Whiskey cask investment offers potential high returns driven by the aging process and increasing demand for rare spirits, while farmland investment provides stable, long-term growth backed by tangible assets and agricultural productivity. Whiskey casks benefit from market trends in premium liquor, whereas farmland investments yield income through crop production and land value appreciation. Explore detailed comparisons to determine the best fit for your investment portfolio.

Why it is important

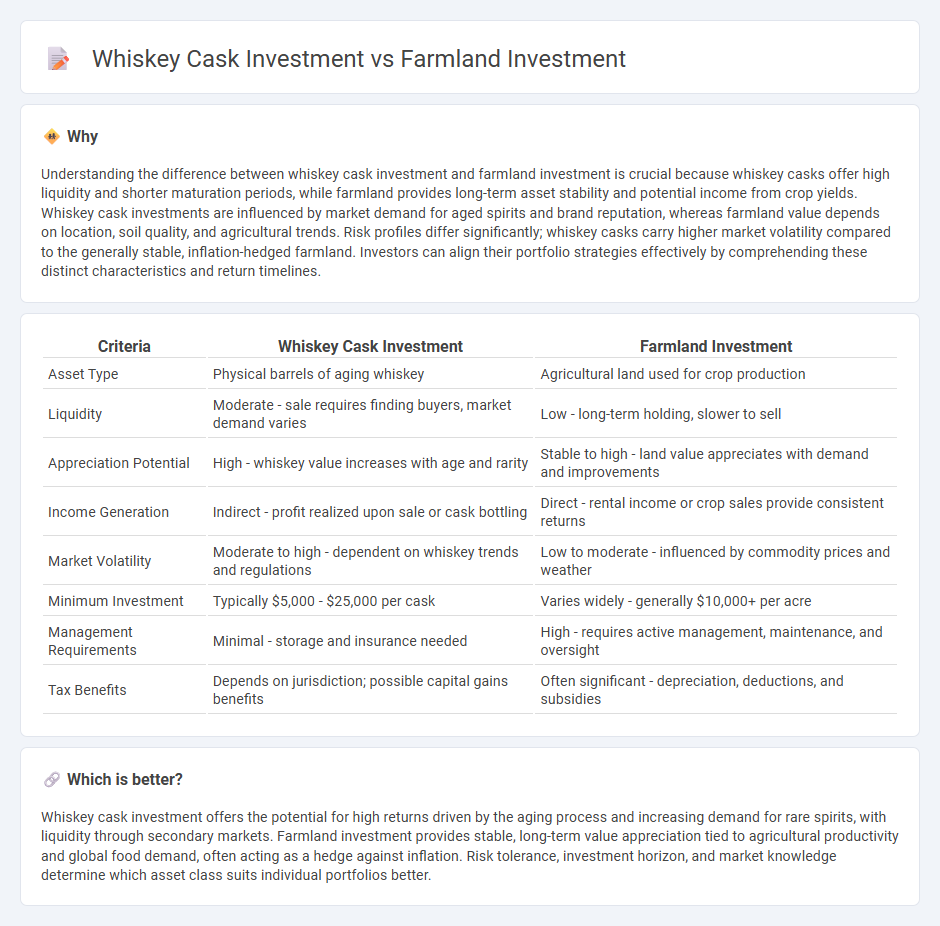

Understanding the difference between whiskey cask investment and farmland investment is crucial because whiskey casks offer high liquidity and shorter maturation periods, while farmland provides long-term asset stability and potential income from crop yields. Whiskey cask investments are influenced by market demand for aged spirits and brand reputation, whereas farmland value depends on location, soil quality, and agricultural trends. Risk profiles differ significantly; whiskey casks carry higher market volatility compared to the generally stable, inflation-hedged farmland. Investors can align their portfolio strategies effectively by comprehending these distinct characteristics and return timelines.

Comparison Table

| Criteria | Whiskey Cask Investment | Farmland Investment |

|---|---|---|

| Asset Type | Physical barrels of aging whiskey | Agricultural land used for crop production |

| Liquidity | Moderate - sale requires finding buyers, market demand varies | Low - long-term holding, slower to sell |

| Appreciation Potential | High - whiskey value increases with age and rarity | Stable to high - land value appreciates with demand and improvements |

| Income Generation | Indirect - profit realized upon sale or cask bottling | Direct - rental income or crop sales provide consistent returns |

| Market Volatility | Moderate to high - dependent on whiskey trends and regulations | Low to moderate - influenced by commodity prices and weather |

| Minimum Investment | Typically $5,000 - $25,000 per cask | Varies widely - generally $10,000+ per acre |

| Management Requirements | Minimal - storage and insurance needed | High - requires active management, maintenance, and oversight |

| Tax Benefits | Depends on jurisdiction; possible capital gains benefits | Often significant - depreciation, deductions, and subsidies |

Which is better?

Whiskey cask investment offers the potential for high returns driven by the aging process and increasing demand for rare spirits, with liquidity through secondary markets. Farmland investment provides stable, long-term value appreciation tied to agricultural productivity and global food demand, often acting as a hedge against inflation. Risk tolerance, investment horizon, and market knowledge determine which asset class suits individual portfolios better.

Connection

Whiskey cask investment and farmland investment both represent alternative asset classes that offer diversification beyond traditional stocks and bonds. Both assets benefit from tangible, appreciating commodities--whiskey casks increase in value as the spirit ages, while farmland appreciates through land value growth and agricultural production. Investors seek these options for long-term capital preservation and inflation hedging due to their scarcity and intrinsic value.

Key Terms

Asset Appreciation

Farmland investment offers stable asset appreciation driven by rising agricultural land values and increasing global food demand, supported by limited supply and the essential nature of farmland. Whiskey cask investment gains value through the aging process, rarity, and growing collector interest, often outperforming traditional assets during economic uncertainty. Explore detailed comparisons and growth trends to determine which asset aligns best with your investment goals.

Liquidity

Farmland investment typically offers lower liquidity as it involves physical assets and longer sale processes, often requiring months to complete transactions. Whiskey cask investment provides higher liquidity through specialized platforms enabling quicker trading and resale within weeks or months. Explore detailed comparisons to understand which asset aligns better with your liquidity needs.

Yield

Farmland investment typically offers stable returns averaging 6-12% annually due to land appreciation and agricultural income. Whiskey cask investment can yield higher returns, often between 8-15%, driven by the increasing rarity and aging process of casks. Discover in-depth insights on yield comparisons to optimize your investment portfolio.

Source and External Links

Investing in farmland | Nuveen - Farmland investment offers stable returns, low correlation to traditional assets, and acts as a hedge against inflation, driven by rising global food demand and finite arable land resources.

6 Easy Ways to Invest in Farmland in 2025 - APXN Property - Investing in farmland requires analyzing crop yields, local land markets, and additional assets like irrigation systems, while also offering opportunities for passive income through leases, water rights, and renewable energy projects.

FarmTogether - Invest in US Farmland - US farmland has historically delivered low-volatility, inflation-hedged returns uncorrelated with major asset classes, supported by long-term trends in food demand and land scarcity.

dowidth.com

dowidth.com