Esports franchises have rapidly become major players in the investment world, attracting substantial funding due to their global audience reach and digital engagement. Entertainment conglomerates leverage their vast resources and content distribution networks to enter the esports market, aiming to diversify revenue streams and capitalize on emerging trends. Explore how investment dynamics shape the competitive landscape between these two powerful entities.

Why it is important

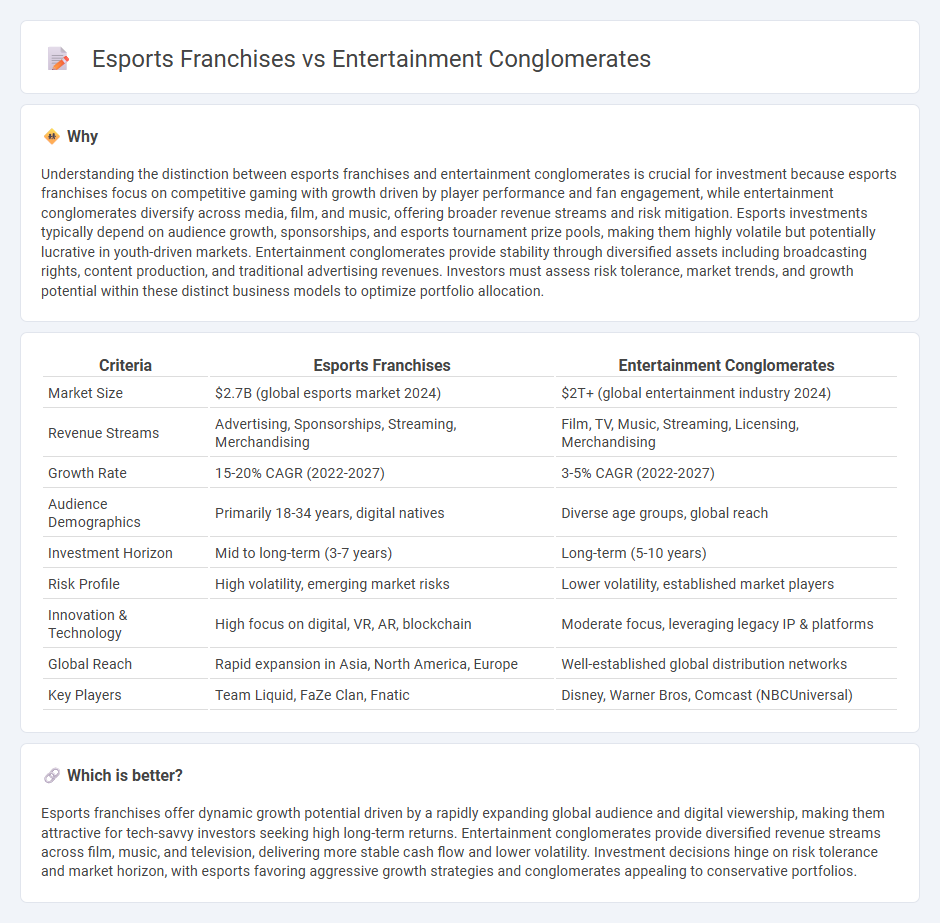

Understanding the distinction between esports franchises and entertainment conglomerates is crucial for investment because esports franchises focus on competitive gaming with growth driven by player performance and fan engagement, while entertainment conglomerates diversify across media, film, and music, offering broader revenue streams and risk mitigation. Esports investments typically depend on audience growth, sponsorships, and esports tournament prize pools, making them highly volatile but potentially lucrative in youth-driven markets. Entertainment conglomerates provide stability through diversified assets including broadcasting rights, content production, and traditional advertising revenues. Investors must assess risk tolerance, market trends, and growth potential within these distinct business models to optimize portfolio allocation.

