Luxury handbag investment often benefits from brand prestige, limited editions, and seasonal trends that drive value appreciation, while vintage watch investment relies heavily on craftsmanship, historical significance, and mechanical rarity. High-demand brands like Hermes and Rolex dominate their respective markets, with record auction prices highlighting their strong investment potential. Explore the key factors shaping returns in luxury handbag and vintage watch investments to make informed financial decisions.

Why it is important

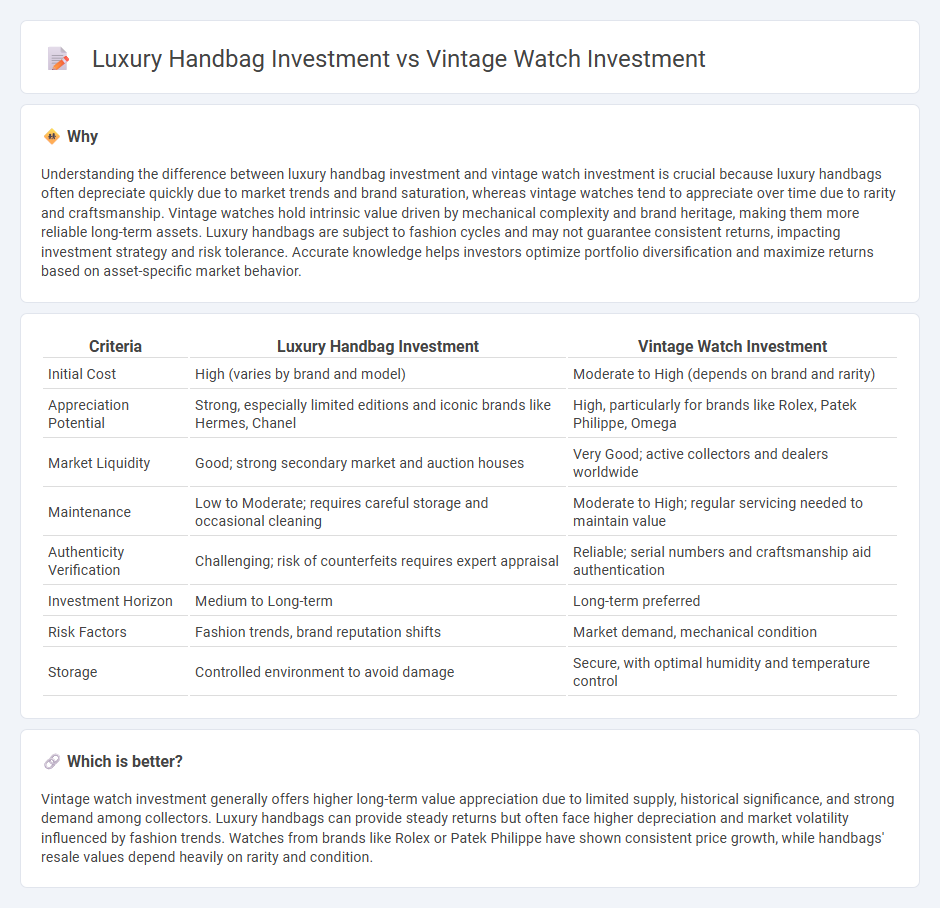

Understanding the difference between luxury handbag investment and vintage watch investment is crucial because luxury handbags often depreciate quickly due to market trends and brand saturation, whereas vintage watches tend to appreciate over time due to rarity and craftsmanship. Vintage watches hold intrinsic value driven by mechanical complexity and brand heritage, making them more reliable long-term assets. Luxury handbags are subject to fashion cycles and may not guarantee consistent returns, impacting investment strategy and risk tolerance. Accurate knowledge helps investors optimize portfolio diversification and maximize returns based on asset-specific market behavior.

Comparison Table

| Criteria | Luxury Handbag Investment | Vintage Watch Investment |

|---|---|---|

| Initial Cost | High (varies by brand and model) | Moderate to High (depends on brand and rarity) |

| Appreciation Potential | Strong, especially limited editions and iconic brands like Hermes, Chanel | High, particularly for brands like Rolex, Patek Philippe, Omega |

| Market Liquidity | Good; strong secondary market and auction houses | Very Good; active collectors and dealers worldwide |

| Maintenance | Low to Moderate; requires careful storage and occasional cleaning | Moderate to High; regular servicing needed to maintain value |

| Authenticity Verification | Challenging; risk of counterfeits requires expert appraisal | Reliable; serial numbers and craftsmanship aid authentication |

| Investment Horizon | Medium to Long-term | Long-term preferred |

| Risk Factors | Fashion trends, brand reputation shifts | Market demand, mechanical condition |

| Storage | Controlled environment to avoid damage | Secure, with optimal humidity and temperature control |

Which is better?

Vintage watch investment generally offers higher long-term value appreciation due to limited supply, historical significance, and strong demand among collectors. Luxury handbags can provide steady returns but often face higher depreciation and market volatility influenced by fashion trends. Watches from brands like Rolex or Patek Philippe have shown consistent price growth, while handbags' resale values depend heavily on rarity and condition.

Connection

Luxury handbag investment and vintage watch investment share a strong connection through their appeal as alternative asset classes that appreciate over time due to rarity, brand prestige, and historical significance. Both markets benefit from limited editions and iconic designs that drive demand among collectors and investors seeking diversification beyond traditional stocks and bonds. The rising global trend of luxury goods as status symbols further enhances their value retention and potential for high returns.

Key Terms

Vintage watch investment:

Vintage watch investment offers significant potential for value appreciation due to limited production runs, historical significance, and increasing global demand among collectors. Brands like Rolex, Patek Philippe, and Audemars Piguet consistently outperform other luxury assets, often providing better long-term returns compared to luxury handbags. Explore comprehensive guides on vintage watch investment strategies and market trends to maximize your portfolio growth.

Provenance

Vintage watch investment often hinges on provenance tied to historical significance, original manufacturing details, and limited editions, which can significantly enhance value over time. Luxury handbag investment values provenance through brand heritage, iconic design collaborations, and ownership history that authenticate exclusivity. Explore further to understand how provenance impacts these investment choices.

Rarity

Vintage watch investment hinges on the rarity of limited-edition models, unique complications, and historical significance that drive demand among collectors. Luxury handbag investment focuses on scarce production runs, iconic designs, and collaborations that ensure exclusivity and sustained value appreciation. Explore in-depth analyses of rarity factors shaping these two distinct markets.

Source and External Links

How to Invest in Vintage Watches: A Complete Guide - Investing in vintage watches is currently very opportune due to a rapidly growing luxury second-hand watch market, with potential for significant value appreciation, diversification benefits, and new fractional investment models making the market more accessible.

5 Vintage Watches That Will Make You Money - YouTube - Vintage watches from prestigious brands like Rolex, Patek Philippe, and Omega are sought after for their rarity, craftsmanship, and historical significance, often appreciating in value and becoming a tangible, wearable investment.

How To Invest In Watches | Wristcheck - Key investment strategies include focusing on rare and undervalued vintage pieces from top brands such as Patek Philippe, Audemars Piguet, and Rolex while carefully assessing authenticity, condition, and provenance to maximize value retention and appreciation.

dowidth.com

dowidth.com