Blue economy funds focus on sustainable investments in ocean-based industries such as fisheries, renewable marine energy, and coastal tourism, promoting environmental conservation alongside economic growth. Sovereign wealth funds are state-owned investment vehicles that allocate national revenues to diversify assets across global markets, ensuring long-term fiscal stability and wealth preservation. Explore the unique advantages and strategies of blue economy funds compared to sovereign wealth funds to optimize your investment decisions.

Why it is important

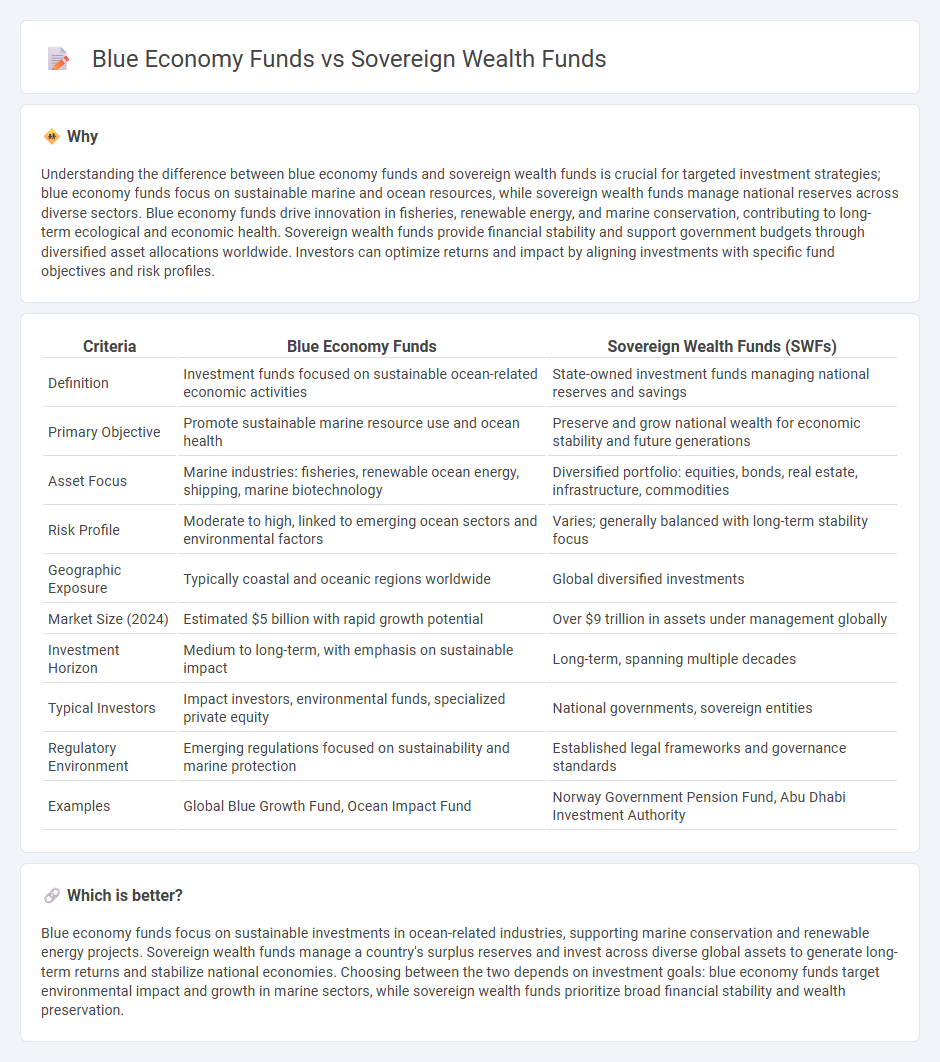

Understanding the difference between blue economy funds and sovereign wealth funds is crucial for targeted investment strategies; blue economy funds focus on sustainable marine and ocean resources, while sovereign wealth funds manage national reserves across diverse sectors. Blue economy funds drive innovation in fisheries, renewable energy, and marine conservation, contributing to long-term ecological and economic health. Sovereign wealth funds provide financial stability and support government budgets through diversified asset allocations worldwide. Investors can optimize returns and impact by aligning investments with specific fund objectives and risk profiles.

