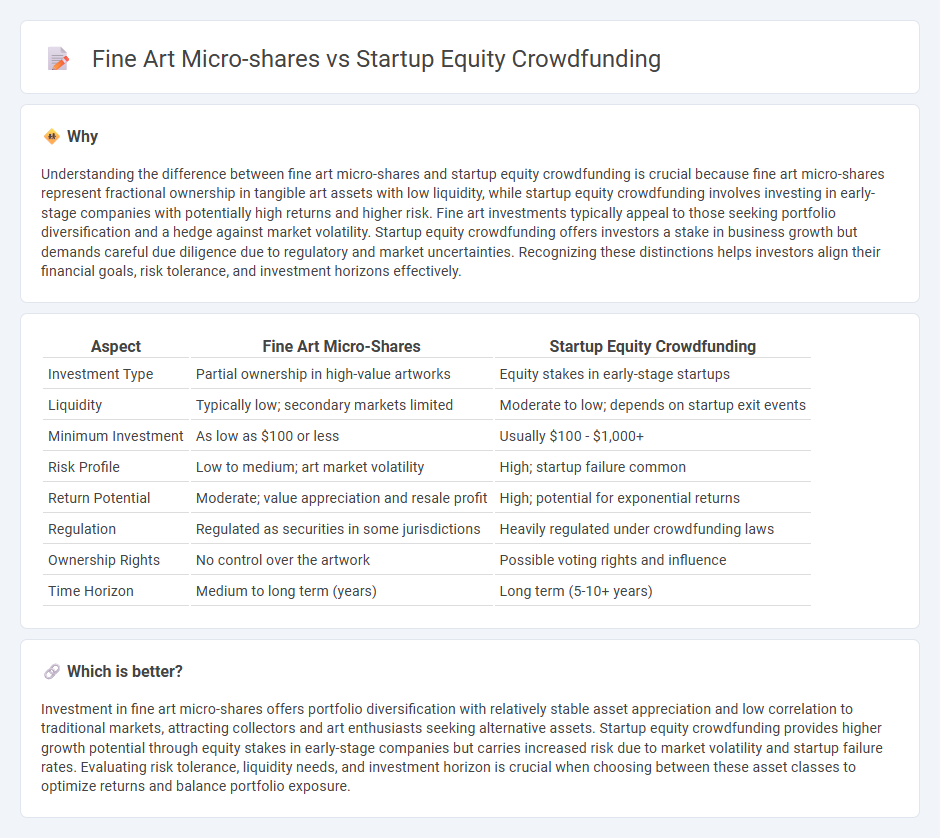

Understanding the difference between fine art micro-shares and startup equity crowdfunding is crucial because fine art micro-shares represent fractional ownership in tangible art assets with low liquidity, while startup equity crowdfunding involves investing in early-stage companies with potentially high returns and higher risk. Fine art investments typically appeal to those seeking portfolio diversification and a hedge against market volatility. Startup equity crowdfunding offers investors a stake in business growth but demands careful due diligence due to regulatory and market uncertainties. Recognizing these distinctions helps investors align their financial goals, risk tolerance, and investment horizons effectively.

Comparison Table

| Aspect | Fine Art Micro-Shares | Startup Equity Crowdfunding |

|---|---|---|

| Investment Type | Partial ownership in high-value artworks | Equity stakes in early-stage startups |

| Liquidity | Typically low; secondary markets limited | Moderate to low; depends on startup exit events |

| Minimum Investment | As low as $100 or less | Usually $100 - $1,000+ |

| Risk Profile | Low to medium; art market volatility | High; startup failure common |

| Return Potential | Moderate; value appreciation and resale profit | High; potential for exponential returns |

| Regulation | Regulated as securities in some jurisdictions | Heavily regulated under crowdfunding laws |

| Ownership Rights | No control over the artwork | Possible voting rights and influence |

| Time Horizon | Medium to long term (years) | Long term (5-10+ years) |

Which is better?

Investment in fine art micro-shares offers portfolio diversification with relatively stable asset appreciation and low correlation to traditional markets, attracting collectors and art enthusiasts seeking alternative assets. Startup equity crowdfunding provides higher growth potential through equity stakes in early-stage companies but carries increased risk due to market volatility and startup failure rates. Evaluating risk tolerance, liquidity needs, and investment horizon is crucial when choosing between these asset classes to optimize returns and balance portfolio exposure.

Connection

Fine art micro-shares and startup equity crowdfunding both democratize investment by enabling fractional ownership, allowing individual investors to access high-value assets with lower capital requirements. These alternative investment models leverage digital platforms to facilitate transparency, liquidity, and broader market participation. The convergence of these methods reflects a growing trend in diversified portfolio strategies that blend tangible assets with early-stage business equity.

Key Terms

**Startup equity crowdfunding:**

Startup equity crowdfunding enables individual investors to purchase shares in early-stage companies, offering potential high returns alongside significant risks. Platforms like SeedInvest, Republic, and Crowdcube facilitate access to startup equity, democratizing venture capital and allowing investors to diversify portfolios beyond traditional stocks. Explore more about startup equity crowdfunding opportunities and investment strategies to maximize growth potential.

Valuation

Startup equity crowdfunding valuation relies heavily on projected company growth, market potential, and financial forecasts, often leading to dynamic fluctuations based on business performance and investor sentiment. Fine art micro-shares valuation depends on the artwork's provenance, historical significance, and market demand for comparable pieces, creating a more stable yet niche-driven asset value. Explore more insights into how these valuation methodologies impact investment strategies and risk profiles.

Equity stake

Startup equity crowdfunding offers investors ownership stakes in emerging companies, providing potential for significant financial returns through equity appreciation and dividends. Fine art micro-shares represent fractional ownership in high-value artworks, allowing investors to benefit from art market appreciation without full asset acquisition. Explore the differences in equity stakes between these investment platforms to understand which aligns best with your financial goals.

Source and External Links

What is Equity Crowdfunding? Pros & Cons and How it Works - Equity crowdfunding allows startups to raise capital by offering ownership stakes to a large pool of investors via online platforms, enabling access to funds without taking on debt while sharing future success with investors.

Equity Crowdfunding: Pros & Cons of Funding Options - Nav - Equity crowdfunding enables entrepreneurs to get funds from both individual and institutional investors in exchange for equity shares, without repayment obligations, and is useful especially when traditional loans or venture capital are inaccessible.

What is crowdfunding? Here are four types to know - Equity crowdfunding involves investors receiving shares of the company, allowing startups to raise larger amounts through investors who seek returns and may provide expertise, though it comes with challenges like ownership dilution, regulatory complexity, and increased reporting requirements.

dowidth.com

dowidth.com