Sneakers flipping involves purchasing limited-edition or rare sneakers and reselling them at a higher price, capitalizing on market demand and trends. Real estate investing focuses on acquiring properties to generate rental income, appreciation, or both, often requiring significant capital and long-term commitment. Explore the pros and cons of each investment strategy to determine which aligns best with your financial goals.

Why it is important

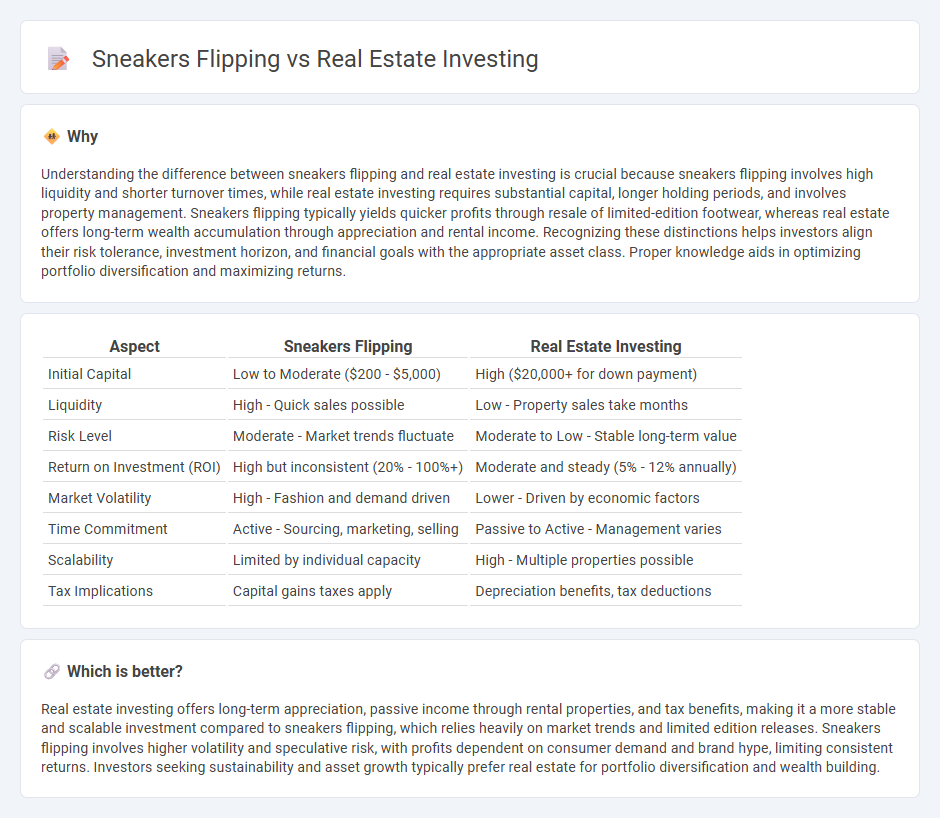

Understanding the difference between sneakers flipping and real estate investing is crucial because sneakers flipping involves high liquidity and shorter turnover times, while real estate investing requires substantial capital, longer holding periods, and involves property management. Sneakers flipping typically yields quicker profits through resale of limited-edition footwear, whereas real estate offers long-term wealth accumulation through appreciation and rental income. Recognizing these distinctions helps investors align their risk tolerance, investment horizon, and financial goals with the appropriate asset class. Proper knowledge aids in optimizing portfolio diversification and maximizing returns.

Comparison Table

| Aspect | Sneakers Flipping | Real Estate Investing |

|---|---|---|

| Initial Capital | Low to Moderate ($200 - $5,000) | High ($20,000+ for down payment) |

| Liquidity | High - Quick sales possible | Low - Property sales take months |

| Risk Level | Moderate - Market trends fluctuate | Moderate to Low - Stable long-term value |

| Return on Investment (ROI) | High but inconsistent (20% - 100%+) | Moderate and steady (5% - 12% annually) |

| Market Volatility | High - Fashion and demand driven | Lower - Driven by economic factors |

| Time Commitment | Active - Sourcing, marketing, selling | Passive to Active - Management varies |

| Scalability | Limited by individual capacity | High - Multiple properties possible |

| Tax Implications | Capital gains taxes apply | Depreciation benefits, tax deductions |

Which is better?

Real estate investing offers long-term appreciation, passive income through rental properties, and tax benefits, making it a more stable and scalable investment compared to sneakers flipping, which relies heavily on market trends and limited edition releases. Sneakers flipping involves higher volatility and speculative risk, with profits dependent on consumer demand and brand hype, limiting consistent returns. Investors seeking sustainability and asset growth typically prefer real estate for portfolio diversification and wealth building.

Connection

Sneakers flipping and real estate investing both capitalize on market demand, leveraging asset appreciation for profit through strategic buying and selling. Both practices require understanding trends, timing purchases, and identifying undervalued products or properties to maximize returns. Successful investors in each field analyze market data and consumer behavior to predict value growth and optimize investment outcomes.

Key Terms

**Real Estate Investing:**

Real estate investing offers long-term wealth-building potential through property appreciation, rental income, and tax benefits, making it a stable asset class compared to the volatile sneaker flipping market driven by trends and resale demand. Key metrics such as capitalization rates, cash-on-cash returns, and market analysis guide investors toward profitable property acquisitions and portfolio diversification. Explore in-depth strategies and financial insights to maximize your returns in real estate investing.

Equity

Real estate investing builds equity by increasing property value and paying down mortgage principal over time, creating substantial long-term wealth. Sneakers flipping generates quick profits through buying limited-edition shoes at retail and reselling them at higher prices but lacks tangible equity accumulation. Explore detailed strategies and benefits to understand how each approach suits your financial goals.

Cash Flow

Real estate investing generates steady cash flow through rental income, offering long-term financial stability and potential property appreciation. Sneakers flipping relies on market trends and limited releases, producing faster but less predictable cash flow with higher risk. Explore these investment strategies to determine which best suits your financial goals and cash flow preferences.

Source and External Links

Real estate investing - Wikipedia - Real estate investing involves purchasing, owning, managing, renting, or selling real estate to generate profit or long-term wealth, with success depending on market conditions, valuation, financing, and risk management.

Real Estate Investing: 5 Ways to Get Started - NerdWallet - Key ways to start investing in real estate include buying REITs, using online platforms, rental properties, property flipping, and other strategies for diversifying and generating income.

Real Estate Investing for Beginners: 5 Skills of Successful Investors - Harvard Professional Development - Real estate is the world's largest asset class offering potential passive income and tax advantages, but requires specific skills, understanding of property types, and patience for long-term success.

dowidth.com

dowidth.com