Carbon credits trading enables companies to offset their greenhouse gas emissions by purchasing credits from verified environmental projects, creating a market-driven approach to reducing carbon footprints. Blue bonds finance ocean and marine conservation initiatives, supporting sustainable fishing, pollution reduction, and climate resilience through debt instruments linked to environmental outcomes. Explore how these innovative financial tools can drive sustainable investment and environmental impact.

Why it is important

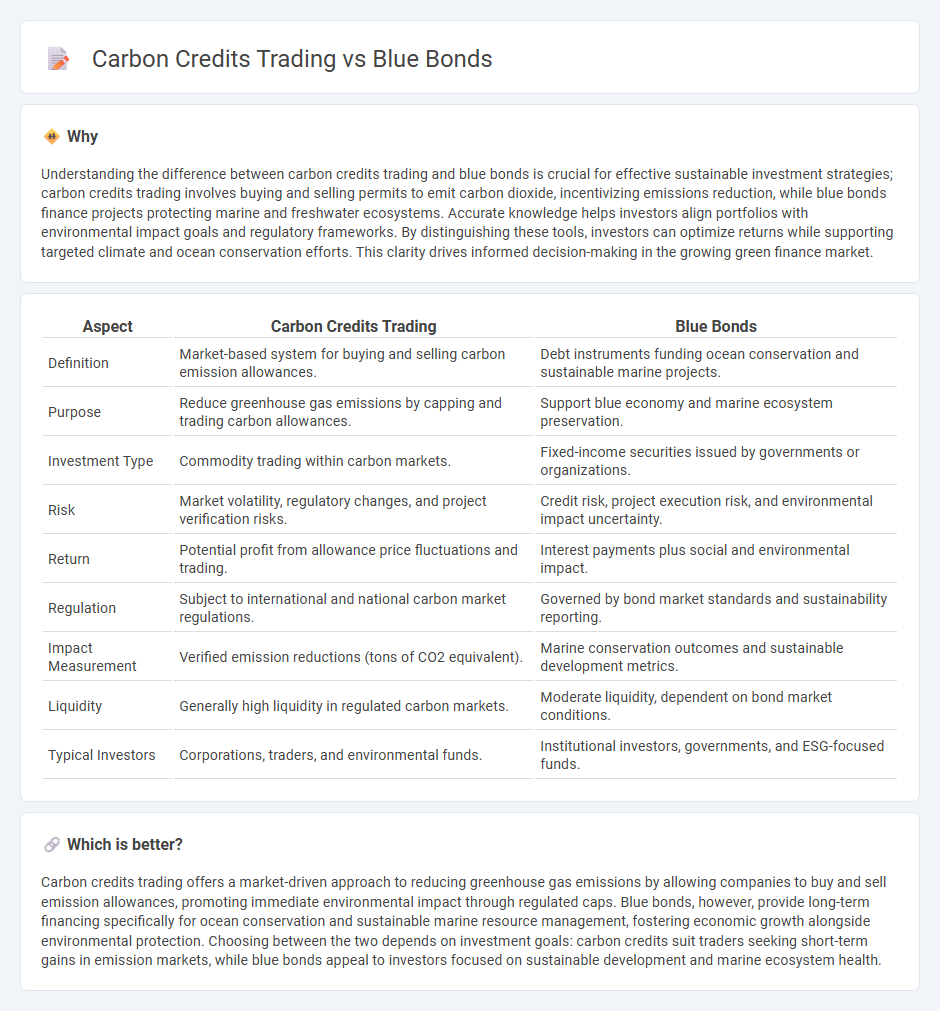

Understanding the difference between carbon credits trading and blue bonds is crucial for effective sustainable investment strategies; carbon credits trading involves buying and selling permits to emit carbon dioxide, incentivizing emissions reduction, while blue bonds finance projects protecting marine and freshwater ecosystems. Accurate knowledge helps investors align portfolios with environmental impact goals and regulatory frameworks. By distinguishing these tools, investors can optimize returns while supporting targeted climate and ocean conservation efforts. This clarity drives informed decision-making in the growing green finance market.

