Private credit funds offer investors access to direct lending opportunities with potentially higher yield and lower volatility compared to traditional fixed income assets. Real estate funds focus on acquiring, managing, and developing property assets, providing income through rent and capital appreciation. Explore the unique benefits and risks of each fund type to make informed investment decisions.

Why it is important

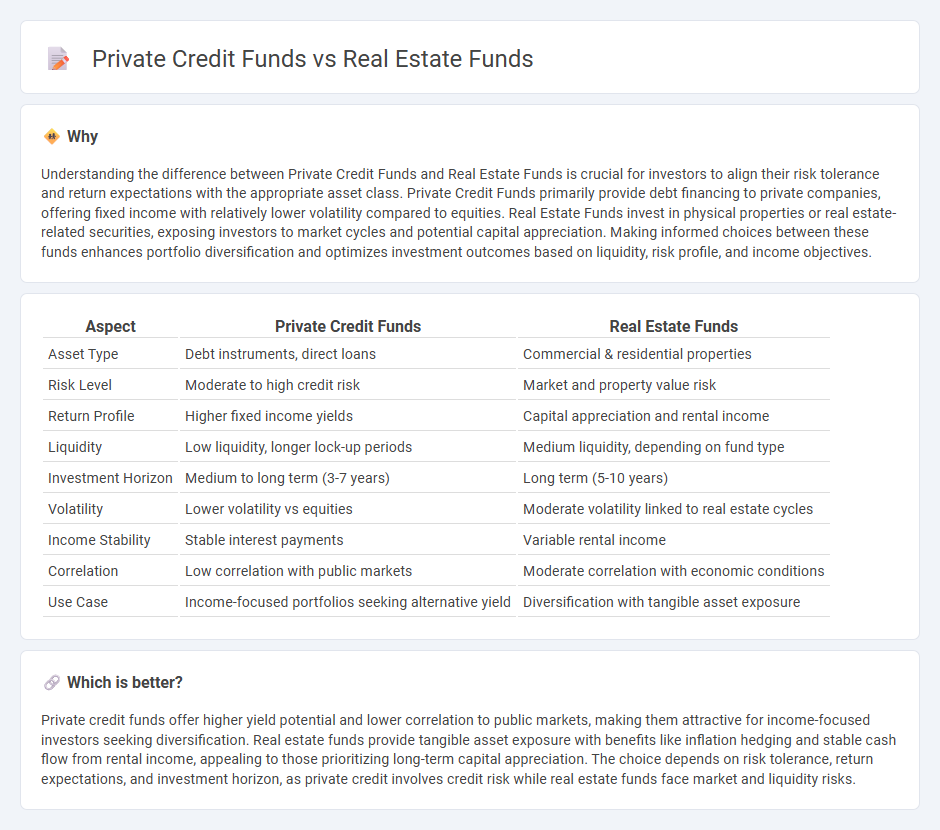

Understanding the difference between Private Credit Funds and Real Estate Funds is crucial for investors to align their risk tolerance and return expectations with the appropriate asset class. Private Credit Funds primarily provide debt financing to private companies, offering fixed income with relatively lower volatility compared to equities. Real Estate Funds invest in physical properties or real estate-related securities, exposing investors to market cycles and potential capital appreciation. Making informed choices between these funds enhances portfolio diversification and optimizes investment outcomes based on liquidity, risk profile, and income objectives.

Comparison Table

| Aspect | Private Credit Funds | Real Estate Funds |

|---|---|---|

| Asset Type | Debt instruments, direct loans | Commercial & residential properties |

| Risk Level | Moderate to high credit risk | Market and property value risk |

| Return Profile | Higher fixed income yields | Capital appreciation and rental income |

| Liquidity | Low liquidity, longer lock-up periods | Medium liquidity, depending on fund type |

| Investment Horizon | Medium to long term (3-7 years) | Long term (5-10 years) |

| Volatility | Lower volatility vs equities | Moderate volatility linked to real estate cycles |

| Income Stability | Stable interest payments | Variable rental income |

| Correlation | Low correlation with public markets | Moderate correlation with economic conditions |

| Use Case | Income-focused portfolios seeking alternative yield | Diversification with tangible asset exposure |

Which is better?

Private credit funds offer higher yield potential and lower correlation to public markets, making them attractive for income-focused investors seeking diversification. Real estate funds provide tangible asset exposure with benefits like inflation hedging and stable cash flow from rental income, appealing to those prioritizing long-term capital appreciation. The choice depends on risk tolerance, return expectations, and investment horizon, as private credit involves credit risk while real estate funds face market and liquidity risks.

Connection

Private credit funds and real estate funds are connected through their shared focus on alternative investments outside traditional public markets. Both fund types often collaborate, with private credit funds providing debt financing for real estate projects, enhancing liquidity and capital access. This synergy allows real estate funds to optimize property acquisitions and development while private credit funds achieve diversified, risk-adjusted returns.

Key Terms

**Real Estate Funds:**

Real estate funds invest primarily in property assets such as commercial, residential, and industrial real estate, offering investors exposure to rental income and property value appreciation. These funds provide diversification benefits and potential inflation hedging, with returns driven by market conditions, occupancy rates, and property management expertise. Explore how real estate funds can fit into your portfolio and generate steady cash flow by learning more about their advantages and risks.

Property Appreciation

Real estate funds primarily generate returns through property appreciation by investing in residential, commercial, or industrial properties, benefiting from market-driven asset value increases and rental income. Private credit funds focus on lending to real estate projects or developers, earning income from interest payments rather than direct property value gains. Explore detailed comparisons to understand which investment aligns best with your financial goals and risk tolerance.

Rental Income

Rental income generated by real estate funds typically provides a steady cash flow derived from leased residential or commercial properties, offering investors consistent returns linked to property market stability. In contrast, private credit funds earn income through interest payments on loans extended to businesses or individuals, with returns that fluctuate based on borrower creditworthiness and loan terms. Explore more about how these income streams impact investment strategies and risk profiles.

Source and External Links

How to Set Up a Private Equity Real Estate Fund - This article guides on setting up and managing private equity real estate funds, including various strategies like value-add and opportunity funds.

Private Real Estate Investment Funds - DLP Capital offers private real estate funds focusing on strong returns through expertly managed investments, targeting high current income and capital appreciation.

List of REITs & Real Estate Funds - Provides a list of real estate funds, including mutual funds and ETFs, which allow investors to access the real estate asset class through REITs and other vehicles.

dowidth.com

dowidth.com