Collectibles investment involves acquiring tangible assets like art, rare coins, or vintage cars, which often appreciate based on rarity and market demand. Private equity investment focuses on purchasing ownership stakes in private companies with the goal of driving growth and achieving high returns through active management and eventual exit events. Explore detailed comparisons to determine which investment strategy aligns best with your financial goals.

Why it is important

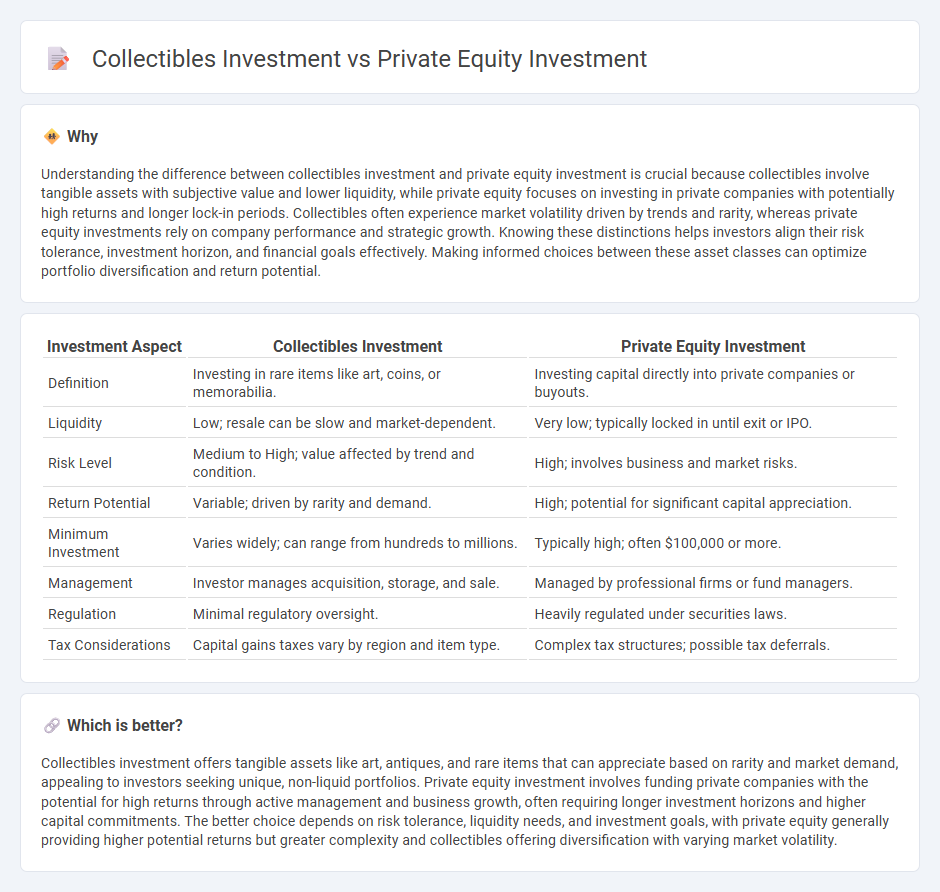

Understanding the difference between collectibles investment and private equity investment is crucial because collectibles involve tangible assets with subjective value and lower liquidity, while private equity focuses on investing in private companies with potentially high returns and longer lock-in periods. Collectibles often experience market volatility driven by trends and rarity, whereas private equity investments rely on company performance and strategic growth. Knowing these distinctions helps investors align their risk tolerance, investment horizon, and financial goals effectively. Making informed choices between these asset classes can optimize portfolio diversification and return potential.

Comparison Table

| Investment Aspect | Collectibles Investment | Private Equity Investment |

|---|---|---|

| Definition | Investing in rare items like art, coins, or memorabilia. | Investing capital directly into private companies or buyouts. |

| Liquidity | Low; resale can be slow and market-dependent. | Very low; typically locked in until exit or IPO. |

| Risk Level | Medium to High; value affected by trend and condition. | High; involves business and market risks. |

| Return Potential | Variable; driven by rarity and demand. | High; potential for significant capital appreciation. |

| Minimum Investment | Varies widely; can range from hundreds to millions. | Typically high; often $100,000 or more. |

| Management | Investor manages acquisition, storage, and sale. | Managed by professional firms or fund managers. |

| Regulation | Minimal regulatory oversight. | Heavily regulated under securities laws. |

| Tax Considerations | Capital gains taxes vary by region and item type. | Complex tax structures; possible tax deferrals. |

Which is better?

Collectibles investment offers tangible assets like art, antiques, and rare items that can appreciate based on rarity and market demand, appealing to investors seeking unique, non-liquid portfolios. Private equity investment involves funding private companies with the potential for high returns through active management and business growth, often requiring longer investment horizons and higher capital commitments. The better choice depends on risk tolerance, liquidity needs, and investment goals, with private equity generally providing higher potential returns but greater complexity and collectibles offering diversification with varying market volatility.

Connection

Collectibles investment and private equity investment both focus on acquiring tangible or intangible assets with the potential for significant appreciation over time. Collectibles, such as art, rare coins, and vintage cars, share similarities with private equity in that both require specialized knowledge, long-term commitment, and market expertise to identify undervalued opportunities. The connection lies in their alternative investment nature, providing portfolio diversification beyond traditional stocks and bonds while catering to investors seeking unique asset classes with potentially high returns.

Key Terms

**Private Equity Investment:**

Private equity investment involves acquiring ownership stakes in private companies, aiming for long-term capital appreciation through strategic management and operational improvements. This asset class typically requires substantial capital commitment, offers less liquidity compared to public equities, and is driven by detailed financial analysis and market expertise. Explore more about the benefits, risks, and strategies of private equity investment to enhance your portfolio diversification.

Buyout

Buyout private equity investments involve acquiring controlling stakes in established companies to improve operational efficiencies and drive growth, often with the goal of resale at a higher valuation. In contrast, collectibles investment focuses on acquiring rare items such as art, coins, or vintage cars, with value appreciation driven by rarity, demand, and market trends rather than company performance. Explore detailed comparisons and strategies for maximizing returns in buyout private equity and collectibles investments.

Limited Partner (LP)

Limited Partners (LPs) in private equity investments commit capital to funds managed by General Partners, benefiting from diversified portfolios and potential high returns through long-term equity stakes in private companies. Collectibles investments, such as art, rare coins, or vintage cars, attract LPs seeking tangible assets with unique value appreciation and less correlation to traditional financial markets. Explore detailed comparisons to understand risk profiles, liquidity, and return expectations for LPs in both investment types.

Source and External Links

An Introduction to Private Equity Basics | Morgan Stanley - Private equity (PE) involves equity or equity-like investments in private companies or assets not listed on stock exchanges, managed by general partners who typically hold investments for several years before exiting at a gain.

Private equity - Wikipedia - Private equity consists of investments in private companies, funded by institutional investors via specialized funds, with managers aiming to enhance value through strategies like revenue growth, cost reduction, and governance restructuring over a typical 4-7 year period.

Private Equity: What You Need to Know - KKR - Private equity strategies focus on improving the performance of non-public companies by strengthening management, streamlining operations, and optimizing capital structure to generate stronger returns before eventual exit.

dowidth.com

dowidth.com