Sneakers flipping offers rapid returns through limited-edition releases and resale on platforms like StockX, capitalizing on trends and brand collaborations. Comic book investing provides long-term value appreciation by acquiring rare editions and first appearances, tracked by CGC grading standards and auction results. Explore detailed strategies and market insights to determine which investment aligns best with your financial goals.

Why it is important

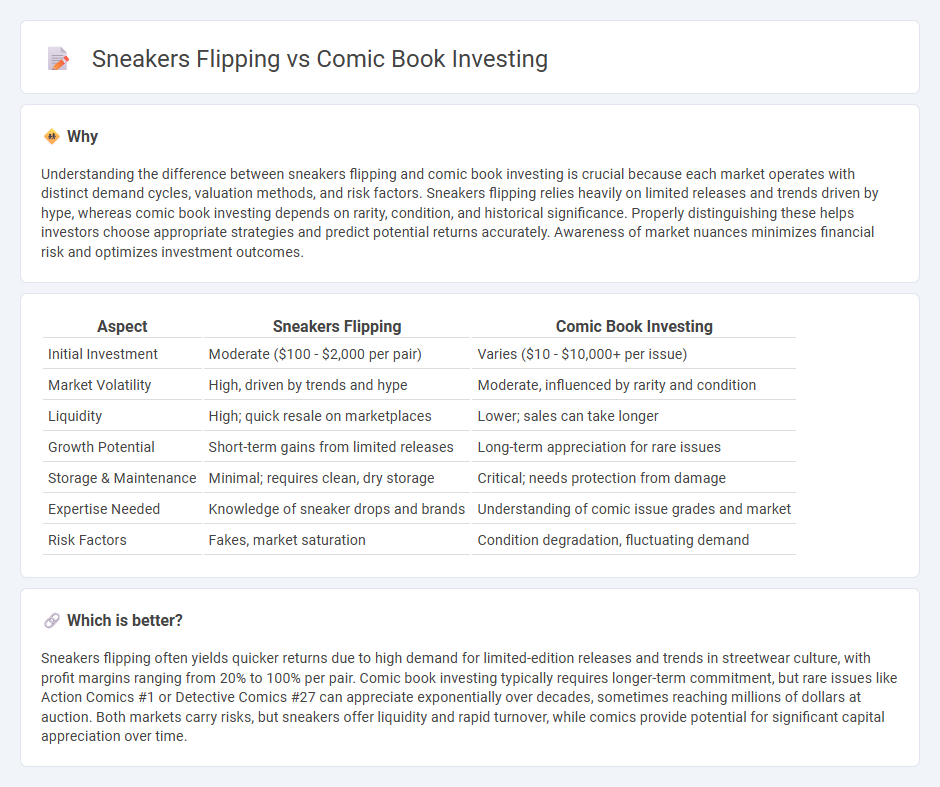

Understanding the difference between sneakers flipping and comic book investing is crucial because each market operates with distinct demand cycles, valuation methods, and risk factors. Sneakers flipping relies heavily on limited releases and trends driven by hype, whereas comic book investing depends on rarity, condition, and historical significance. Properly distinguishing these helps investors choose appropriate strategies and predict potential returns accurately. Awareness of market nuances minimizes financial risk and optimizes investment outcomes.

Comparison Table

| Aspect | Sneakers Flipping | Comic Book Investing |

|---|---|---|

| Initial Investment | Moderate ($100 - $2,000 per pair) | Varies ($10 - $10,000+ per issue) |

| Market Volatility | High, driven by trends and hype | Moderate, influenced by rarity and condition |

| Liquidity | High; quick resale on marketplaces | Lower; sales can take longer |

| Growth Potential | Short-term gains from limited releases | Long-term appreciation for rare issues |

| Storage & Maintenance | Minimal; requires clean, dry storage | Critical; needs protection from damage |

| Expertise Needed | Knowledge of sneaker drops and brands | Understanding of comic issue grades and market |

| Risk Factors | Fakes, market saturation | Condition degradation, fluctuating demand |

Which is better?

Sneakers flipping often yields quicker returns due to high demand for limited-edition releases and trends in streetwear culture, with profit margins ranging from 20% to 100% per pair. Comic book investing typically requires longer-term commitment, but rare issues like Action Comics #1 or Detective Comics #27 can appreciate exponentially over decades, sometimes reaching millions of dollars at auction. Both markets carry risks, but sneakers offer liquidity and rapid turnover, while comics provide potential for significant capital appreciation over time.

Connection

Sneakers flipping and comic book investing both capitalize on the principles of scarcity and consumer demand within niche markets, driving significant appreciation in asset value over time. Collectors in both domains focus on rare editions, brand collaborations, and limited releases that generate high resale potential. Market trends, cultural relevance, and condition grading play crucial roles in maximizing returns in these alternative investment strategies.

Key Terms

**Comic Book Investing:**

Comic book investing offers significant long-term value due to rarity, condition, and cultural significance, with iconic issues like Action Comics #1 or Amazing Fantasy #15 commanding high demand and escalating prices. Unlike sneakers, which often experience rapid depreciation after initial hype, rare comic books tend to appreciate steadily as collector interest and historical importance grow. Explore the detailed market trends and investment potential of comic book collecting to maximize your returns.

Grading

Comic book investing heavily relies on professional grading services like CGC to authenticate and assess condition, significantly impacting market value. Sneakers flipping depends on reputable authentication and grading platforms such as StockX and GOAT to verify originality and condition, influencing resale prices. Explore deeper insights into grading's role in maximizing profits in both markets.

Key Issues

Comic book investing revolves around the rarity, condition (graded by CGC), and cultural significance of the issues, with key pieces like Action Comics #1 or Detective Comics #27 commanding high premiums. Sneakers flipping hinges on limited editions, brand collaborations (e.g., Nike x Off-White), and market demand driven by hype cycles, with resale platforms like StockX facilitating transactions. Explore in-depth analyses on market trends, valuation models, and risk factors to better understand these dynamic investment arenas.

Source and External Links

I buy comics as an investment... - Comic book investing carries long-term risks, especially as demographics of collectors change, but can be profitable if one can pick the right books and sell at the right time, though it is not recommended to treat comics as a safe, long-term-only investment.

COMICSHEATINGUP - Informed Comic Book Speculation - This site highlights weekly comic releases with potential investment return, analyzing which new issues, variants, or exclusives might increase in value.

CBSI Comics | Comic Book Speculation and Investing - This resource focuses on finding undervalued comic books and guides collectors on how to spot promising issues or events that could yield substantial profits through speculation.

dowidth.com

dowidth.com