Tax lien certificates offer investors a secured return by purchasing liens on properties with unpaid taxes, allowing them to earn interest or acquire ownership through foreclosure. Fix and flip involves purchasing undervalued properties, renovating them, and selling at a higher price for profit, which requires substantial capital and market knowledge. Explore the detailed benefits and risks of tax lien certificates versus fix and flip investments to make informed decisions.

Why it is important

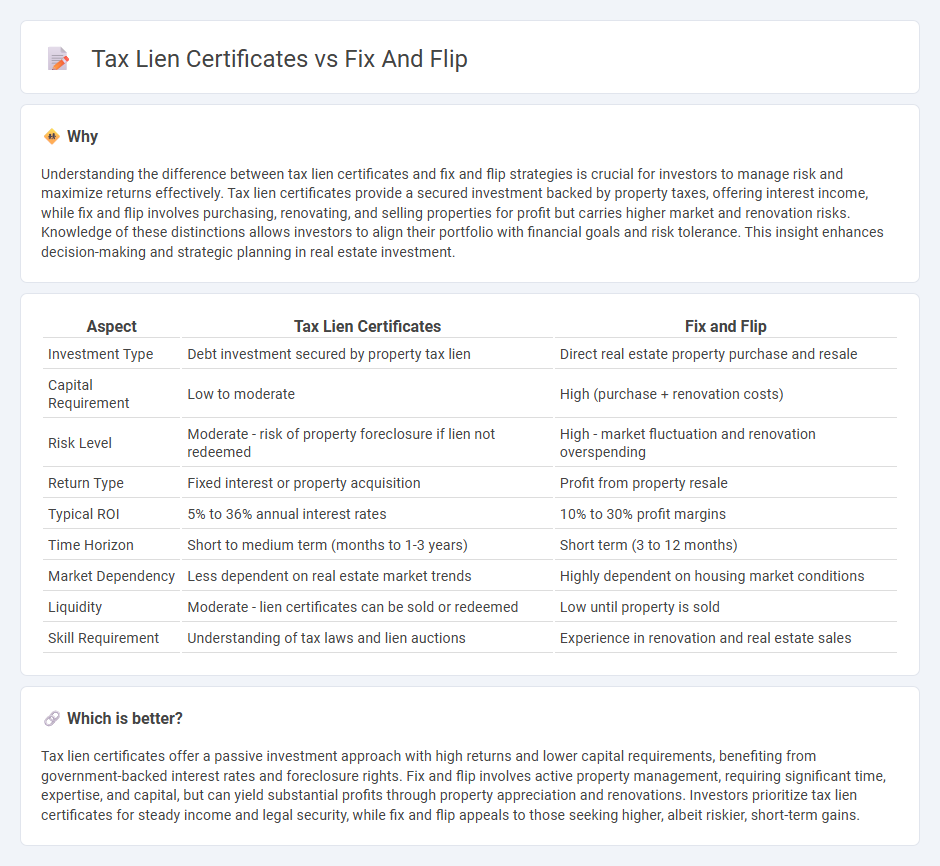

Understanding the difference between tax lien certificates and fix and flip strategies is crucial for investors to manage risk and maximize returns effectively. Tax lien certificates provide a secured investment backed by property taxes, offering interest income, while fix and flip involves purchasing, renovating, and selling properties for profit but carries higher market and renovation risks. Knowledge of these distinctions allows investors to align their portfolio with financial goals and risk tolerance. This insight enhances decision-making and strategic planning in real estate investment.

Comparison Table

| Aspect | Tax Lien Certificates | Fix and Flip |

|---|---|---|

| Investment Type | Debt investment secured by property tax lien | Direct real estate property purchase and resale |

| Capital Requirement | Low to moderate | High (purchase + renovation costs) |

| Risk Level | Moderate - risk of property foreclosure if lien not redeemed | High - market fluctuation and renovation overspending |

| Return Type | Fixed interest or property acquisition | Profit from property resale |

| Typical ROI | 5% to 36% annual interest rates | 10% to 30% profit margins |

| Time Horizon | Short to medium term (months to 1-3 years) | Short term (3 to 12 months) |

| Market Dependency | Less dependent on real estate market trends | Highly dependent on housing market conditions |

| Liquidity | Moderate - lien certificates can be sold or redeemed | Low until property is sold |

| Skill Requirement | Understanding of tax laws and lien auctions | Experience in renovation and real estate sales |

Which is better?

Tax lien certificates offer a passive investment approach with high returns and lower capital requirements, benefiting from government-backed interest rates and foreclosure rights. Fix and flip involves active property management, requiring significant time, expertise, and capital, but can yield substantial profits through property appreciation and renovations. Investors prioritize tax lien certificates for steady income and legal security, while fix and flip appeals to those seeking higher, albeit riskier, short-term gains.

Connection

Tax lien certificates provide a unique investment opportunity by allowing investors to purchase property tax debts and potentially acquire real estate below market value, which aligns closely with the fix and flip strategy. Investors who secure tax lien certificates can gain legal rights to foreclose on delinquent properties, enabling them to acquire homes that may require renovation and subsequent resale for a profit. Combining tax lien certificate investments with fix and flip tactics maximizes returns by leveraging distressed property acquisition and value enhancement through rehabilitation.

Key Terms

Capital Gains

Fix and flip real estate investments often generate short-term capital gains taxed at higher rates due to rapid property sales, while tax lien certificates can yield interest income with capital gains implications when liens are resolved and properties sold. Short-term capital gains from fix and flip projects may significantly impact after-tax profits, requiring careful planning to optimize returns. Explore tax strategies and investment comparisons to maximize financial outcomes in both approaches.

Redemption Period

Fix and flip involves purchasing, renovating, and quickly selling properties for profit, while tax lien certificates are investments in the debt secured by property taxes, often yielding interest or the chance to acquire the property if unpaid. The redemption period in tax lien certificates is a critical timeframe during which property owners can repay overdue taxes plus interest to reclaim ownership, differing significantly from fix and flip, which has no such restriction. Explore the nuances of redemption periods and how they impact your investment strategy further.

After Repair Value (ARV)

After Repair Value (ARV) plays a crucial role in the fix and flip strategy, determining the potential profit margin by estimating the property's market value post-renovation. In contrast, tax lien certificates focus on securing a return through interest or property acquisition rather than property appreciation, making ARV less relevant. Explore detailed comparisons to better understand which investment aligns with your financial goals.

Source and External Links

Fix-and-Flip Deals: Beginner's Guide to Profitable Property ... - A fix-and-flip deal involves buying a property below market value, making improvements over a short period, and selling it for a profit, with the process often taking a few months depending on the extent of renovations needed.

Fix-and-flip - This strategy entails purchasing a discounted property, renovating it (sometimes requiring major repairs), and quickly reselling it at a higher price to make a profit by adding more value than the renovation costs.

Fix-and-Flip Success: Step-by-Step Guide - The fix-and-flip formula is a strategic approach to buying low, renovating wisely, and selling high, involving careful planning to identify undervalued properties and executing renovations to maximize profit.

dowidth.com

dowidth.com