Viticulture land acquisition offers sustainable agricultural investment opportunities with potential for long-term appreciation and environmental benefits, while oil and gas leases provide high-yield prospects tied to fluctuating energy markets and regulatory risks. Wine production benefits from increasing global demand, land value stability, and the ability to diversify income through vineyard operations or land resale. Explore the comparative advantages and risks of these asset classes to make informed investment decisions.

Why it is important

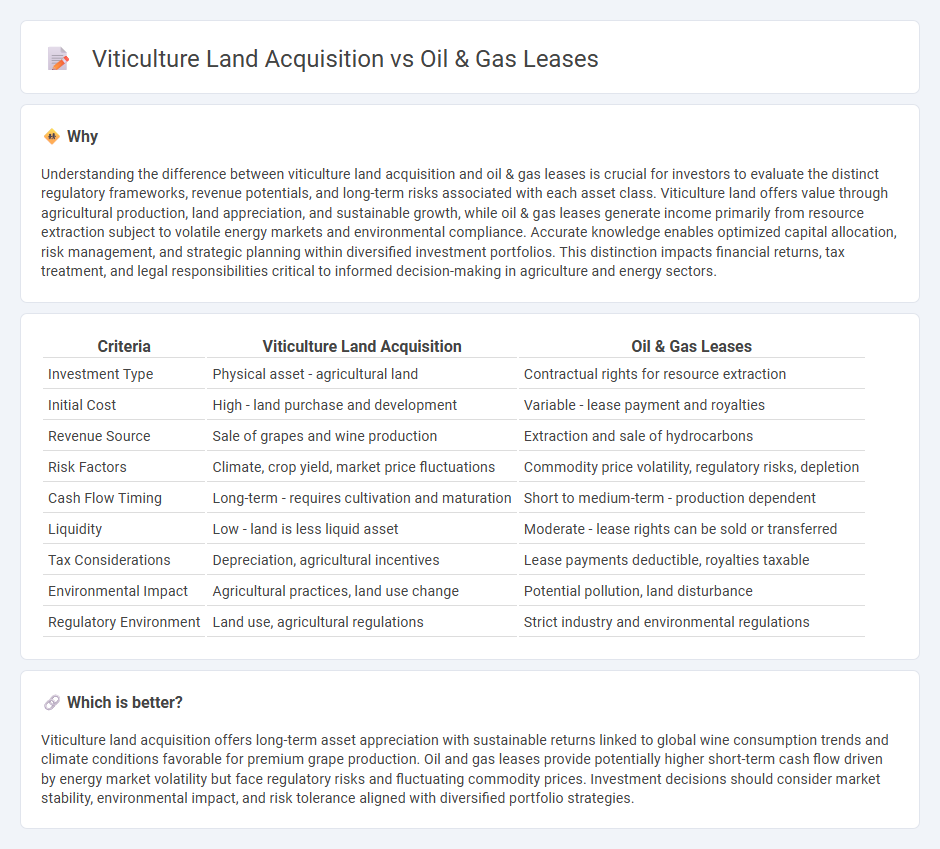

Understanding the difference between viticulture land acquisition and oil & gas leases is crucial for investors to evaluate the distinct regulatory frameworks, revenue potentials, and long-term risks associated with each asset class. Viticulture land offers value through agricultural production, land appreciation, and sustainable growth, while oil & gas leases generate income primarily from resource extraction subject to volatile energy markets and environmental compliance. Accurate knowledge enables optimized capital allocation, risk management, and strategic planning within diversified investment portfolios. This distinction impacts financial returns, tax treatment, and legal responsibilities critical to informed decision-making in agriculture and energy sectors.

Comparison Table

| Criteria | Viticulture Land Acquisition | Oil & Gas Leases |

|---|---|---|

| Investment Type | Physical asset - agricultural land | Contractual rights for resource extraction |

| Initial Cost | High - land purchase and development | Variable - lease payment and royalties |

| Revenue Source | Sale of grapes and wine production | Extraction and sale of hydrocarbons |

| Risk Factors | Climate, crop yield, market price fluctuations | Commodity price volatility, regulatory risks, depletion |

| Cash Flow Timing | Long-term - requires cultivation and maturation | Short to medium-term - production dependent |

| Liquidity | Low - land is less liquid asset | Moderate - lease rights can be sold or transferred |

| Tax Considerations | Depreciation, agricultural incentives | Lease payments deductible, royalties taxable |

| Environmental Impact | Agricultural practices, land use change | Potential pollution, land disturbance |

| Regulatory Environment | Land use, agricultural regulations | Strict industry and environmental regulations |

Which is better?

Viticulture land acquisition offers long-term asset appreciation with sustainable returns linked to global wine consumption trends and climate conditions favorable for premium grape production. Oil and gas leases provide potentially higher short-term cash flow driven by energy market volatility but face regulatory risks and fluctuating commodity prices. Investment decisions should consider market stability, environmental impact, and risk tolerance aligned with diversified portfolio strategies.

Connection

Investment in viticulture land acquisition and oil & gas leases intersects through the strategic diversification of natural resource assets. Both asset types require extensive land management, regulatory compliance, and long-term capital commitment to yield profitable returns. Investors leverage viticulture land's agricultural potential alongside oil & gas lease rights to balance portfolio risk and capitalize on fluctuating commodity markets.

Key Terms

Royalty Interest

Royalty interest in oil and gas leases grants a percentage of production revenue to the landowner without operational costs, whereas viticulture land acquisition involves ownership of vineyard property and potential profits from grape cultivation and wine sales. Oil and gas royalty interests provide passive income based on extraction volumes, contrasting with the active management and long-term investment typical in viticulture. Explore deeper insights into optimizing royalty interests and land assets by learning more about these distinct investment strategies.

Surface Rights

Surface rights in oil and gas leases typically grant companies access to land for drilling and extraction, often involving compensation for landowners due to potential land disruption. In viticulture land acquisitions, surface rights are crucial for vineyard establishment, ensuring rights to cultivate, manage water resources, and install infrastructure without interfering with mineral rights. Explore more about how surface rights influence different land use strategies and legal considerations in resource and agricultural sectors.

Zoning Regulations

Zoning regulations play a critical role in distinguishing oil & gas leases from viticulture land acquisition, as they determine the permissible land use and environmental safeguards for each sector. Oil & gas leases often require zoning that supports industrial activities, including exploration and extraction, while viticulture land acquisition prioritizes agricultural zoning with restrictions to preserve soil quality and natural resources. Explore further to understand how zoning impacts investment decisions and operational compliance in these industries.

Source and External Links

How Oil and Gas Leasing Works - MehaffyWeber - Oil and gas leases are contracts between landowners and companies granting rights to explore and produce resources with payments made as royalties, typically covering a primary term (exploration) and a secondary term (production) with negotiable terms and royalty provisions.

What is Oil and Gas Leasing and How Does it Work | Pheasant Energy - Oil and gas leases give companies exclusive rights to explore and produce minerals for a primary term (commonly 1 to 10 years) and a secondary term that continues production as long as wells produce, with possible extension payments after the primary term.

Oil and Gas Lease For Dummies: The Ultimate 2024 Guide - Oil and gas leases involve various important clauses such as royalty, drilling, and force majeure clauses, and provide mineral owners a percentage of production revenue as monthly royalties during extraction.

dowidth.com

dowidth.com