NFT domain names offer decentralized ownership and enhanced digital identity control, providing a novel asset class with unique value propositions for investors. Venture capital involves funding high-growth startups with potential for significant returns but comes with higher risks and longer exit timelines. Explore how these distinct investment avenues can diversify your portfolio and shape future opportunities.

Why it is important

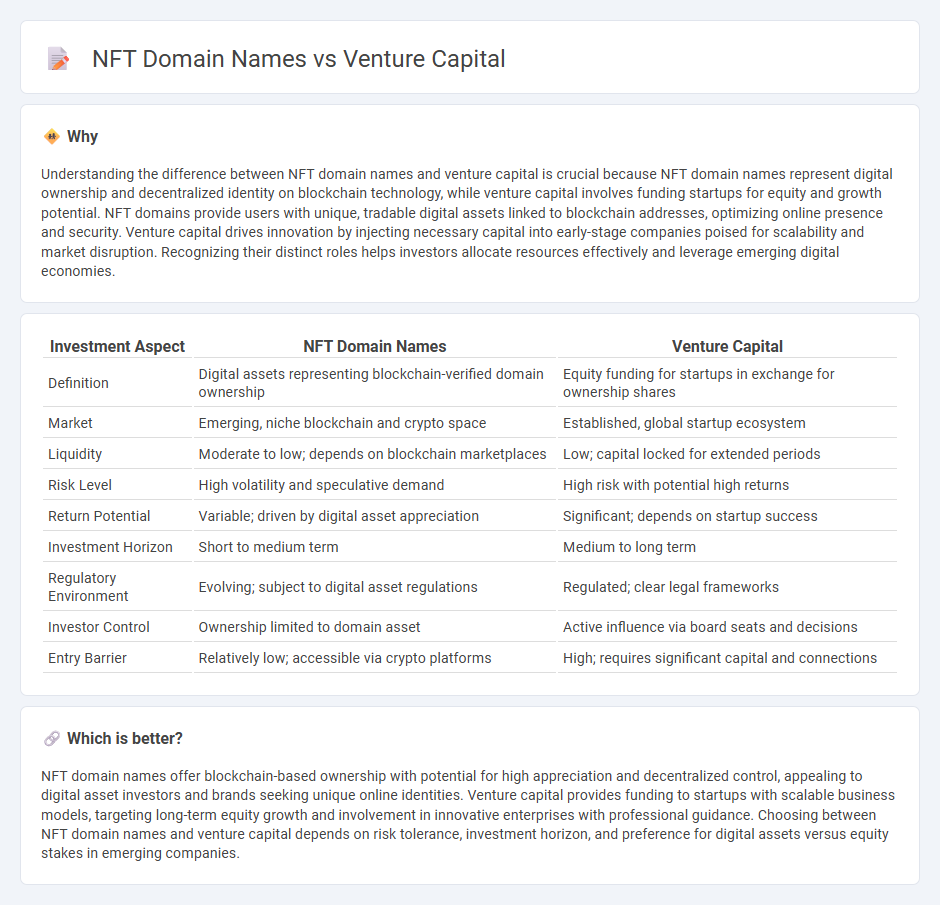

Understanding the difference between NFT domain names and venture capital is crucial because NFT domain names represent digital ownership and decentralized identity on blockchain technology, while venture capital involves funding startups for equity and growth potential. NFT domains provide users with unique, tradable digital assets linked to blockchain addresses, optimizing online presence and security. Venture capital drives innovation by injecting necessary capital into early-stage companies poised for scalability and market disruption. Recognizing their distinct roles helps investors allocate resources effectively and leverage emerging digital economies.

Comparison Table

| Investment Aspect | NFT Domain Names | Venture Capital |

|---|---|---|

| Definition | Digital assets representing blockchain-verified domain ownership | Equity funding for startups in exchange for ownership shares |

| Market | Emerging, niche blockchain and crypto space | Established, global startup ecosystem |

| Liquidity | Moderate to low; depends on blockchain marketplaces | Low; capital locked for extended periods |

| Risk Level | High volatility and speculative demand | High risk with potential high returns |

| Return Potential | Variable; driven by digital asset appreciation | Significant; depends on startup success |

| Investment Horizon | Short to medium term | Medium to long term |

| Regulatory Environment | Evolving; subject to digital asset regulations | Regulated; clear legal frameworks |

| Investor Control | Ownership limited to domain asset | Active influence via board seats and decisions |

| Entry Barrier | Relatively low; accessible via crypto platforms | High; requires significant capital and connections |

Which is better?

NFT domain names offer blockchain-based ownership with potential for high appreciation and decentralized control, appealing to digital asset investors and brands seeking unique online identities. Venture capital provides funding to startups with scalable business models, targeting long-term equity growth and involvement in innovative enterprises with professional guidance. Choosing between NFT domain names and venture capital depends on risk tolerance, investment horizon, and preference for digital assets versus equity stakes in emerging companies.

Connection

NFT domain names represent a new digital asset class attracting venture capital due to their potential for decentralized internet ownership and brand identity. Venture capital firms invest in NFT domains to capitalize on the growing blockchain ecosystem, leveraging their scalability and market liquidity. This convergence signals a shift towards tokenized digital real estate as a high-growth investment sector within the broader web3 economy.

Key Terms

**Venture Capital:**

Venture capital involves funding startups with high growth potential in exchange for equity, emphasizing scalability, innovation, and long-term financial returns. Investment decisions are driven by market trends, business models, and leadership teams, targeting industries such as technology, healthcare, and fintech. Explore deeper insights into venture capital strategies and its impact on emerging markets.

Equity

Venture capital investments prioritize equity ownership, providing investors with partial control and potential long-term returns through company growth. NFT domain names, while offering digital asset ownership, do not typically confer equity or governance rights in the underlying platforms. Explore the distinctions in asset control and value creation to understand which investment aligns best with your financial goals.

Startup

Venture capital provides essential funding and strategic support for startups to scale rapidly, whereas NFT domain names offer innovative branding and digital identity opportunities within the blockchain ecosystem. Startups leveraging NFT domains can enhance online presence and unlock unique value through tokenized ownership and decentralized control. Explore how combining venture capital insights with NFT domain strategies can propel your startup's growth.

Source and External Links

What is Venture Capital? - Venture capital funds high-growth startups by providing equity investments and strategic support, transforming innovative ideas into globally impactful companies and jobs.

Fund your business | U.S. Small Business Administration - Venture capital is investment provided in exchange for equity and often a board seat, targeting companies with rapid growth potential and higher risk than traditional financing.

What is venture capital? - Silicon Valley Bank - Venture capital is private equity funding for startups and early-stage companies, offering not just capital but also expertise, in return for an ownership stake and potential influence over company decisions.

dowidth.com

dowidth.com