Collectibles investment involves acquiring physical items such as art, coins, or vintage memorabilia that may appreciate in value over time, offering tangible assets backed by cultural and historical significance. Cryptocurrency investment focuses on digital assets like Bitcoin or Ethereum, characterized by high volatility, decentralized blockchain technology, and potential for rapid gains or losses. Explore the unique risks and opportunities associated with each investment type to make informed financial decisions.

Why it is important

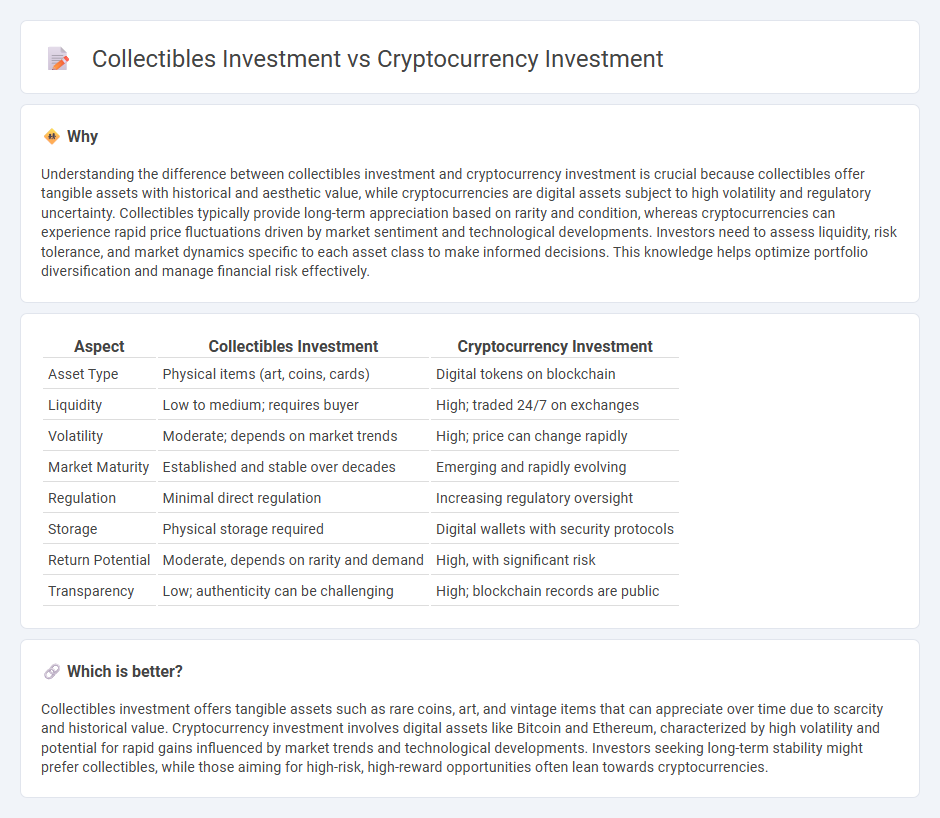

Understanding the difference between collectibles investment and cryptocurrency investment is crucial because collectibles offer tangible assets with historical and aesthetic value, while cryptocurrencies are digital assets subject to high volatility and regulatory uncertainty. Collectibles typically provide long-term appreciation based on rarity and condition, whereas cryptocurrencies can experience rapid price fluctuations driven by market sentiment and technological developments. Investors need to assess liquidity, risk tolerance, and market dynamics specific to each asset class to make informed decisions. This knowledge helps optimize portfolio diversification and manage financial risk effectively.

Comparison Table

| Aspect | Collectibles Investment | Cryptocurrency Investment |

|---|---|---|

| Asset Type | Physical items (art, coins, cards) | Digital tokens on blockchain |

| Liquidity | Low to medium; requires buyer | High; traded 24/7 on exchanges |

| Volatility | Moderate; depends on market trends | High; price can change rapidly |

| Market Maturity | Established and stable over decades | Emerging and rapidly evolving |

| Regulation | Minimal direct regulation | Increasing regulatory oversight |

| Storage | Physical storage required | Digital wallets with security protocols |

| Return Potential | Moderate, depends on rarity and demand | High, with significant risk |

| Transparency | Low; authenticity can be challenging | High; blockchain records are public |

Which is better?

Collectibles investment offers tangible assets such as rare coins, art, and vintage items that can appreciate over time due to scarcity and historical value. Cryptocurrency investment involves digital assets like Bitcoin and Ethereum, characterized by high volatility and potential for rapid gains influenced by market trends and technological developments. Investors seeking long-term stability might prefer collectibles, while those aiming for high-risk, high-reward opportunities often lean towards cryptocurrencies.

Connection

Collectibles investment and cryptocurrency investment share a connection through their emphasis on market speculation, rarity, and value appreciation potential. Both asset classes offer investors opportunities to diversify portfolios by acquiring unique or scarce items, such as rare coins, art, or digital tokens, which can increase in value based on demand and scarcity. The use of blockchain technology in cryptocurrency also facilitates provenance tracking and authenticity verification, concepts already valued in traditional collectibles markets.

Key Terms

Cryptocurrency Investment:

Cryptocurrency investment offers high liquidity, decentralized control, and potential for rapid value appreciation driven by blockchain technology and market demand. Unlike traditional collectibles, cryptocurrencies provide 24/7 trading access on global exchanges, allowing investors to capitalize on price volatility and emerging technological innovations such as DeFi and NFTs. Explore further to understand risk management strategies and market trends in cryptocurrency investment.

Blockchain

Cryptocurrency investment leverages blockchain technology to offer decentralized, transparent, and secure digital assets, ensuring real-time transaction verification and immutable ledger records. Collectibles investment increasingly incorporates blockchain through NFTs (Non-Fungible Tokens), providing provenance, ownership authenticity, and rarity verification in the digital and physical asset markets. Explore how blockchain revolutionizes asset security and market dynamics to better understand these emerging investment opportunities.

Volatility

Cryptocurrency investment is characterized by extreme volatility, with prices often swinging by double-digit percentages within hours due to market sentiment, regulatory news, and technological developments. In contrast, collectibles investment tends to exhibit lower volatility, influenced more by rarity, condition, and long-term demand rather than frequent market fluctuations. Explore the distinct risk profiles and market behaviors to determine which investment aligns better with your volatility tolerance.

Source and External Links

How Does Cryptocurrency Work? A Beginner's Guide - Coursera - Cryptocurrency investment involves significant risk due to price volatility; beginners should start small, research different assets like Bitcoin and Ethereum, and consider options like crypto funds and blockchain ETFs while managing risk according to their investment timeline and tolerance.

What is Cryptocurrency and How Does it Work? - Kaspersky - Safe cryptocurrency investing requires thorough research of exchanges and storage wallets, diversification of assets, and preparedness for volatility given the speculative and high-risk nature of the market.

Cryptocurrency Investment Types - Charles Schwab - Investors can access cryptocurrency exposure through direct crypto coin trusts, mutual funds, futures, and spot- or options-based products, but due to extreme volatility and lack of traditional valuation metrics, these assets demand a high risk tolerance and are not suited for typical asset allocation.

dowidth.com

dowidth.com