Sports card fractionalization allows investors to buy shares in valuable collectible cards, providing accessible entry into the memorabilia market with potentially high returns. Real estate fractional ownership enables multiple investors to hold proportional shares in property assets, offering diversification and steady income streams through rental yields. Explore more to understand which fractional investment aligns best with your financial goals.

Why it is important

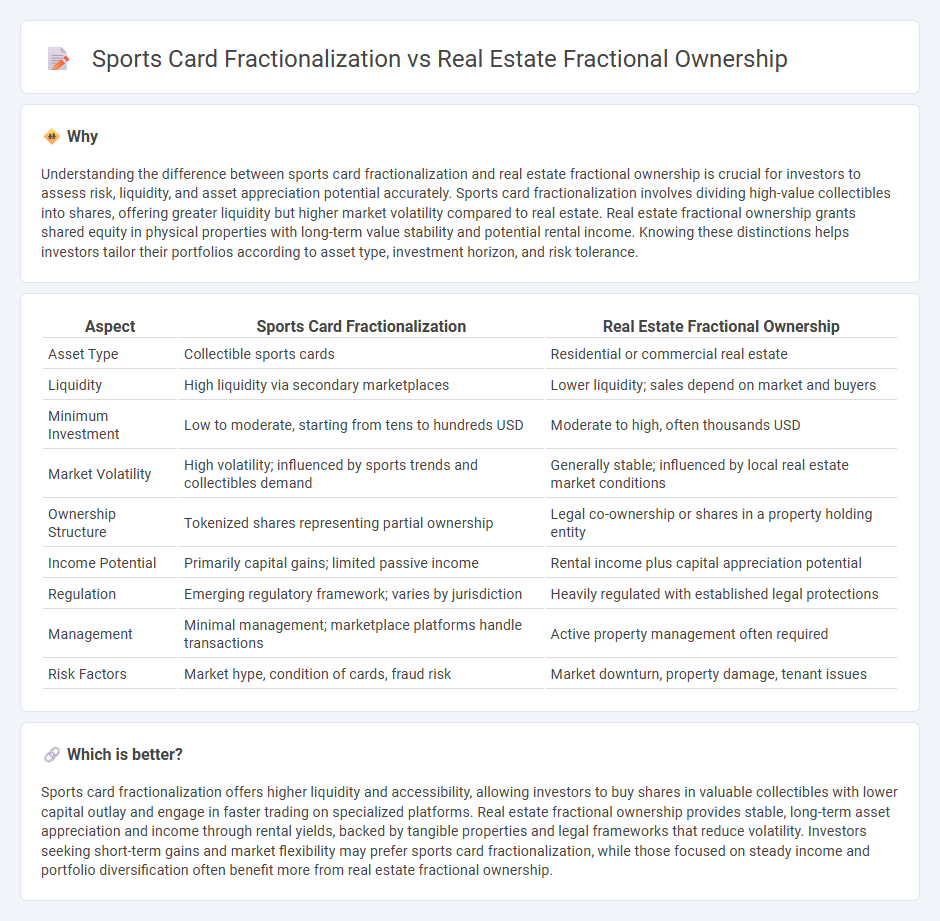

Understanding the difference between sports card fractionalization and real estate fractional ownership is crucial for investors to assess risk, liquidity, and asset appreciation potential accurately. Sports card fractionalization involves dividing high-value collectibles into shares, offering greater liquidity but higher market volatility compared to real estate. Real estate fractional ownership grants shared equity in physical properties with long-term value stability and potential rental income. Knowing these distinctions helps investors tailor their portfolios according to asset type, investment horizon, and risk tolerance.

Comparison Table

| Aspect | Sports Card Fractionalization | Real Estate Fractional Ownership |

|---|---|---|

| Asset Type | Collectible sports cards | Residential or commercial real estate |

| Liquidity | High liquidity via secondary marketplaces | Lower liquidity; sales depend on market and buyers |

| Minimum Investment | Low to moderate, starting from tens to hundreds USD | Moderate to high, often thousands USD |

| Market Volatility | High volatility; influenced by sports trends and collectibles demand | Generally stable; influenced by local real estate market conditions |

| Ownership Structure | Tokenized shares representing partial ownership | Legal co-ownership or shares in a property holding entity |

| Income Potential | Primarily capital gains; limited passive income | Rental income plus capital appreciation potential |

| Regulation | Emerging regulatory framework; varies by jurisdiction | Heavily regulated with established legal protections |

| Management | Minimal management; marketplace platforms handle transactions | Active property management often required |

| Risk Factors | Market hype, condition of cards, fraud risk | Market downturn, property damage, tenant issues |

Which is better?

Sports card fractionalization offers higher liquidity and accessibility, allowing investors to buy shares in valuable collectibles with lower capital outlay and engage in faster trading on specialized platforms. Real estate fractional ownership provides stable, long-term asset appreciation and income through rental yields, backed by tangible properties and legal frameworks that reduce volatility. Investors seeking short-term gains and market flexibility may prefer sports card fractionalization, while those focused on steady income and portfolio diversification often benefit more from real estate fractional ownership.

Connection

Sports card fractionalization and real estate fractional ownership both leverage blockchain technology to democratize investment access by allowing multiple investors to own shares of high-value assets. These models increase liquidity and reduce entry barriers, enabling small-scale investors to participate in markets traditionally dominated by wealthy individuals. Fractional ownership platforms utilize smart contracts to ensure transparent transactions and secure asset management, bridging collectibles and property investments through shared ownership structures.

Key Terms

**Real estate fractional ownership:**

Real estate fractional ownership allows multiple investors to share equity in a property, reducing individual capital requirements and diversifying risk across residential or commercial assets. This method leverages legal frameworks, property appreciation, and rental income distributions to optimize returns for stakeholders. Explore the dynamics of real estate fractional ownership to unlock innovative investment opportunities.

Property shares

Fractional ownership in real estate allows multiple investors to hold shares in a property, diversifying risk and lowering entry costs through property shares. Sports card fractionalization partitions ownership of high-value collectibles into tradable shares, enabling enthusiasts to invest with smaller capital outlay. Explore the nuances of property shares to understand how fractional ownership transforms real estate investment opportunities.

Rental income

Real estate fractional ownership offers investors rental income generated from physical properties, providing steady cash flow and potential appreciation in value. Sports card fractionalization, by contrast, typically lacks direct income streams, focusing instead on asset appreciation and market trading liquidity. Explore the nuances of rental income benefits in real estate versus capital gains potential in sports card fractional investing to make informed decisions.

Source and External Links

Fractional ownership - Wikipedia - Fractional ownership allows multiple unrelated parties to share ownership and costs of a high-value asset like resort real estate, with each owner having a guaranteed usage portion and sharing ongoing management and maintenance fees.

What is fractional ownership in real estate? (+ pros and cons) - Pacaso - Fractional ownership in real estate involves multiple parties holding deeds to a shared property, with ownership shares granting proportionate usage rights, shared expenses, and potential appreciation of their investment.

Fractional Interest Ownership - National Association of REALTORS(r) - Fractional ownership splits the cost and benefits of an asset like a vacation home among shareholders, offering affordability and divided responsibilities, but it can have drawbacks such as difficulty in selling and restrictions tied to ownership.

dowidth.com

dowidth.com