Sneakers flipping involves buying limited-edition sneakers and reselling them at a higher price, leveraging scarcity and brand hype, while cryptocurrency trading focuses on buying and selling digital assets like Bitcoin or Ethereum based on market trends and volatility. Sneakers flipping typically requires knowledge of sneaker culture and market demand, whereas cryptocurrency trading demands understanding of blockchain technology and technical analysis. Explore the distinct investment opportunities and risks associated with both to make informed financial decisions.

Why it is important

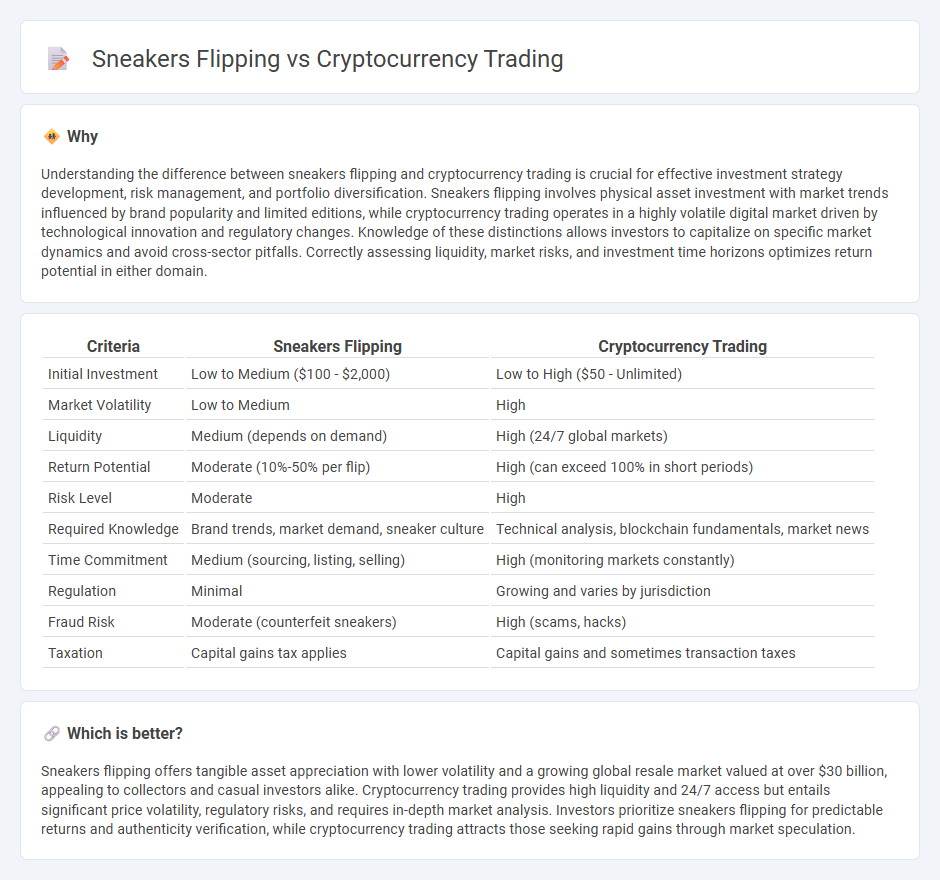

Understanding the difference between sneakers flipping and cryptocurrency trading is crucial for effective investment strategy development, risk management, and portfolio diversification. Sneakers flipping involves physical asset investment with market trends influenced by brand popularity and limited editions, while cryptocurrency trading operates in a highly volatile digital market driven by technological innovation and regulatory changes. Knowledge of these distinctions allows investors to capitalize on specific market dynamics and avoid cross-sector pitfalls. Correctly assessing liquidity, market risks, and investment time horizons optimizes return potential in either domain.

Comparison Table

| Criteria | Sneakers Flipping | Cryptocurrency Trading |

|---|---|---|

| Initial Investment | Low to Medium ($100 - $2,000) | Low to High ($50 - Unlimited) |

| Market Volatility | Low to Medium | High |

| Liquidity | Medium (depends on demand) | High (24/7 global markets) |

| Return Potential | Moderate (10%-50% per flip) | High (can exceed 100% in short periods) |

| Risk Level | Moderate | High |

| Required Knowledge | Brand trends, market demand, sneaker culture | Technical analysis, blockchain fundamentals, market news |

| Time Commitment | Medium (sourcing, listing, selling) | High (monitoring markets constantly) |

| Regulation | Minimal | Growing and varies by jurisdiction |

| Fraud Risk | Moderate (counterfeit sneakers) | High (scams, hacks) |

| Taxation | Capital gains tax applies | Capital gains and sometimes transaction taxes |

Which is better?

Sneakers flipping offers tangible asset appreciation with lower volatility and a growing global resale market valued at over $30 billion, appealing to collectors and casual investors alike. Cryptocurrency trading provides high liquidity and 24/7 access but entails significant price volatility, regulatory risks, and requires in-depth market analysis. Investors prioritize sneakers flipping for predictable returns and authenticity verification, while cryptocurrency trading attracts those seeking rapid gains through market speculation.

Connection

Sneakers flipping and cryptocurrency trading both capitalize on market volatility and trend-driven demand to generate high returns in short timeframes. Each requires keen market analysis, timing, and the ability to predict shifts in consumer interest or asset value. These activities illustrate alternative investment strategies leveraging digital platforms and global marketplaces for profit maximization.

Key Terms

**Cryptocurrency Trading:**

Cryptocurrency trading involves buying and selling digital assets like Bitcoin, Ethereum, and altcoins on various exchanges to capitalize on market volatility and price fluctuations. Traders use technical analysis, market trends, and real-time data to make informed decisions and maximize returns within short time frames. Explore the essential strategies and tools behind successful cryptocurrency trading to enhance your investment approach.

Blockchain

Cryptocurrency trading leverages blockchain technology to enable secure, transparent, and decentralized transactions, offering real-time price tracking and automated smart contracts. Sneakers flipping involves buying limited-edition sneakers and reselling them at a profit, typically relying on market demand and hype rather than digital infrastructure. Explore the impact of blockchain advancements on emerging investment opportunities to learn more.

Volatility

Cryptocurrency trading experiences extreme volatility, with price fluctuations often exceeding 10% within hours, driven by market sentiment, regulatory news, and technological developments. Sneakers flipping generally sees more stable value changes, influenced by limited releases, brand collaborations, and cultural trends, resulting in slower but consistent profit margins. Explore detailed comparisons to understand which market suits your risk appetite and investment strategy.

Source and External Links

Crypto.com - A platform for buying, selling, and trading over 400 cryptocurrencies with various payment options.

IG Cryptocurrency Trading - Provides information on how to trade cryptocurrencies via CFDs or buying underlying coins, with options to speculate on price movements.

Gemini: Day Trading Crypto - Offers a guide to day trading cryptocurrencies, including strategies and tools for managing risk and profit in this volatile market.

dowidth.com

dowidth.com