Esports franchises leverage competitive gaming audiences to drive revenue through sponsorships, merchandise, and event ticket sales, while media companies capitalize on content creation, advertising, and subscription models for sustained growth. Investment in esports franchises often involves community engagement and real-time fan interaction, contrasting with media companies' focus on broad content distribution and intellectual property rights. Explore how these distinct investment strategies shape the evolving landscape of digital entertainment.

Why it is important

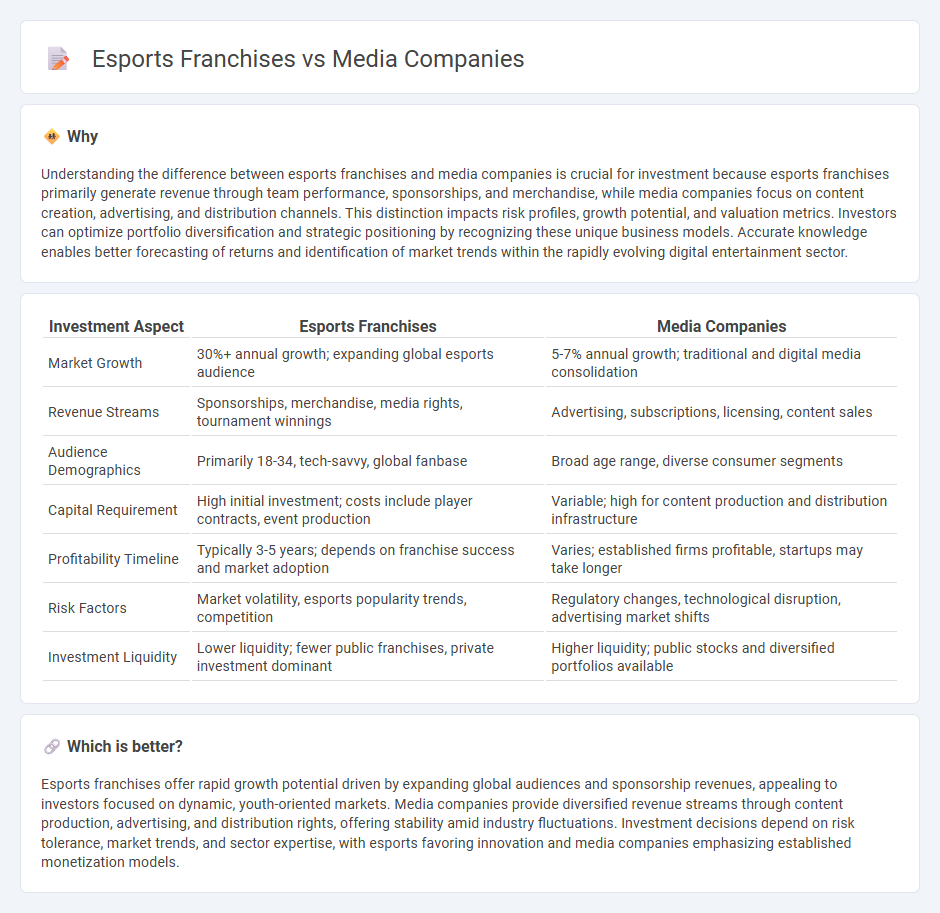

Understanding the difference between esports franchises and media companies is crucial for investment because esports franchises primarily generate revenue through team performance, sponsorships, and merchandise, while media companies focus on content creation, advertising, and distribution channels. This distinction impacts risk profiles, growth potential, and valuation metrics. Investors can optimize portfolio diversification and strategic positioning by recognizing these unique business models. Accurate knowledge enables better forecasting of returns and identification of market trends within the rapidly evolving digital entertainment sector.

Comparison Table

| Investment Aspect | Esports Franchises | Media Companies |

|---|---|---|

| Market Growth | 30%+ annual growth; expanding global esports audience | 5-7% annual growth; traditional and digital media consolidation |

| Revenue Streams | Sponsorships, merchandise, media rights, tournament winnings | Advertising, subscriptions, licensing, content sales |

| Audience Demographics | Primarily 18-34, tech-savvy, global fanbase | Broad age range, diverse consumer segments |

| Capital Requirement | High initial investment; costs include player contracts, event production | Variable; high for content production and distribution infrastructure |

| Profitability Timeline | Typically 3-5 years; depends on franchise success and market adoption | Varies; established firms profitable, startups may take longer |

| Risk Factors | Market volatility, esports popularity trends, competition | Regulatory changes, technological disruption, advertising market shifts |

| Investment Liquidity | Lower liquidity; fewer public franchises, private investment dominant | Higher liquidity; public stocks and diversified portfolios available |

Which is better?

Esports franchises offer rapid growth potential driven by expanding global audiences and sponsorship revenues, appealing to investors focused on dynamic, youth-oriented markets. Media companies provide diversified revenue streams through content production, advertising, and distribution rights, offering stability amid industry fluctuations. Investment decisions depend on risk tolerance, market trends, and sector expertise, with esports favoring innovation and media companies emphasizing established monetization models.

Connection

Esports franchises and media companies collaborate extensively to maximize audience engagement and revenue through content distribution and sponsorship deals. Media companies provide critical broadcasting platforms that amplify esports events, enabling franchises to reach global viewers and attract advertising investments. This symbiotic relationship drives the growth of the esports ecosystem by enhancing visibility and creating diverse monetization opportunities.

Key Terms

Revenue Streams

Media companies primarily generate revenue through advertising, subscriptions, and content licensing, leveraging broad audience reach and diverse multimedia platforms. Esports franchises focus on revenue streams such as sponsorship deals, merchandise sales, ticketing for live events, and broadcasting rights within the competitive gaming ecosystem. Explore deeper insights into how these industries structure their financial strategies for sustained growth and competitive advantage.

Valuation

Media companies consistently achieve higher market valuations than esports franchises due to diversified revenue streams, established brand equity, and broader audience reach. Esports franchises show rapid growth potential but remain comparatively undervalued, driven primarily by competitive prize pools, sponsorship deals, and digital content monetization. Explore the latest valuation trends and compare financial metrics to understand the evolving landscape of media companies and esports franchises.

Intellectual Property (IP)

Media companies leverage extensive Intellectual Property portfolios including original content, patents, and trademarks to strengthen brand presence and drive revenue. Esports franchises focus on IP related to game titles, team branding, and streaming rights, creating exclusive value through player contracts and digital assets. Explore the contrasting IP strategies shaping innovation and market dominance in these dynamic industries.

Source and External Links

13 Examples of Media Companies that Know Their Audience - Features media companies like Vice Media, Hollywood.com, and IGN, highlighting their audience focus and content strategies.

Media & Communication Companies | Indeed.com - Lists major media companies including NBCUniversal, Warner Bros. Discovery, ESPN, and The Walt Disney Company with company overviews and employee reviews.

33 Digital Media Companies to Know 2025 | Built In - Covers digital media firms such as Optimum, Medium, MediaNews Group, and Multi Media that specialize in digital content distribution, advertising, and streaming platforms.

dowidth.com

dowidth.com