Social token investment involves acquiring digital assets that represent community membership or influence, often linked to creators or brands, enabling unique engagement opportunities. Staking investment requires holding and locking cryptocurrencies in a blockchain network to support operations, earning rewards or interest over time. Discover the key differences and benefits to optimize your investment strategy.

Why it is important

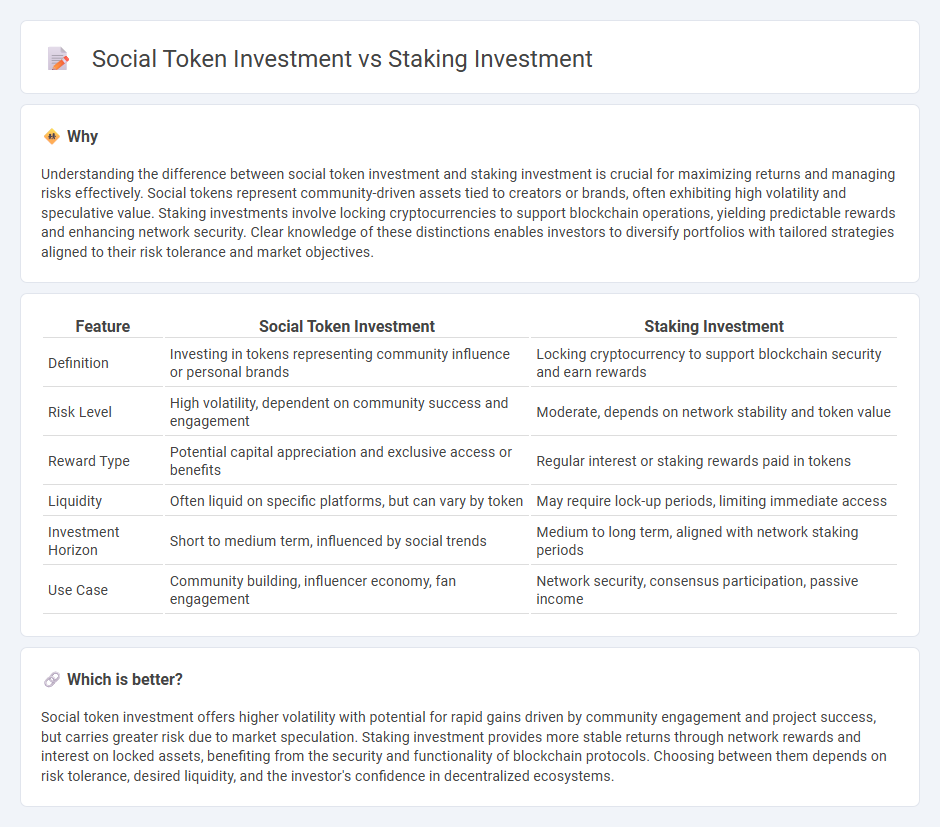

Understanding the difference between social token investment and staking investment is crucial for maximizing returns and managing risks effectively. Social tokens represent community-driven assets tied to creators or brands, often exhibiting high volatility and speculative value. Staking investments involve locking cryptocurrencies to support blockchain operations, yielding predictable rewards and enhancing network security. Clear knowledge of these distinctions enables investors to diversify portfolios with tailored strategies aligned to their risk tolerance and market objectives.

Comparison Table

| Feature | Social Token Investment | Staking Investment |

|---|---|---|

| Definition | Investing in tokens representing community influence or personal brands | Locking cryptocurrency to support blockchain security and earn rewards |

| Risk Level | High volatility, dependent on community success and engagement | Moderate, depends on network stability and token value |

| Reward Type | Potential capital appreciation and exclusive access or benefits | Regular interest or staking rewards paid in tokens |

| Liquidity | Often liquid on specific platforms, but can vary by token | May require lock-up periods, limiting immediate access |

| Investment Horizon | Short to medium term, influenced by social trends | Medium to long term, aligned with network staking periods |

| Use Case | Community building, influencer economy, fan engagement | Network security, consensus participation, passive income |

Which is better?

Social token investment offers higher volatility with potential for rapid gains driven by community engagement and project success, but carries greater risk due to market speculation. Staking investment provides more stable returns through network rewards and interest on locked assets, benefiting from the security and functionality of blockchain protocols. Choosing between them depends on risk tolerance, desired liquidity, and the investor's confidence in decentralized ecosystems.

Connection

Social token investment and staking investment intertwine through blockchain technology, where social tokens represent digital assets issued by communities or creators, and staking involves locking these tokens to support network functions while earning rewards. Investors enhance token value and liquidity by staking, incentivizing engagement and long-term commitment within the social ecosystem. This connection drives decentralized finance (DeFi) growth by aligning community incentives with secure, transparent reward mechanisms.

Key Terms

Yield (Staking ROI)

Staking investment offers predictable yield through network participation rewards, typically ranging from 5% to 20% annually depending on the blockchain protocol and tokenomics. In contrast, social token investment yields are highly variable, influenced by community engagement, token utility, and market demand, with potential for both high returns and significant volatility. Explore deeper insights into optimizing yield strategies between staking and social tokens to enhance your investment portfolio.

Community Governance

Staking investment involves locking tokens to support blockchain network security while earning rewards, enhancing community participation through decentralized governance mechanisms. Social token investment centers on purchasing tokens issued by creators or communities, enabling holders to influence decisions and unlock exclusive perks, thus fostering stronger communal ties. Explore how these models reshape community governance and empower stakeholders by learning more about their unique impact on decentralized ecosystems.

Token Utility

Staking investment enhances token utility by enabling holders to earn rewards while supporting network security and governance in blockchain ecosystems. Social token investment focuses on community engagement and creator economy, where tokens grant access to exclusive content, voting rights, or personalized experiences. Explore the distinct utilities of staking and social tokens to understand their impact on investment strategies.

Source and External Links

Investors' Guide to Crypto Staking | Bitwise - Staking involves pledging crypto assets to validate blockchain transactions, earning additional tokens as rewards while helping secure the network.

What is crypto staking? | Learn how to earn crypto - Kraken - Crypto staking allows token holders to earn rewards by participating in securing proof-of-stake blockchains, with options like direct staking, staking pools, delegated staking, exchange staking, and liquid staking.

What is Staking? The crypto process explained simply - Bitpanda - Staking is the process of locking coins in a wallet to earn rewards, with returns calculated based on the amount staked, duration, and reward rate, often expressed as APY.

dowidth.com

dowidth.com