Investing in vintage video games involves acquiring rare and collectible titles that can appreciate in value due to their scarcity, nostalgia, and growing demand among enthusiasts. Stock market investing focuses on purchasing shares of publicly traded companies, offering liquidity and potential dividends backed by financial performance and market trends. Explore the unique benefits and risks of both investment avenues to determine which aligns best with your financial goals.

Why it is important

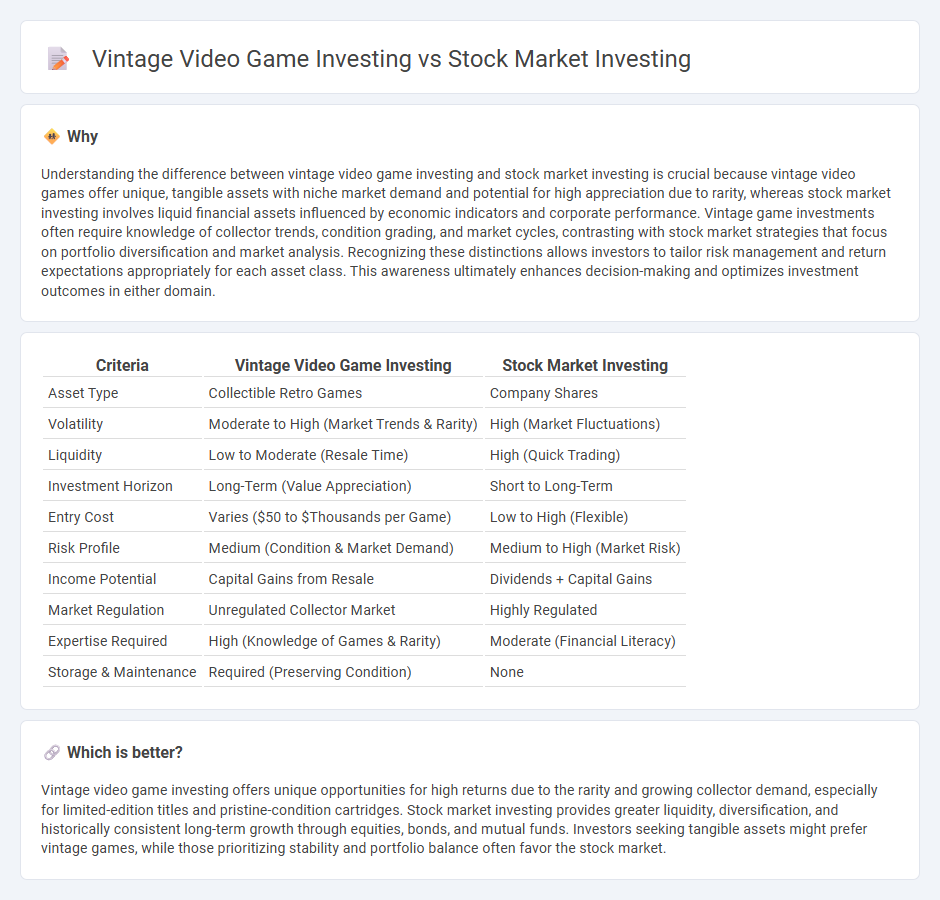

Understanding the difference between vintage video game investing and stock market investing is crucial because vintage video games offer unique, tangible assets with niche market demand and potential for high appreciation due to rarity, whereas stock market investing involves liquid financial assets influenced by economic indicators and corporate performance. Vintage game investments often require knowledge of collector trends, condition grading, and market cycles, contrasting with stock market strategies that focus on portfolio diversification and market analysis. Recognizing these distinctions allows investors to tailor risk management and return expectations appropriately for each asset class. This awareness ultimately enhances decision-making and optimizes investment outcomes in either domain.

Comparison Table

| Criteria | Vintage Video Game Investing | Stock Market Investing |

|---|---|---|

| Asset Type | Collectible Retro Games | Company Shares |

| Volatility | Moderate to High (Market Trends & Rarity) | High (Market Fluctuations) |

| Liquidity | Low to Moderate (Resale Time) | High (Quick Trading) |

| Investment Horizon | Long-Term (Value Appreciation) | Short to Long-Term |

| Entry Cost | Varies ($50 to $Thousands per Game) | Low to High (Flexible) |

| Risk Profile | Medium (Condition & Market Demand) | Medium to High (Market Risk) |

| Income Potential | Capital Gains from Resale | Dividends + Capital Gains |

| Market Regulation | Unregulated Collector Market | Highly Regulated |

| Expertise Required | High (Knowledge of Games & Rarity) | Moderate (Financial Literacy) |

| Storage & Maintenance | Required (Preserving Condition) | None |

Which is better?

Vintage video game investing offers unique opportunities for high returns due to the rarity and growing collector demand, especially for limited-edition titles and pristine-condition cartridges. Stock market investing provides greater liquidity, diversification, and historically consistent long-term growth through equities, bonds, and mutual funds. Investors seeking tangible assets might prefer vintage games, while those prioritizing stability and portfolio balance often favor the stock market.

Connection

Vintage video game investing and stock market investing both rely on understanding market trends, rarity, and demand to maximize returns. Collectors and investors analyze historical data, market sentiment, and asset liquidity to make informed decisions. Both investment types leverage asset valuation techniques and risk management strategies to capitalize on appreciation potential.

Key Terms

**Stock market investing:**

Stock market investing involves purchasing shares in publicly traded companies, allowing investors to capitalize on market fluctuations and company growth through dividends and capital gains. This form of investment provides liquidity, diversification, and access to extensive financial data and regulatory oversight, making it a preferred choice for both short-term trading and long-term wealth accumulation. Explore the nuances of stock market investing to understand its potential benefits and risks more comprehensively.

Dividend

Dividend stocks provide investors with regular income through profit sharing, typically distributed quarterly by well-established companies in sectors like utilities and consumer goods. Vintage video games, while lacking dividends, offer potential capital gains driven by rarity, condition, and nostalgia within a niche collector market. Explore how dividend strategies compare to asset appreciation in alternative investments to enhance your portfolio diversification.

Portfolio diversification

Stock market investing offers extensive portfolio diversification through various asset classes like stocks, bonds, and ETFs that balance risk and return. Vintage video game investing provides a niche alternative, appealing to collectors and enthusiasts, with value influenced by rarity, condition, and cultural significance rather than market trends. Explore deeper insights on combining these diverse assets for optimal portfolio diversification strategies.

Source and External Links

Stocks | Investor.gov - Stocks represent ownership in a company and can be bought via direct stock plans, dividend reinvestment plans, brokers, or stock funds; each has different methods and fees associated with buying and selling shares.

How to Invest in Stocks: 2025 Beginner's Guide - NerdWallet - To invest, open a brokerage account, add funds, and purchase stocks or stock funds; you can start with small amounts using fractional shares or ETFs, and allocation depends on your investment horizon.

The Basics of Investing In Stocks - Common ways to buy stocks include direct stock plans, dividend reinvestment plans, brokers, and stock funds, each with different rules and fees to consider when investing.

dowidth.com

dowidth.com