Sports card fractionalization offers investors affordable access to high-value collectibles by dividing ownership into smaller shares, enabling liquidity in a traditionally illiquid market. Luxury watch fractionalization similarly democratizes access to premium timepieces, combining tangible asset appreciation with potential rental income streams. Explore how fractional investment in these high-demand assets can diversify your portfolio and enhance wealth-building opportunities.

Why it is important

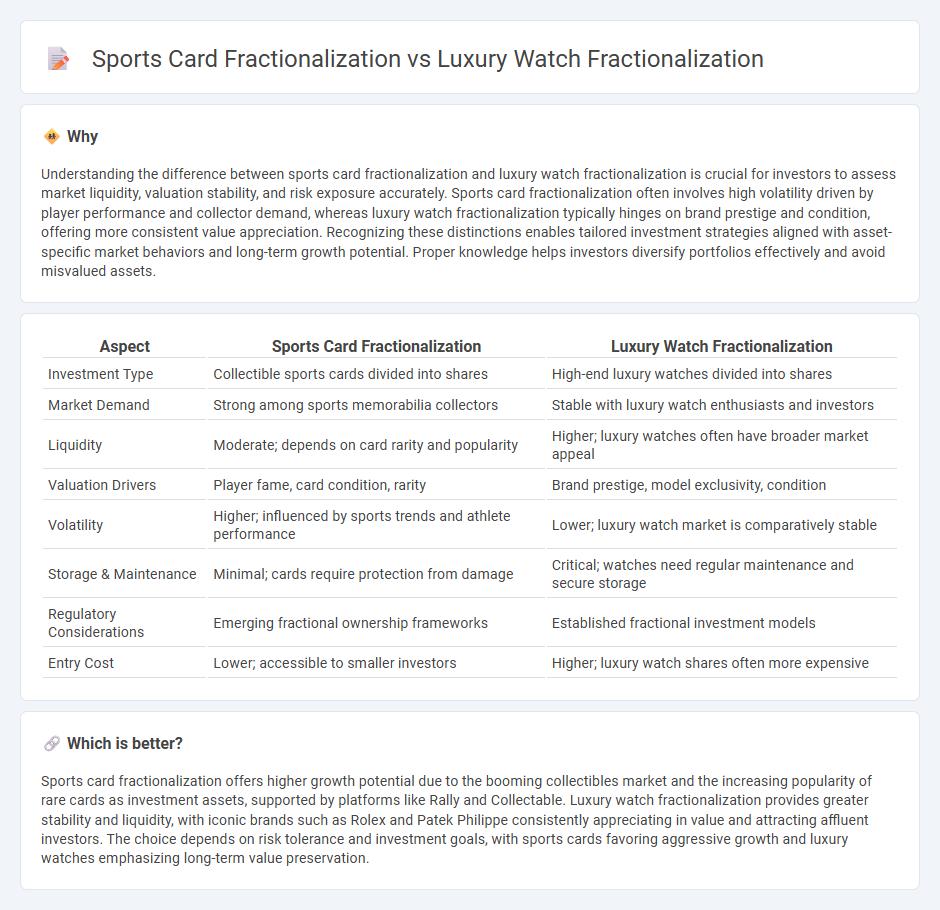

Understanding the difference between sports card fractionalization and luxury watch fractionalization is crucial for investors to assess market liquidity, valuation stability, and risk exposure accurately. Sports card fractionalization often involves high volatility driven by player performance and collector demand, whereas luxury watch fractionalization typically hinges on brand prestige and condition, offering more consistent value appreciation. Recognizing these distinctions enables tailored investment strategies aligned with asset-specific market behaviors and long-term growth potential. Proper knowledge helps investors diversify portfolios effectively and avoid misvalued assets.

Comparison Table

| Aspect | Sports Card Fractionalization | Luxury Watch Fractionalization |

|---|---|---|

| Investment Type | Collectible sports cards divided into shares | High-end luxury watches divided into shares |

| Market Demand | Strong among sports memorabilia collectors | Stable with luxury watch enthusiasts and investors |

| Liquidity | Moderate; depends on card rarity and popularity | Higher; luxury watches often have broader market appeal |

| Valuation Drivers | Player fame, card condition, rarity | Brand prestige, model exclusivity, condition |

| Volatility | Higher; influenced by sports trends and athlete performance | Lower; luxury watch market is comparatively stable |

| Storage & Maintenance | Minimal; cards require protection from damage | Critical; watches need regular maintenance and secure storage |

| Regulatory Considerations | Emerging fractional ownership frameworks | Established fractional investment models |

| Entry Cost | Lower; accessible to smaller investors | Higher; luxury watch shares often more expensive |

Which is better?

Sports card fractionalization offers higher growth potential due to the booming collectibles market and the increasing popularity of rare cards as investment assets, supported by platforms like Rally and Collectable. Luxury watch fractionalization provides greater stability and liquidity, with iconic brands such as Rolex and Patek Philippe consistently appreciating in value and attracting affluent investors. The choice depends on risk tolerance and investment goals, with sports cards favoring aggressive growth and luxury watches emphasizing long-term value preservation.

Connection

Sports card fractionalization and luxury watch fractionalization both leverage blockchain technology to democratize ownership of high-value collectibles, enabling multiple investors to hold shares in rare assets. This fractional ownership increases liquidity by allowing trading of smaller stakes, reducing entry barriers for investors interested in the sports memorabilia and luxury watch markets. The shared platform infrastructure creates transparent provenance and secure transfers, fostering trust and expanding market participation in both asset classes.

Key Terms

Asset Valuation

Luxury watch fractionalization leverages precise market data, brand heritage, and rarity to establish asset valuation, often resulting in stable and appreciating shares due to inherent craftsmanship and limited editions. Sports card fractionalization relies heavily on player performance, card condition, and market sentiment, which can lead to more volatile valuation impacted by athlete popularity and game outcomes. Explore how these differing asset valuations influence investment strategies and market dynamics.

Ownership Shares

Luxury watch fractionalization offers investors shared ownership of rare timepieces, enabling access to high-value assets without full purchase costs. Sports card fractionalization allows collectors to invest in portions of valuable cards, benefiting from market appreciation while reducing individual financial exposure. Explore the distinct advantages and market dynamics of ownership shares in these collectible asset classes to enhance your investment strategy.

Secondary Market Liquidity

Luxury watch fractionalization enhances secondary market liquidity by enabling investors to trade ownership shares of rare timepieces, unlocking high-value assets with limited initial capital. Sports card fractionalization similarly increases liquidity by dividing ownership of valuable collectible cards, facilitating easier entry and faster transactions within expanding trading platforms. Explore the nuanced impacts of fractional ownership on market dynamics and asset accessibility for deeper insights.

Source and External Links

Own Fractions of The Most Valuable Watches With Elephants - This article discusses how Elephants, a Swiss-Italian startup, uses blockchain to fractionalize luxury watches, allowing multiple owners to share high-value timepieces.

The Investment Market for Luxury Watches is Growing - The piece highlights the growth of the luxury watch investment market, particularly through fractionalization, which lowers entry barriers for potential investors.

Elephantsclub: Your Gateway to Fractional Luxury Watch Ownership - This platform explains how fractional ownership through Elephantsclub democratizes access to high-value watches, offering convenience and liquidity in an otherwise illiquid market.

dowidth.com

dowidth.com