Comparison Table

| Criteria | Blue Economy Funds | Sovereign Wealth Funds (SWFs) |

|---|---|---|

| Definition | Investment funds focused on sustainable ocean-related economic activities | State-owned investment funds managing national reserves and savings |

| Primary Objective | Promote sustainable marine resource use and ocean health | Preserve and grow national wealth for economic stability and future generations |

| Asset Focus | Marine industries: fisheries, renewable ocean energy, shipping, marine biotechnology | Diversified portfolio: equities, bonds, real estate, infrastructure, commodities |

| Risk Profile | Moderate to high, linked to emerging ocean sectors and environmental factors | Varies; generally balanced with long-term stability focus |

| Geographic Exposure | Typically coastal and oceanic regions worldwide | Global diversified investments |

| Market Size (2024) | Estimated $5 billion with rapid growth potential | Over $9 trillion in assets under management globally |

| Investment Horizon | Medium to long-term, with emphasis on sustainable impact | Long-term, spanning multiple decades |

| Typical Investors | Impact investors, environmental funds, specialized private equity | National governments, sovereign entities |

| Regulatory Environment | Emerging regulations focused on sustainability and marine protection | Established legal frameworks and governance standards |

| Examples | Global Blue Growth Fund, Ocean Impact Fund | Norway Government Pension Fund, Abu Dhabi Investment Authority |

Which is better?

Blue economy funds focus on sustainable investments in ocean-related industries, supporting marine conservation and renewable energy projects. Sovereign wealth funds manage a country's surplus reserves and invest across diverse global assets to generate long-term returns and stabilize national economies. Choosing between the two depends on investment goals: blue economy funds target environmental impact and growth in marine sectors, while sovereign wealth funds prioritize broad financial stability and wealth preservation.

Connection

Blue economy funds and sovereign wealth funds connect through their strategic investment goals focused on sustainable growth and natural resource management. Both invest in sectors like marine renewable energy, fisheries, and ocean conservation to promote economic development while preserving marine ecosystems. This alignment enables sovereign wealth funds to diversify portfolios with blue economy assets, enhancing long-term value and environmental resilience.

Key Terms

**Sovereign Wealth Funds:**

Sovereign Wealth Funds (SWFs) are state-owned investment funds primarily financed by surplus revenues from commodities or fiscal reserves, often exceeding trillions in assets under management globally. They aim to stabilize national economies, generate long-term returns, and finance social and economic development projects across various sectors, including infrastructure and technology. Explore more to understand how SWFs strategically influence global markets and sustainable growth initiatives.

Asset Allocation

Sovereign wealth funds typically allocate a large portion of their assets to diversified global equities, fixed income, and alternative investments to ensure long-term capital growth and stability, while blue economy funds concentrate their allocations on sustainable marine industries such as fisheries, renewable ocean energy, and maritime transport to support environmental and economic resilience. The asset allocation of sovereign wealth funds is often influenced by national economic objectives and fiscal stabilization needs, contrasting with blue economy funds which prioritize environmental impact and sustainable resource management within their portfolios. Explore further how these distinct strategies drive investment decisions and risk management in evolving global markets.

Fiscal Stabilization

Sovereign wealth funds (SWFs) primarily support fiscal stabilization by managing national resource revenues to buffer economic fluctuations and maintain budgetary balance. Blue economy funds invest in sustainable marine and aquatic industries, promoting long-term environmental resilience while contributing to economic growth without direct fiscal stabilization mandates. Explore how integrating blue economy investments with sovereign wealth strategies can enhance multi-dimensional fiscal and ecological stability.

Source and External Links

What is a Sovereign Wealth Fund? - Provides an overview of sovereign wealth funds, including their definition, characteristics, and objectives.

Sovereign Wealth Fund - Describes the nature and role of sovereign wealth funds as state-owned investment vehicles investing in various assets globally.

Sovereign Wealth Fund Rankings - Offers rankings of the top sovereign wealth funds by total assets, providing insights into major investment players.

dowidth.com

dowidth.com