Investing in whale watching shares exposes investors to the growing eco-tourism market, benefiting from rising demand for sustainable and experiential travel options. SPACs (Special Purpose Acquisition Companies) offer a unique investment vehicle that allows investors to participate in a faster route to public markets with potential for high returns but increased risk due to their speculative nature. Explore the advantages and challenges of both investment types to make an informed decision tailored to your portfolio goals.

Why it is important

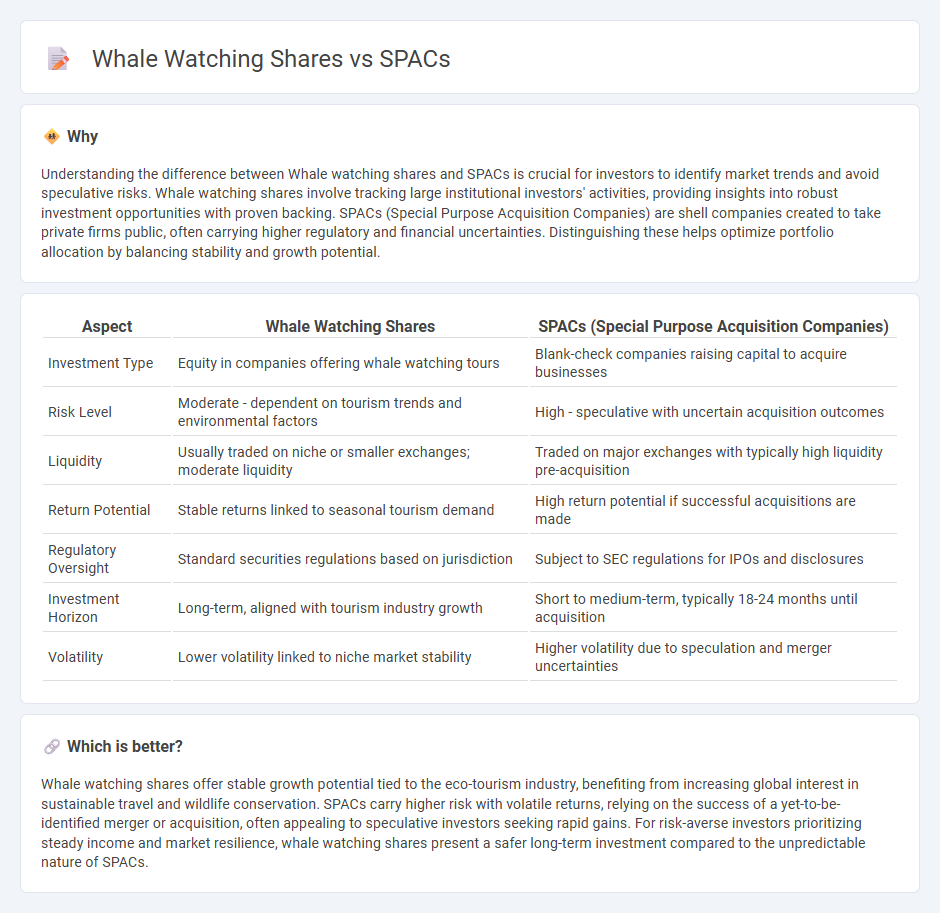

Understanding the difference between Whale watching shares and SPACs is crucial for investors to identify market trends and avoid speculative risks. Whale watching shares involve tracking large institutional investors' activities, providing insights into robust investment opportunities with proven backing. SPACs (Special Purpose Acquisition Companies) are shell companies created to take private firms public, often carrying higher regulatory and financial uncertainties. Distinguishing these helps optimize portfolio allocation by balancing stability and growth potential.

Comparison Table

| Aspect | Whale Watching Shares | SPACs (Special Purpose Acquisition Companies) |

|---|---|---|

| Investment Type | Equity in companies offering whale watching tours | Blank-check companies raising capital to acquire businesses |

| Risk Level | Moderate - dependent on tourism trends and environmental factors | High - speculative with uncertain acquisition outcomes |

| Liquidity | Usually traded on niche or smaller exchanges; moderate liquidity | Traded on major exchanges with typically high liquidity pre-acquisition |

| Return Potential | Stable returns linked to seasonal tourism demand | High return potential if successful acquisitions are made |

| Regulatory Oversight | Standard securities regulations based on jurisdiction | Subject to SEC regulations for IPOs and disclosures |

| Investment Horizon | Long-term, aligned with tourism industry growth | Short to medium-term, typically 18-24 months until acquisition |

| Volatility | Lower volatility linked to niche market stability | Higher volatility due to speculation and merger uncertainties |

Which is better?

Whale watching shares offer stable growth potential tied to the eco-tourism industry, benefiting from increasing global interest in sustainable travel and wildlife conservation. SPACs carry higher risk with volatile returns, relying on the success of a yet-to-be-identified merger or acquisition, often appealing to speculative investors seeking rapid gains. For risk-averse investors prioritizing steady income and market resilience, whale watching shares present a safer long-term investment compared to the unpredictable nature of SPACs.

Connection

Whale watching shares experience volatility influenced by SPACs (Special Purpose Acquisition Companies) due to the rising trend of eco-tourism investments attracting SPAC-funded companies. SPACs facilitate faster public listings for emerging whale watching enterprises, increasing market liquidity and exposure. This connection underscores the growing investor interest in sustainable tourism sectors driven by innovative financial vehicles.

Key Terms

IPO (Initial Public Offering)

SPACs (Special Purpose Acquisition Companies) offer a streamlined IPO process that allows companies to go public more quickly compared to traditional whale watching shares seeking IPOs. Whale watching companies entering the stock market typically face extensive regulatory scrutiny and market volatility, impacting share price stability during their IPO. Explore detailed comparisons of SPACs and whale watching IPOs to understand investment opportunities and risks.

Beneficial Ownership

SPACs (Special Purpose Acquisition Companies) often showcase concentrated beneficial ownership with a few key investors holding significant stakes, while whale watching shares typically display more dispersed ownership among smaller, individual investors. Analyzing beneficial ownership provides crucial insights into control dynamics and potential market influence within these sectors. Explore the implications of beneficial ownership on these investment vehicles to make informed decisions.

PIPE (Private Investment in Public Equity)

PIPE transactions play a critical role in both SPACs and whale watching shares by providing essential capital infusion from private investors into public companies. In SPACs, PIPE investments often serve to solidify the merger deal and ensure sufficient funding for the business combination, whereas in whale watching shares, PIPEs help fuel operational expansion and sustainable tourism initiatives. Explore the strategic impact of PIPE deals to understand their influence on market confidence and growth potential.

Source and External Links

Special-purpose acquisition company - Wikipedia - A SPAC is a shell company listed on stock exchanges to raise funds through an IPO with the sole purpose of acquiring a private company and taking it public via a merger, often with fewer regulatory requirements than a traditional IPO.

SPACs | Investor.gov - SPACs are blank check companies that become publicly traded without operations, aiming to merge with private companies and facilitate their transition to public markets with potential advantages in pricing and deal control compared to traditional IPOs.

SPACs explained - Fidelity Investments - SPACs raise funds through an IPO and typically have a time limit to complete an acquisition; if no deal is made, funds are returned, and investors receive shares plus warrants, with recent regulatory changes separating voting rights from redemption rights to influence deal success.

dowidth.com

dowidth.com