Fractional real estate investing allows individuals to acquire partial ownership of high-value properties with lower capital requirements, offering diversified portfolios and liquidity compared to traditional investments. Private equity real estate involves pooling funds from accredited investors to acquire, manage, and sell large-scale real estate assets, often yielding higher returns but requiring longer investment horizons and greater risk tolerance. Explore the key differences and benefits of each to determine the best fit for your investment goals.

Why it is important

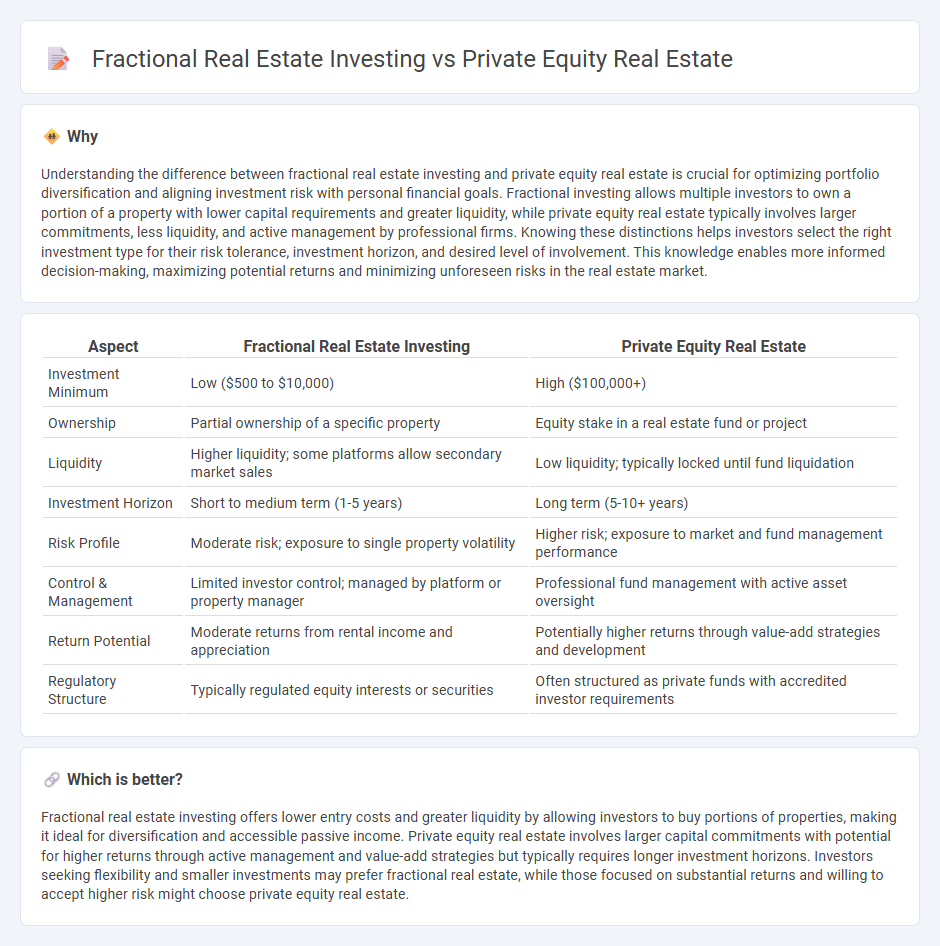

Understanding the difference between fractional real estate investing and private equity real estate is crucial for optimizing portfolio diversification and aligning investment risk with personal financial goals. Fractional investing allows multiple investors to own a portion of a property with lower capital requirements and greater liquidity, while private equity real estate typically involves larger commitments, less liquidity, and active management by professional firms. Knowing these distinctions helps investors select the right investment type for their risk tolerance, investment horizon, and desired level of involvement. This knowledge enables more informed decision-making, maximizing potential returns and minimizing unforeseen risks in the real estate market.

Comparison Table

| Aspect | Fractional Real Estate Investing | Private Equity Real Estate |

|---|---|---|

| Investment Minimum | Low ($500 to $10,000) | High ($100,000+) |

| Ownership | Partial ownership of a specific property | Equity stake in a real estate fund or project |

| Liquidity | Higher liquidity; some platforms allow secondary market sales | Low liquidity; typically locked until fund liquidation |

| Investment Horizon | Short to medium term (1-5 years) | Long term (5-10+ years) |

| Risk Profile | Moderate risk; exposure to single property volatility | Higher risk; exposure to market and fund management performance |

| Control & Management | Limited investor control; managed by platform or property manager | Professional fund management with active asset oversight |

| Return Potential | Moderate returns from rental income and appreciation | Potentially higher returns through value-add strategies and development |

| Regulatory Structure | Typically regulated equity interests or securities | Often structured as private funds with accredited investor requirements |

Which is better?

Fractional real estate investing offers lower entry costs and greater liquidity by allowing investors to buy portions of properties, making it ideal for diversification and accessible passive income. Private equity real estate involves larger capital commitments with potential for higher returns through active management and value-add strategies but typically requires longer investment horizons. Investors seeking flexibility and smaller investments may prefer fractional real estate, while those focused on substantial returns and willing to accept higher risk might choose private equity real estate.

Connection

Fractional real estate investing allows multiple investors to own a percentage of a property, providing access to high-value assets with lower capital requirements, while private equity real estate involves pooled funds managed by professionals to acquire, manage, and sell real estate investments. Both investment methods offer diversification and professional management, catering to investors seeking exposure to real estate markets without direct property ownership. The connection lies in their shared objective of democratizing access to real estate assets, leveraging collective capital to optimize returns and mitigate risks.

Key Terms

Ownership Structure

Private equity real estate typically involves pooled investment in large-scale properties managed by professional firms, granting investors indirect ownership through shares in a trust or fund. Fractional real estate investing offers direct ownership of a specific property segment, allowing investors to hold actual title deeds for a fraction of the asset. Explore detailed comparisons to understand which ownership model aligns best with your investment goals.

Liquidity

Private equity real estate investments typically involve long-term capital commitments with limited liquidity, often locking investors' funds for several years until a property is sold or a fund is liquidated. Fractional real estate investing offers greater liquidity by allowing investors to buy and sell partial ownership shares on secondary markets or platforms more frequently and with lower entry costs. Explore more to understand which investment type aligns best with your liquidity needs and financial goals.

Minimum Investment

Private equity real estate typically requires a high minimum investment, often starting at $250,000 or more, limiting access to accredited investors. Fractional real estate investing, on the other hand, offers significantly lower minimums, sometimes as low as $500, enabling broader participation from individual investors. Explore the differences further to determine which investment strategy aligns with your financial goals.

Source and External Links

Real Estate Private Equity: Overview, Careers, Salaries & Interviews - Real estate private equity firms raise capital from investors (Limited Partners) to acquire, develop, operate, and sell commercial properties such as offices, industrial, retail, and multifamily, mainly focusing on commercial real estate rather than residential.

Private equity real estate - Wikipedia - Private equity real estate involves direct ownership and financing of properties or portfolios, primarily through pooled investment vehicles, with investors including accredited individuals and institutional investors seeking illiquid private real estate securities.

Private Real Estate Investments: What You Need to Know - KKR - Private real estate investment includes two main categories: equity (ownership interests) and credit (loans secured by properties), aiming to provide returns through rental income, appreciation, and portfolio diversification often with inflation-hedging benefits.

dowidth.com

dowidth.com