Collectible sneakers have emerged as an alternative investment class, offering potential high returns through rarity and brand collaborations, while bonds provide steady income with lower risk and predictable returns through fixed interest payments. Sneakers' value is driven by market demand, cultural trends, and limited editions, whereas bonds rely on credit ratings and economic factors. Explore the differences further to determine which investment aligns best with your financial goals.

Why it is important

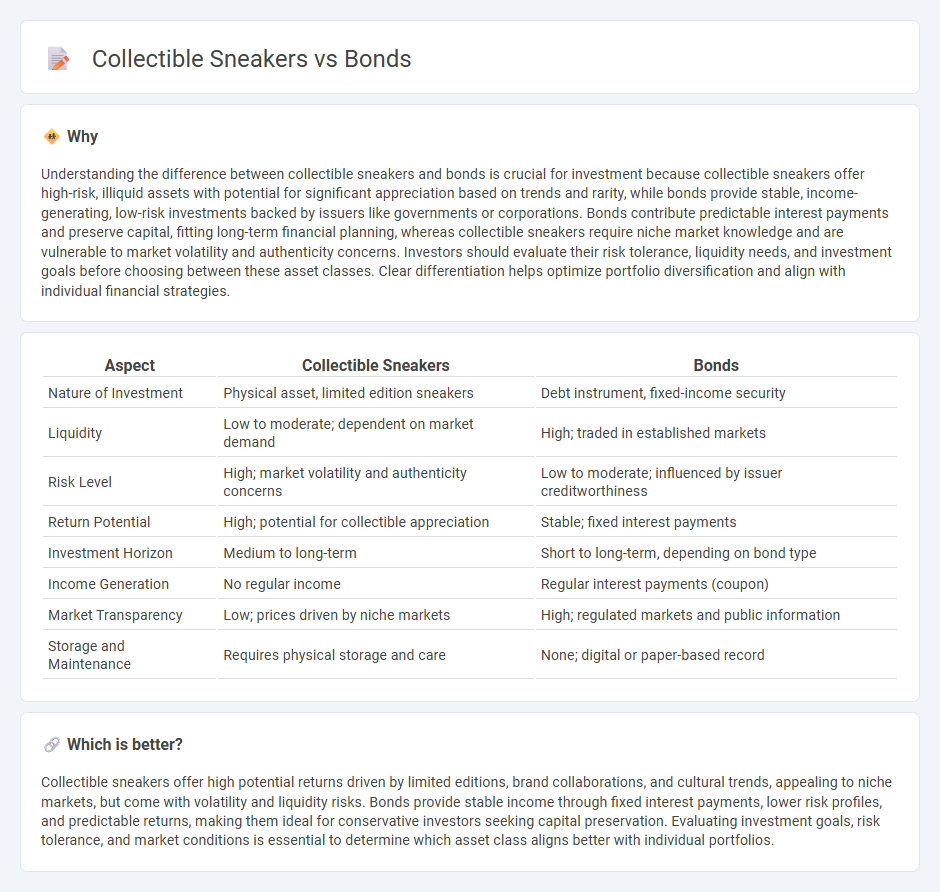

Understanding the difference between collectible sneakers and bonds is crucial for investment because collectible sneakers offer high-risk, illiquid assets with potential for significant appreciation based on trends and rarity, while bonds provide stable, income-generating, low-risk investments backed by issuers like governments or corporations. Bonds contribute predictable interest payments and preserve capital, fitting long-term financial planning, whereas collectible sneakers require niche market knowledge and are vulnerable to market volatility and authenticity concerns. Investors should evaluate their risk tolerance, liquidity needs, and investment goals before choosing between these asset classes. Clear differentiation helps optimize portfolio diversification and align with individual financial strategies.

Comparison Table

| Aspect | Collectible Sneakers | Bonds |

|---|---|---|

| Nature of Investment | Physical asset, limited edition sneakers | Debt instrument, fixed-income security |

| Liquidity | Low to moderate; dependent on market demand | High; traded in established markets |

| Risk Level | High; market volatility and authenticity concerns | Low to moderate; influenced by issuer creditworthiness |

| Return Potential | High; potential for collectible appreciation | Stable; fixed interest payments |

| Investment Horizon | Medium to long-term | Short to long-term, depending on bond type |

| Income Generation | No regular income | Regular interest payments (coupon) |

| Market Transparency | Low; prices driven by niche markets | High; regulated markets and public information |

| Storage and Maintenance | Requires physical storage and care | None; digital or paper-based record |

Which is better?

Collectible sneakers offer high potential returns driven by limited editions, brand collaborations, and cultural trends, appealing to niche markets, but come with volatility and liquidity risks. Bonds provide stable income through fixed interest payments, lower risk profiles, and predictable returns, making them ideal for conservative investors seeking capital preservation. Evaluating investment goals, risk tolerance, and market conditions is essential to determine which asset class aligns better with individual portfolios.

Connection

Collectible sneakers and bonds both serve as alternative investment assets with unique market dynamics and potential for long-term appreciation. While bonds offer fixed income and lower risk through government or corporate debt, collectible sneakers provide high-growth opportunities driven by rarity, brand significance, and cultural trends. Investors often diversify portfolios by balancing the stability of bonds with the speculative potential of sneaker investments, optimizing risk and return.

Key Terms

Yield

Bonds typically offer fixed income with yields ranging from 1% to 5% annually depending on credit quality and duration, providing predictable returns and lower risk compared to other asset classes. Collectible sneakers can generate higher yields through appreciation, sometimes exceeding 10% annually, but carry greater market volatility, liquidity challenges, and valuation uncertainty. Explore detailed comparisons of yield potential and risk profiles to decide which investment aligns with your financial goals.

Liquidity

Bonds offer high liquidity due to established markets where investors can quickly buy or sell at transparent prices, making them ideal for those needing easy access to cash. Collectible sneakers, on the other hand, typically have lower liquidity as they rely on niche resale platforms and fluctuating demand, which can delay sales and affect price stability. Explore the dynamics of liquidity between these asset classes to make informed investment decisions.

Market Value

Bonds typically offer stable, predictable returns with lower volatility, making them a reliable asset for preserving capital and generating steady income. Collectible sneakers, driven by limited editions and cultural trends, can experience rapid appreciation but carry higher risk due to fluctuating demand and market speculation. Explore further to understand which investment aligns best with your financial goals and risk tolerance.

Source and External Links

Investor.gov Bonds - A bond is a debt security, like an IOU, where you lend money to an issuer (government, municipality, or company) in exchange for regular interest payments and the return of the principal at maturity.

Wikipedia Bond (finance) - Bonds are issued by governments or corporations to secure long-term investment capital, and investors receive fixed interest payments along with the promised repayment of the principal on a predetermined future date.

Vanguard What Is a Bond and How Do They Work? - By purchasing a bond, you are making a loan to the issuer, who agrees to pay you periodic interest (usually twice a year) and to return the bond's face value at maturity, without granting you any ownership rights in the issuer.

dowidth.com

dowidth.com