Comparison Table

| Criteria | Esports Franchises | Entertainment Conglomerates |

|---|---|---|

| Market Size | $2.7B (global esports market 2024) | $2T+ (global entertainment industry 2024) |

| Revenue Streams | Advertising, Sponsorships, Streaming, Merchandising | Film, TV, Music, Streaming, Licensing, Merchandising |

| Growth Rate | 15-20% CAGR (2022-2027) | 3-5% CAGR (2022-2027) |

| Audience Demographics | Primarily 18-34 years, digital natives | Diverse age groups, global reach |

| Investment Horizon | Mid to long-term (3-7 years) | Long-term (5-10 years) |

| Risk Profile | High volatility, emerging market risks | Lower volatility, established market players |

| Innovation & Technology | High focus on digital, VR, AR, blockchain | Moderate focus, leveraging legacy IP & platforms |

| Global Reach | Rapid expansion in Asia, North America, Europe | Well-established global distribution networks |

| Key Players | Team Liquid, FaZe Clan, Fnatic | Disney, Warner Bros, Comcast (NBCUniversal) |

Which is better?

Esports franchises offer dynamic growth potential driven by a rapidly expanding global audience and digital viewership, making them attractive for tech-savvy investors seeking high long-term returns. Entertainment conglomerates provide diversified revenue streams across film, music, and television, delivering more stable cash flow and lower volatility. Investment decisions hinge on risk tolerance and market horizon, with esports favoring aggressive growth strategies and conglomerates appealing to conservative portfolios.

Connection

Esports franchises increasingly attract investment from entertainment conglomerates seeking to diversify portfolios and capture younger, digitally native audiences. These conglomerates leverage their media rights, marketing expertise, and content distribution networks to enhance the value and global reach of esports teams. Strategic partnerships between esports organizations and entertainment giants drive growth through cross-platform promotions, sponsorships, and integrated fan engagement strategies.

Key Terms

Diversification

Entertainment conglomerates diversify their portfolios by investing across various media sectors, including film, music, and digital streaming, enabling risk distribution and revenue maximization. Esports franchises focus on niche market engagement through competitive gaming, sponsorships, and merchandise, capitalizing on rapidly growing youth demographics and streaming platforms. Explore the evolving strategies behind diversification in both industries for deeper insights.

Revenue Streams

Entertainment conglomerates generate revenue through diverse streams such as film, television, music, and merchandising, leveraging vast intellectual property portfolios and established global distribution networks. Esports franchises primarily earn income from sponsorships, media rights, merchandise sales, ticketing, and player transfers, capitalizing on growing audience engagement in competitive gaming. Explore how these revenue models evolve by delving deeper into the dynamics between traditional media giants and esports enterprises.

Intellectual Property

Entertainment conglomerates leverage vast intellectual property portfolios to create extensive media ecosystems, incorporating films, music, and merchandise into esports franchises for diversified revenue streams. Esports franchises, in contrast, prioritize developing unique brands, game-related content, and player likeness rights to secure competitive advantages and fan loyalty within the digital gaming landscape. Explore how the strategic management of intellectual property shapes the future of both entertainment conglomerates and esports franchises.

Source and External Links

Major Media Conglomerates to Know for Mass Media and ... - Key entertainment conglomerates include The Walt Disney Company, Comcast Corporation, AT&T (WarnerMedia), ViacomCBS, News Corporation, Sony Corporation, Bertelsmann, Vivendi, Meta Platforms, and Alphabet, which influence entertainment and news globally.

The 10 Largest Media Companies In The United States - Comcast is the largest U.S. media conglomerate owning brands like NBCUniversal, Universal Pictures, and Dreamworks Animation; it controls significant portions of U.S. entertainment and media consumption.

Concentration of media ownership - The biggest global media conglomerates by revenue include Comcast NBCUniversal, The Walt Disney Company, Warner Bros. Discovery, and Paramount Global, which also operate extensively in Europe and worldwide.

dowidth.com

dowidth.com