Comparison Table

| Aspect | Carbon Credits Trading | Blue Bonds |

|---|---|---|

| Definition | Market-based system for buying and selling carbon emission allowances. | Debt instruments funding ocean conservation and sustainable marine projects. |

| Purpose | Reduce greenhouse gas emissions by capping and trading carbon allowances. | Support blue economy and marine ecosystem preservation. |

| Investment Type | Commodity trading within carbon markets. | Fixed-income securities issued by governments or organizations. |

| Risk | Market volatility, regulatory changes, and project verification risks. | Credit risk, project execution risk, and environmental impact uncertainty. |

| Return | Potential profit from allowance price fluctuations and trading. | Interest payments plus social and environmental impact. |

| Regulation | Subject to international and national carbon market regulations. | Governed by bond market standards and sustainability reporting. |

| Impact Measurement | Verified emission reductions (tons of CO2 equivalent). | Marine conservation outcomes and sustainable development metrics. |

| Liquidity | Generally high liquidity in regulated carbon markets. | Moderate liquidity, dependent on bond market conditions. |

| Typical Investors | Corporations, traders, and environmental funds. | Institutional investors, governments, and ESG-focused funds. |

Which is better?

Carbon credits trading offers a market-driven approach to reducing greenhouse gas emissions by allowing companies to buy and sell emission allowances, promoting immediate environmental impact through regulated caps. Blue bonds, however, provide long-term financing specifically for ocean conservation and sustainable marine resource management, fostering economic growth alongside environmental protection. Choosing between the two depends on investment goals: carbon credits suit traders seeking short-term gains in emission markets, while blue bonds appeal to investors focused on sustainable development and marine ecosystem health.

Connection

Carbon credits trading and blue bonds are connected through their shared goal of promoting sustainable environmental investments. Carbon credits trading incentivizes reducing greenhouse gas emissions by monetizing emission reductions, while blue bonds finance projects aimed at ocean conservation and sustainable marine resource management. Integrating these mechanisms attracts impact investors seeking returns that support climate change mitigation and marine ecosystem preservation.

Key Terms

**Blue bonds:**

Blue bonds are debt instruments specifically designed to finance projects that protect ocean health and promote sustainable marine resource management, offering investors fixed returns while supporting environmental conservation. These bonds help address issues like overfishing, pollution, and habitat destruction by channeling capital into initiatives such as marine protected areas and sustainable fisheries. Discover more about how blue bonds contribute to ocean sustainability and investment portfolios.

Ocean conservation

Blue bonds finance projects that protect and restore ocean ecosystems, providing sustainable investment opportunities specifically targeting marine conservation and blue economy growth. Carbon credits trading allows companies to offset their greenhouse gas emissions by purchasing credits generated from verified carbon reduction projects, including those supporting ocean-based carbon sequestration like mangrove restoration. Explore the advantages and challenges of both mechanisms in driving effective ocean conservation solutions.

Sustainable fisheries

Blue bonds provide targeted financing for sustainable fisheries projects, supporting marine conservation and ecosystem restoration while offering investors a fixed income with environmental benefits. Carbon credits trading involves the buying and selling of emission allowances to offset carbon footprints, indirectly benefiting fisheries by funding initiatives that reduce ocean pollution and climate impacts. Explore how integrating blue bonds and carbon credits can drive innovation and effectiveness in sustainable fisheries management.

Source and External Links

Blue Bonds - NAP Global Network - Blue bonds are a type of green bond focused on financing marine resource projects like mangrove restoration, marine protected areas, and coastal climate adaptation to support ocean health and blue economies.

Blue Bond | Research and Innovation - European Union - Blue bonds are debt instruments issued by governments and corporations to raise capital for marine and ocean sustainability projects, combining economic and environmental benefits while supporting broader sustainable development goals.

Blue Finance - International Finance Corporation - IFC has actively supported blue bonds and loans, facilitating issuance in regions like East Asia Pacific, focusing on investments in water management, marine plastics reduction, fisheries, and aquaculture to boost blue economy financing.

dowidth.com

dowidth.com