Play-to-earn gaming offers investors a unique opportunity to monetize gameplay through blockchain-based rewards, driven by the rising popularity of NFT assets and decentralized finance integration. Crowdfunding platforms enable diverse investment portfolios by allowing users to back innovative startups and projects in exchange for equity, early access, or rewards, fostering community-driven funding models. Explore detailed comparisons to discover the optimal investment approach for your financial goals.

Why it is important

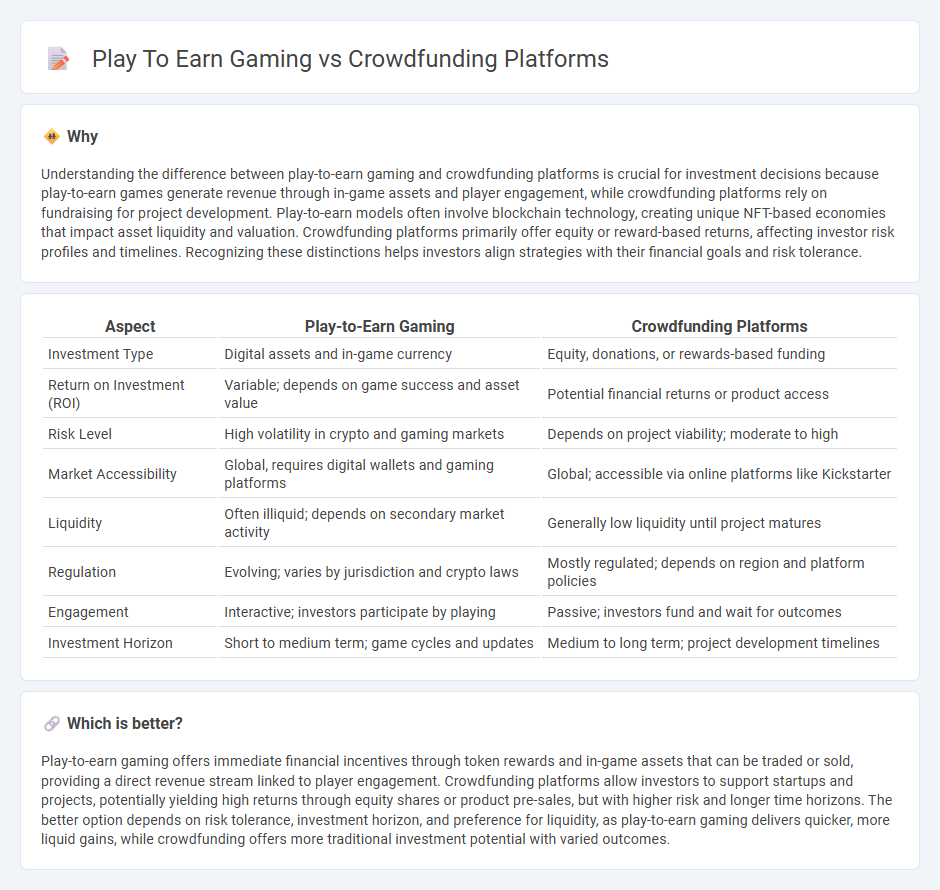

Understanding the difference between play-to-earn gaming and crowdfunding platforms is crucial for investment decisions because play-to-earn games generate revenue through in-game assets and player engagement, while crowdfunding platforms rely on fundraising for project development. Play-to-earn models often involve blockchain technology, creating unique NFT-based economies that impact asset liquidity and valuation. Crowdfunding platforms primarily offer equity or reward-based returns, affecting investor risk profiles and timelines. Recognizing these distinctions helps investors align strategies with their financial goals and risk tolerance.

Comparison Table

| Aspect | Play-to-Earn Gaming | Crowdfunding Platforms |

|---|---|---|

| Investment Type | Digital assets and in-game currency | Equity, donations, or rewards-based funding |

| Return on Investment (ROI) | Variable; depends on game success and asset value | Potential financial returns or product access |

| Risk Level | High volatility in crypto and gaming markets | Depends on project viability; moderate to high |

| Market Accessibility | Global, requires digital wallets and gaming platforms | Global; accessible via online platforms like Kickstarter |

| Liquidity | Often illiquid; depends on secondary market activity | Generally low liquidity until project matures |

| Regulation | Evolving; varies by jurisdiction and crypto laws | Mostly regulated; depends on region and platform policies |

| Engagement | Interactive; investors participate by playing | Passive; investors fund and wait for outcomes |

| Investment Horizon | Short to medium term; game cycles and updates | Medium to long term; project development timelines |

Which is better?

Play-to-earn gaming offers immediate financial incentives through token rewards and in-game assets that can be traded or sold, providing a direct revenue stream linked to player engagement. Crowdfunding platforms allow investors to support startups and projects, potentially yielding high returns through equity shares or product pre-sales, but with higher risk and longer time horizons. The better option depends on risk tolerance, investment horizon, and preference for liquidity, as play-to-earn gaming delivers quicker, more liquid gains, while crowdfunding offers more traditional investment potential with varied outcomes.

Connection

Play-to-earn gaming integrates blockchain technology, enabling players to earn digital assets with real-world value that can be invested via crowdfunding platforms. Crowdfunding platforms facilitate the capital flow needed to develop these games, attracting investors interested in innovative, decentralized gaming economies. This synergy drives new investment opportunities by merging interactive entertainment with community-funded financial models.

Key Terms

Crowdfunding platforms:

Crowdfunding platforms empower entrepreneurs and creators to raise capital directly from a global audience by leveraging online communities and social networks, often offering equity, rewards, or early access in return. These platforms facilitate diverse project funding, from technology startups to creative ventures, fostering innovation by democratizing investment opportunities. Explore how crowdfunding platforms transform fundraising dynamics and create inclusive economic ecosystems.

Equity

Crowdfunding platforms enable users to invest capital in startups or projects in exchange for equity shares, offering potential long-term financial returns based on company performance. Play-to-earn gaming integrates blockchain technology, allowing players to earn crypto-assets or NFTs that can reflect fractional ownership or stakes akin to equity in the game ecosystem. Explore how these innovative models balance investment risk and reward by learning more about equity dynamics within digital economies.

Backers

Crowdfunding platforms empower backers to directly finance innovative projects, fostering community engagement through rewards and updates. Play-to-earn gaming offers backers interactive experiences where they can earn digital assets and real-world value by participating in game ecosystems. Explore how these models transform backer participation and value creation in digital economies.

Source and External Links

How to Choose the Best Crowdfunding Website for Your Cause - Overview of platforms like Fundly, FundRazr, and DonorsChoose with their features and fee structures for individuals, nonprofits, and educational causes.

10 Best Crowdfunding Sites and Platforms in 2025 - A list of top crowdfunding sites including Mightycause for nonprofits and CrowdStreet for real estate, outlining their fees, pros, and cons.

GoFundMe | The #1 Crowdfunding and Fundraising Platform - Details on GoFundMe's ease of use, no platform fees for starters, and its leadership as a global crowdfunding platform for personal and charity causes.

dowidth.com

dowidth.com