Sports memorabilia investment offers tangible assets with potential for long-term appreciation tied to rarity and athlete fame, while venture capital investment focuses on high-risk equity stakes in startups aiming for exponential growth. Collectors benefit from physical collectibles that often hold sentimental value and historical significance, whereas venture capitalists seek financial returns through innovation and market disruption. Explore the advantages and risks of each investment type to make informed portfolio decisions.

Why it is important

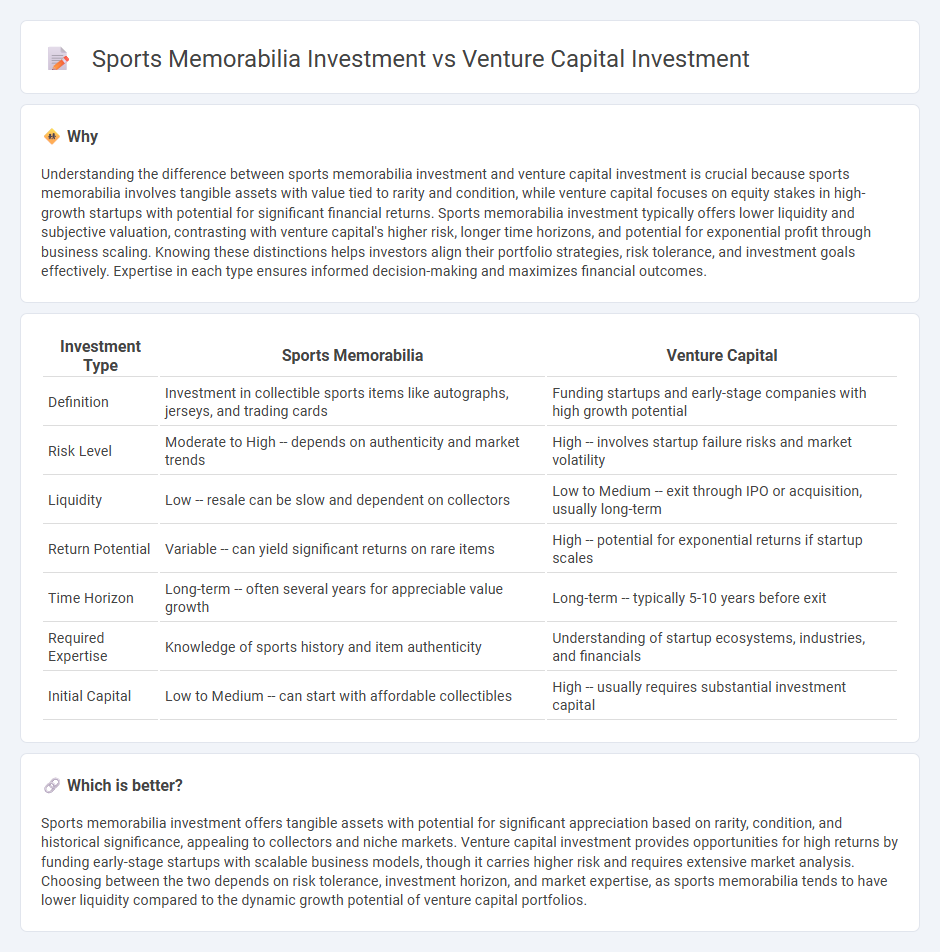

Understanding the difference between sports memorabilia investment and venture capital investment is crucial because sports memorabilia involves tangible assets with value tied to rarity and condition, while venture capital focuses on equity stakes in high-growth startups with potential for significant financial returns. Sports memorabilia investment typically offers lower liquidity and subjective valuation, contrasting with venture capital's higher risk, longer time horizons, and potential for exponential profit through business scaling. Knowing these distinctions helps investors align their portfolio strategies, risk tolerance, and investment goals effectively. Expertise in each type ensures informed decision-making and maximizes financial outcomes.

