Music royalties provide a steady income stream generated from intellectual property rights, offering investors consistent cash flow and diversification from traditional markets. Hedge funds utilize complex strategies and leverage to maximize returns, often involving higher risk and requiring substantial capital commitments. Explore the comparative benefits and risks of investing in music royalties versus hedge funds to make informed financial decisions.

Why it is important

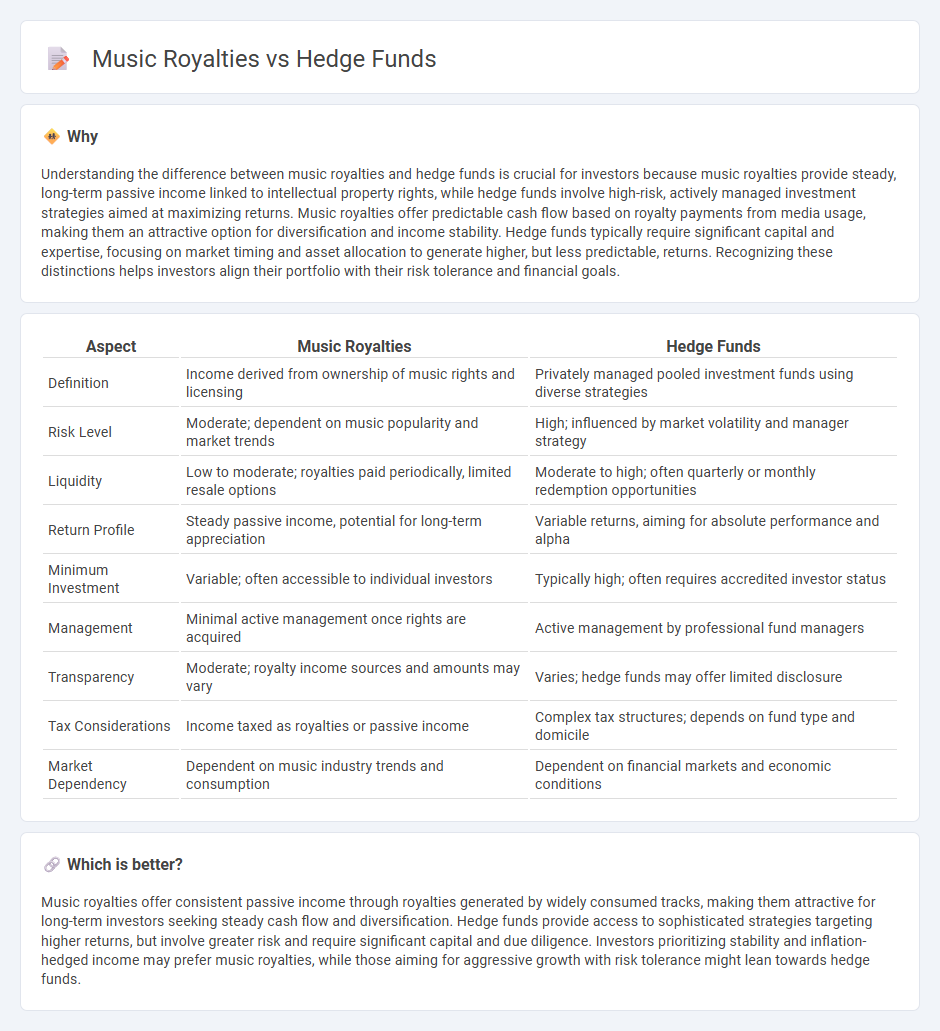

Understanding the difference between music royalties and hedge funds is crucial for investors because music royalties provide steady, long-term passive income linked to intellectual property rights, while hedge funds involve high-risk, actively managed investment strategies aimed at maximizing returns. Music royalties offer predictable cash flow based on royalty payments from media usage, making them an attractive option for diversification and income stability. Hedge funds typically require significant capital and expertise, focusing on market timing and asset allocation to generate higher, but less predictable, returns. Recognizing these distinctions helps investors align their portfolio with their risk tolerance and financial goals.

Comparison Table

| Aspect | Music Royalties | Hedge Funds |

|---|---|---|

| Definition | Income derived from ownership of music rights and licensing | Privately managed pooled investment funds using diverse strategies |

| Risk Level | Moderate; dependent on music popularity and market trends | High; influenced by market volatility and manager strategy |

| Liquidity | Low to moderate; royalties paid periodically, limited resale options | Moderate to high; often quarterly or monthly redemption opportunities |

| Return Profile | Steady passive income, potential for long-term appreciation | Variable returns, aiming for absolute performance and alpha |

| Minimum Investment | Variable; often accessible to individual investors | Typically high; often requires accredited investor status |

| Management | Minimal active management once rights are acquired | Active management by professional fund managers |

| Transparency | Moderate; royalty income sources and amounts may vary | Varies; hedge funds may offer limited disclosure |

| Tax Considerations | Income taxed as royalties or passive income | Complex tax structures; depends on fund type and domicile |

| Market Dependency | Dependent on music industry trends and consumption | Dependent on financial markets and economic conditions |

Which is better?

Music royalties offer consistent passive income through royalties generated by widely consumed tracks, making them attractive for long-term investors seeking steady cash flow and diversification. Hedge funds provide access to sophisticated strategies targeting higher returns, but involve greater risk and require significant capital and due diligence. Investors prioritizing stability and inflation-hedged income may prefer music royalties, while those aiming for aggressive growth with risk tolerance might lean towards hedge funds.

Connection

Music royalties provide a steady income stream that hedge funds leverage for portfolio diversification and risk management. By investing in music royalty rights, hedge funds capitalize on predictable cash flows generated by streaming, licensing, and publishing revenues. This alternative asset class enhances returns while mitigating volatility compared to traditional equity and bond investments.

Key Terms

Leverage

Hedge funds often utilize high leverage to amplify investment returns, employing borrowed capital to increase exposure in diverse asset classes. In contrast, music royalties offer low-leverage, stable cash flows derived from intellectual property rights, minimizing risk through predictable income streams rather than debt. Explore how leverage impacts risk and return profiles in both hedge fund strategies and music royalty investments.

Portfolio diversification

Hedge funds offer portfolio diversification by investing across various asset classes such as equities, fixed income, derivatives, and commodities, aiming to hedge risks and enhance returns through complex strategies. Music royalties provide a unique income stream tied to intellectual property rights, offering non-correlated cash flows that can reduce volatility in a traditional investment portfolio. Explore how combining hedge funds with music royalties can strategically optimize diversification and steady income generation.

Passive income

Hedge funds generate passive income through diversified investment strategies involving equities, bonds, and derivatives, often requiring high initial capital and exposure to market volatility. Music royalties provide a steady stream of passive income by earning payments whenever songs are played, streamed, or licensed, with lower correlation to financial markets and potential for long-term cash flow. Explore the detailed comparison to understand which passive income source aligns best with your financial goals.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - This webpage provides an overview of hedge funds, including their investment strategies and career opportunities.

Hedge Funds | Investor.gov - This page explains what hedge funds are, their investment strategies, and regulatory differences compared to mutual funds.

Hedge Funds - Institutional - BlackRock - BlackRock's webpage details their hedge fund strategies, investment processes, and solutions across various asset classes.

dowidth.com

dowidth.com