Music royalties investment offers a unique opportunity to generate passive income through digital streams and licensing royalties, benefiting from the growing global music consumption market valued at over $60 billion annually. Collectibles investment focuses on physical assets like rare art, vintage toys, and historical memorabilia, which appreciate based on rarity, condition, and market demand, with the collectibles market expected to reach $530 billion by 2027. Explore how these distinct investment avenues compare in risk, liquidity, and growth potential to diversify your portfolio effectively.

Why it is important

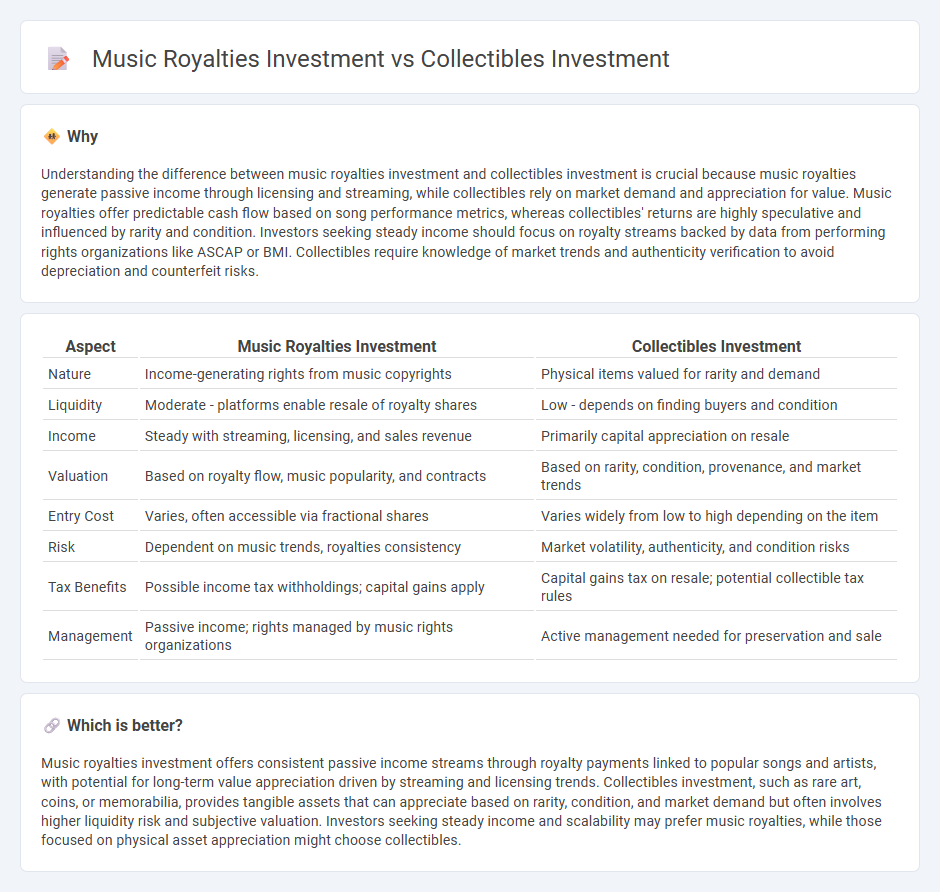

Understanding the difference between music royalties investment and collectibles investment is crucial because music royalties generate passive income through licensing and streaming, while collectibles rely on market demand and appreciation for value. Music royalties offer predictable cash flow based on song performance metrics, whereas collectibles' returns are highly speculative and influenced by rarity and condition. Investors seeking steady income should focus on royalty streams backed by data from performing rights organizations like ASCAP or BMI. Collectibles require knowledge of market trends and authenticity verification to avoid depreciation and counterfeit risks.

Comparison Table

| Aspect | Music Royalties Investment | Collectibles Investment |

|---|---|---|

| Nature | Income-generating rights from music copyrights | Physical items valued for rarity and demand |

| Liquidity | Moderate - platforms enable resale of royalty shares | Low - depends on finding buyers and condition |

| Income | Steady with streaming, licensing, and sales revenue | Primarily capital appreciation on resale |

| Valuation | Based on royalty flow, music popularity, and contracts | Based on rarity, condition, provenance, and market trends |

| Entry Cost | Varies, often accessible via fractional shares | Varies widely from low to high depending on the item |

| Risk | Dependent on music trends, royalties consistency | Market volatility, authenticity, and condition risks |

| Tax Benefits | Possible income tax withholdings; capital gains apply | Capital gains tax on resale; potential collectible tax rules |

| Management | Passive income; rights managed by music rights organizations | Active management needed for preservation and sale |

Which is better?

Music royalties investment offers consistent passive income streams through royalty payments linked to popular songs and artists, with potential for long-term value appreciation driven by streaming and licensing trends. Collectibles investment, such as rare art, coins, or memorabilia, provides tangible assets that can appreciate based on rarity, condition, and market demand but often involves higher liquidity risk and subjective valuation. Investors seeking steady income and scalability may prefer music royalties, while those focused on physical asset appreciation might choose collectibles.

Connection

Music royalties investment and collectibles investment both offer alternative asset classes that capitalize on intellectual property and cultural demand, providing diversified revenue streams outside traditional markets. Investors gain exposure to unique, often appreciating assets driven by fan engagement, historical significance, and rarity, which can generate consistent passive income and long-term value appreciation. These investments benefit from increasing digital consumption of media and the growing collectibles market fueled by niche communities and secondary market platforms.

Key Terms

Collectibles investment:

Collectibles investment involves acquiring rare items such as vintage toys, stamps, coins, or artwork that appreciate over time due to scarcity and demand. This market offers tangible assets with potential for significant long-term returns, often driven by trends in cultural nostalgia and rarity. Explore more about how collectibles can diversify your portfolio and provide unique financial opportunities.

Provenance

Provenance plays a critical role in both collectibles and music royalties investments, ensuring authenticity and historical significance that drive value appreciation. Collectibles rely heavily on verified ownership history and physical condition, while music royalties depend on transparent tracking of rights and revenue flows tied to specific recorded works. Discover the nuances of Provenance in these investment types to make informed decisions.

Rarity

Collectibles investment thrives on rarity, with limited edition items and unique historical artifacts driving higher market value due to their scarcity and demand among passionate collectors. Music royalties investment also hinges on rarity but in the form of exclusive rights to rare, high-performing songs or catalogs that generate consistent, often passive, income through streaming, licensing, and airplay. Explore deeper insights on how rarity shapes these alternative investments and discover which option best fits your portfolio strategy.

Source and External Links

Types of Collectible Investments To Consider - SmartAsset - Collectibles like classic cars, fine art, wine, sports memorabilia, comics, and sneakers offer a way to diversify portfolios with the potential for appreciation, but require careful research, storage, and can be less liquid than traditional investments.

Collectible Investments: 10 Best Assets in 2025 + Insider Tips - Investing in collectibles provides personal satisfaction and portfolio diversification, with assets such as investment-grade wine, comics, toys, stamps, fine art, coins, sports memorabilia, and sneakers often showing low correlation to stocks and bonds and potential for high returns.

Investing In The $500 Billion Collectibles Market: How To Get Started - Some collectibles can be invested in directly, while others (like art and spirits) offer institutionalized investment platforms where investors buy shares in curated collections, though these come with fees and liquidity considerations; successful collectible investing requires market knowledge, trend anticipation, and building networks.

dowidth.com

dowidth.com