Alternative data analytics harnesses non-traditional data sources such as social media trends, satellite imagery, and transaction records to provide real-time insights into market behavior. Fundamental analysis evaluates a company's financial health through metrics like earnings, revenue, and balance sheets to determine intrinsic value. Explore the advantages and limitations of both methods to enhance your investment strategy.

Why it is important

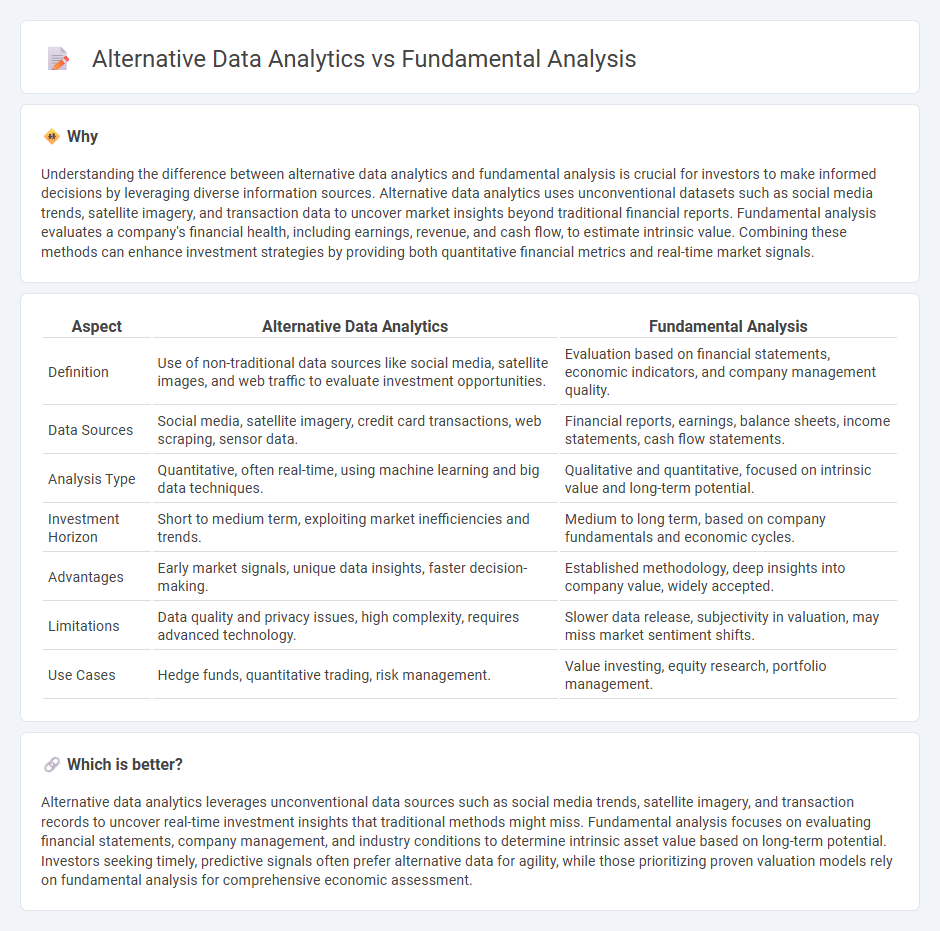

Understanding the difference between alternative data analytics and fundamental analysis is crucial for investors to make informed decisions by leveraging diverse information sources. Alternative data analytics uses unconventional datasets such as social media trends, satellite imagery, and transaction data to uncover market insights beyond traditional financial reports. Fundamental analysis evaluates a company's financial health, including earnings, revenue, and cash flow, to estimate intrinsic value. Combining these methods can enhance investment strategies by providing both quantitative financial metrics and real-time market signals.

Comparison Table

| Aspect | Alternative Data Analytics | Fundamental Analysis |

|---|---|---|

| Definition | Use of non-traditional data sources like social media, satellite images, and web traffic to evaluate investment opportunities. | Evaluation based on financial statements, economic indicators, and company management quality. |

| Data Sources | Social media, satellite imagery, credit card transactions, web scraping, sensor data. | Financial reports, earnings, balance sheets, income statements, cash flow statements. |

| Analysis Type | Quantitative, often real-time, using machine learning and big data techniques. | Qualitative and quantitative, focused on intrinsic value and long-term potential. |

| Investment Horizon | Short to medium term, exploiting market inefficiencies and trends. | Medium to long term, based on company fundamentals and economic cycles. |

| Advantages | Early market signals, unique data insights, faster decision-making. | Established methodology, deep insights into company value, widely accepted. |

| Limitations | Data quality and privacy issues, high complexity, requires advanced technology. | Slower data release, subjectivity in valuation, may miss market sentiment shifts. |

| Use Cases | Hedge funds, quantitative trading, risk management. | Value investing, equity research, portfolio management. |

Which is better?

Alternative data analytics leverages unconventional data sources such as social media trends, satellite imagery, and transaction records to uncover real-time investment insights that traditional methods might miss. Fundamental analysis focuses on evaluating financial statements, company management, and industry conditions to determine intrinsic asset value based on long-term potential. Investors seeking timely, predictive signals often prefer alternative data for agility, while those prioritizing proven valuation models rely on fundamental analysis for comprehensive economic assessment.

Connection

Alternative data analytics complements fundamental analysis by providing non-traditional insights such as social media trends, satellite imagery, and transaction data that enhance the evaluation of a company's financial health and market potential. Integrating alternative data with traditional financial metrics improves investment decision-making by identifying emerging risks and opportunities earlier than conventional methods alone. This combination enables investors to develop more robust, data-driven investment strategies that capture deeper market signals.

Key Terms

Earnings Reports

Earnings reports provide key financial data such as revenue, net income, and earnings per share, essential for fundamental analysis to assess company performance and valuation. Alternative data analytics incorporate non-traditional data sources like satellite imagery, social media sentiment, and transaction data to gain deeper insights into real-time business trends beyond standard financial statements. Discover how combining fundamental analysis with alternative data can enhance investment strategies and decision-making accuracy.

Sentiment Analysis

Fundamental analysis evaluates a company's financial health and market position using traditional metrics like earnings, revenue, and cash flow, while alternative data analytics harnesses non-traditional data sources, including social media trends, news sentiment, and customer reviews, to gauge market sentiment. Sentiment analysis, a key tool in alternative data, processes textual data using natural language processing (NLP) to detect investor mood and potential market trends that may not be reflected in financial statements. Explore how integrating sentiment analysis with fundamental data can enhance investment decisions and uncover hidden market opportunities.

ESG Metrics

Fundamental analysis evaluates company value through financial statements, earnings reports, and market position, emphasizing traditional ESG metrics like carbon emissions, governance structure, and social responsibility reports. Alternative data analytics leverages unconventional data sources such as satellite imagery, social media sentiment, and supply chain information to provide real-time insights into ESG performance and emerging risks. Explore in-depth how integrating these approaches enhances sustainable investing strategies.

Source and External Links

Fundamental Analysis - Corporate Finance Institute - Fundamental analysis is a method of assessing the intrinsic value of a security by analyzing macroeconomic and microeconomic factors to determine its true price for investment decisions.

Fundamental analysis - Wikipedia - Fundamental analysis evaluates a business's financial statements and economic, industry, and company factors to find the stock's intrinsic value and recommended buy, hold, or sell actions based on comparison to market price.

Beginners Guide to Fundamental Analysis | Learn to Trade - Oanda - Fundamental analysis assesses an instrument's strength over time, using top-down or bottom-up approaches and focusing on economic indicators like interest rates and trade balance that influence asset prices.

dowidth.com

dowidth.com