Comparison Table

| Investment Type | Sports Memorabilia | Venture Capital |

|---|---|---|

| Definition | Investment in collectible sports items like autographs, jerseys, and trading cards | Funding startups and early-stage companies with high growth potential |

| Risk Level | Moderate to High -- depends on authenticity and market trends | High -- involves startup failure risks and market volatility |

| Liquidity | Low -- resale can be slow and dependent on collectors | Low to Medium -- exit through IPO or acquisition, usually long-term |

| Return Potential | Variable -- can yield significant returns on rare items | High -- potential for exponential returns if startup scales |

| Time Horizon | Long-term -- often several years for appreciable value growth | Long-term -- typically 5-10 years before exit |

| Required Expertise | Knowledge of sports history and item authenticity | Understanding of startup ecosystems, industries, and financials |

| Initial Capital | Low to Medium -- can start with affordable collectibles | High -- usually requires substantial investment capital |

Which is better?

Sports memorabilia investment offers tangible assets with potential for significant appreciation based on rarity, condition, and historical significance, appealing to collectors and niche markets. Venture capital investment provides opportunities for high returns by funding early-stage startups with scalable business models, though it carries higher risk and requires extensive market analysis. Choosing between the two depends on risk tolerance, investment horizon, and market expertise, as sports memorabilia tends to have lower liquidity compared to the dynamic growth potential of venture capital portfolios.

Connection

Sports memorabilia investment and venture capital investment share a common foundation in asset diversification and high-return potential, attracting investors seeking unique opportunities beyond traditional markets. Both investment types rely on thorough market analysis, with sports memorabilia valuing rarity and historical significance, while venture capital focuses on innovative startups with scalable business models. The increasing intersection of sports technology startups and collectibles platforms highlights the growing synergy between these investment avenues, blending passion-driven assets with cutting-edge financial strategies.

Key Terms

**Venture Capital Investment:**

Venture capital investment involves funding early-stage startups with high growth potential, often within technology, healthcare, and fintech sectors, offering the possibility of significant returns but accompanied by high risk and illiquidity. This investment type requires deep market analysis, industry expertise, and patience, as returns typically materialize over a 5-10 year horizon through IPOs or acquisitions. Explore the dynamics of venture capital investment to understand its impact on innovation and wealth creation potential.

Equity

Venture capital investment involves acquiring equity stakes in early-stage companies with high growth potential, offering the possibility of substantial returns but accompanied by significant risk and illiquidity. In contrast, sports memorabilia investment focuses on tangible assets such as rare collectibles and autographed items, which may appreciate based on rarity, provenance, and market demand rather than equity ownership or company performance. Explore deeper insights into how equity dynamics influence investment strategies across these distinct asset classes.

Startup Valuation

Startup valuation in venture capital investment often relies on projected growth, market potential, and financial metrics, driving strategically planned funding rounds. In contrast, sports memorabilia investment hinges on rarity, provenance, and fan demand, with valuation fluctuating based on cultural trends and auction outcomes. Explore deeper insights into how valuation dynamics differ between these distinct asset classes.

Source and External Links

What is Venture Capital? - Venture capital is an investment model where funds are provided to high-growth startups in exchange for equity, enabling these businesses to develop from ideas and research into transformative products and services, with a typical investment horizon of 5-10 years and support beyond funding including strategic guidance and operational help.

Venture Capital investing - Deutsche Bank Wealth Management - Venture capital investing involves providing equity capital to early-stage companies that lack access to traditional financing and have high growth potential, with investors typically seeking significant returns by supporting startups through multiple growth phases.

Venture capital | British Business Bank - Venture capital usually involves staged investments across rounds (e.g., Series A, B, C) where investors acquire minority stakes in innovative, early-stage companies, providing capital and expertise to scale businesses that often culminate in IPOs or acquisitions within 5 to 7 years, supported by government schemes like EIS and SEIS to encourage investment.

dowidth.com

dowidth.com