Royalty streaming provides investors with a percentage of revenue generated by assets without ownership dilution, offering predictable cash flow linked to asset performance. Preferred shares grant priority dividend payments and liquidation preferences but may lack upside potential tied directly to revenue streams. Explore the nuances and benefits of these investment options to tailor your portfolio strategy effectively.

Why it is important

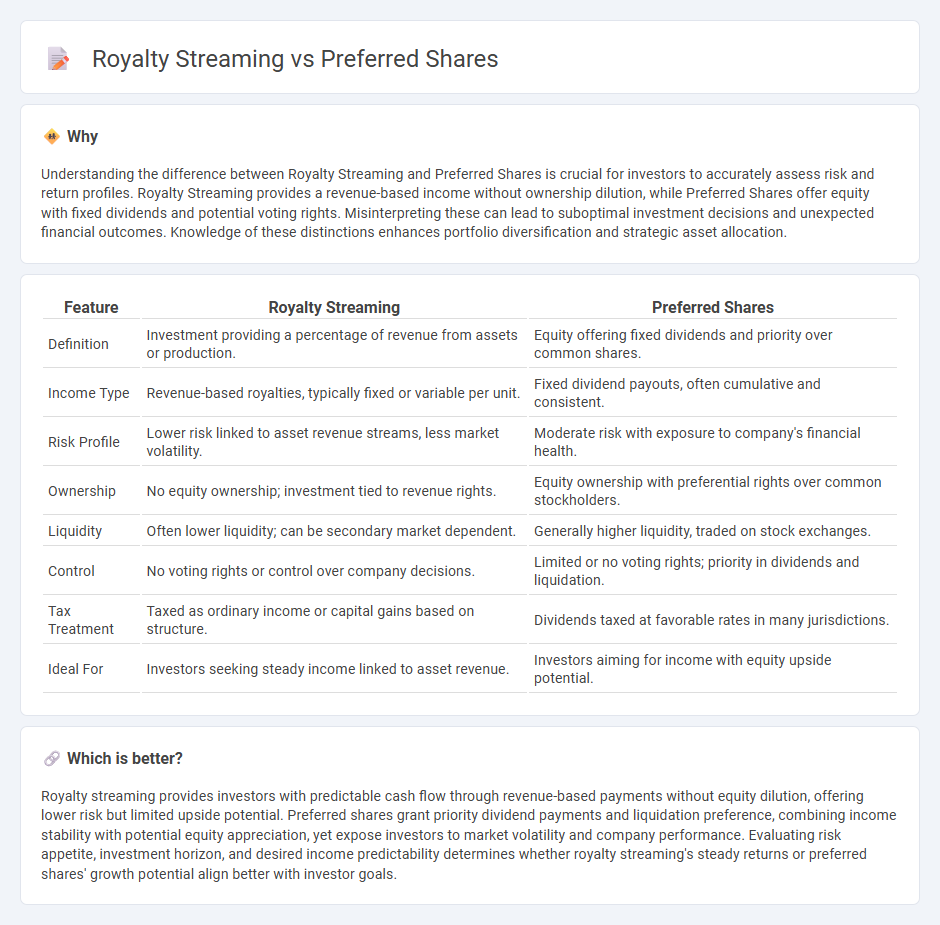

Understanding the difference between Royalty Streaming and Preferred Shares is crucial for investors to accurately assess risk and return profiles. Royalty Streaming provides a revenue-based income without ownership dilution, while Preferred Shares offer equity with fixed dividends and potential voting rights. Misinterpreting these can lead to suboptimal investment decisions and unexpected financial outcomes. Knowledge of these distinctions enhances portfolio diversification and strategic asset allocation.

Comparison Table

| Feature | Royalty Streaming | Preferred Shares |

|---|---|---|

| Definition | Investment providing a percentage of revenue from assets or production. | Equity offering fixed dividends and priority over common shares. |

| Income Type | Revenue-based royalties, typically fixed or variable per unit. | Fixed dividend payouts, often cumulative and consistent. |

| Risk Profile | Lower risk linked to asset revenue streams, less market volatility. | Moderate risk with exposure to company's financial health. |

| Ownership | No equity ownership; investment tied to revenue rights. | Equity ownership with preferential rights over common stockholders. |

| Liquidity | Often lower liquidity; can be secondary market dependent. | Generally higher liquidity, traded on stock exchanges. |

| Control | No voting rights or control over company decisions. | Limited or no voting rights; priority in dividends and liquidation. |

| Tax Treatment | Taxed as ordinary income or capital gains based on structure. | Dividends taxed at favorable rates in many jurisdictions. |

| Ideal For | Investors seeking steady income linked to asset revenue. | Investors aiming for income with equity upside potential. |

Which is better?

Royalty streaming provides investors with predictable cash flow through revenue-based payments without equity dilution, offering lower risk but limited upside potential. Preferred shares grant priority dividend payments and liquidation preference, combining income stability with potential equity appreciation, yet expose investors to market volatility and company performance. Evaluating risk appetite, investment horizon, and desired income predictability determines whether royalty streaming's steady returns or preferred shares' growth potential align better with investor goals.

Connection

Royalty streaming and preferred shares are connected through their roles in providing investors with stable, predictable income streams. Royalty streaming agreements grant investors rights to a percentage of a company's revenue or production, similar to how preferred shares offer fixed dividends and priority in earnings distribution. Both instruments offer downside protection and are favored in sectors like mining and energy for risk-averse investment strategies.

Key Terms

Dividend Preference

Preferred shares offer investors a fixed dividend preference, ensuring they receive dividend payments before common shareholders, enhancing income stability. Royalty streaming provides revenue-based payments tied to production or sales, without ownership or voting rights, limiting dividend-like benefits. Explore the nuances of dividend preference and investment benefits between preferred shares and royalty streaming opportunities for informed decisions.

Royalty Payments

Preferred shares provide shareholders with fixed dividend payments that have priority over common stock dividends, ensuring a steady income stream. Royalty streaming involves upfront capital investment in exchange for a percentage of revenue or production, yielding ongoing royalty payments tied directly to asset performance. Explore the key benefits and differences in how royalty payments drive investor returns compared to preferred dividends.

Equity Ownership

Preferred shares provide investors with equity ownership, offering priority dividends and potential voting rights within a company. Royalty streaming involves purchasing rights to future revenue streams without acquiring equity or ownership stakes. Explore detailed comparisons to understand which investment aligns with your equity ownership goals.

Source and External Links

Preferred Shares - Types, Features, Classification of Shares - Preferred shares represent ownership in a corporation with priority over common shares for dividends and assets, offering a mix of equity and debt-like features, typically without voting rights and are senior to common stock but junior to bonds.

Preferred Shares vs. Common Shares | Differences - Wall Street Prep - Preferred shares provide more stable dividends but less profit potential than common shares and usually do not carry voting rights, making them favored by mature companies with steady earnings.

preferred stock | Wex | US Law | LII / Legal Information Institute - Preferred stock holders have priority in dividend payments and asset claims over common shareholders and often lack voting rights; preferred stock may include conversion or buyback clauses and has specific tax treatments.

dowidth.com

dowidth.com