Livestock investment platforms allow investors to gain returns by funding animal farming operations, capitalizing on the growing demand for meat and dairy products. Crowdfunding real estate platforms pool resources from multiple investors to finance property developments, offering diversified portfolios and potential rental income or capital appreciation. Explore the differences in risk, returns, and market dynamics between these two innovative investment avenues.

Why it is important

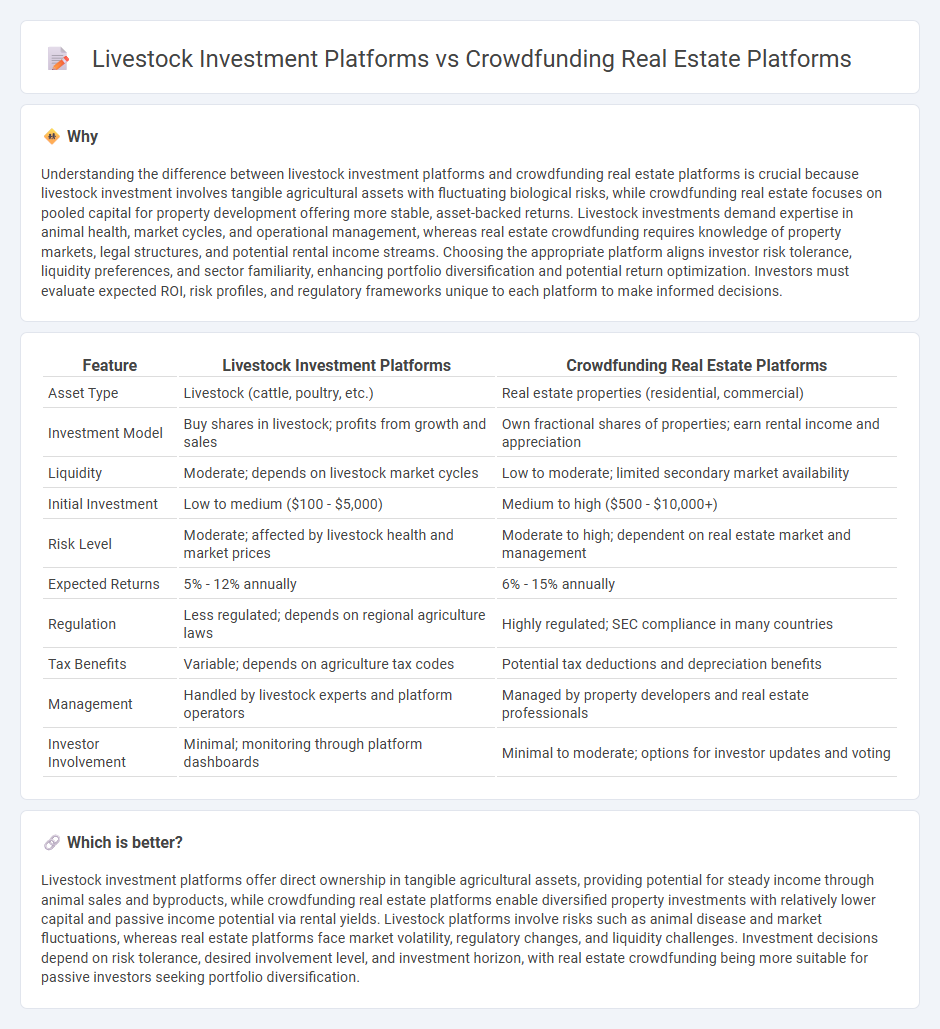

Understanding the difference between livestock investment platforms and crowdfunding real estate platforms is crucial because livestock investment involves tangible agricultural assets with fluctuating biological risks, while crowdfunding real estate focuses on pooled capital for property development offering more stable, asset-backed returns. Livestock investments demand expertise in animal health, market cycles, and operational management, whereas real estate crowdfunding requires knowledge of property markets, legal structures, and potential rental income streams. Choosing the appropriate platform aligns investor risk tolerance, liquidity preferences, and sector familiarity, enhancing portfolio diversification and potential return optimization. Investors must evaluate expected ROI, risk profiles, and regulatory frameworks unique to each platform to make informed decisions.

Comparison Table

| Feature | Livestock Investment Platforms | Crowdfunding Real Estate Platforms |

|---|---|---|

| Asset Type | Livestock (cattle, poultry, etc.) | Real estate properties (residential, commercial) |

| Investment Model | Buy shares in livestock; profits from growth and sales | Own fractional shares of properties; earn rental income and appreciation |

| Liquidity | Moderate; depends on livestock market cycles | Low to moderate; limited secondary market availability |

| Initial Investment | Low to medium ($100 - $5,000) | Medium to high ($500 - $10,000+) |

| Risk Level | Moderate; affected by livestock health and market prices | Moderate to high; dependent on real estate market and management |

| Expected Returns | 5% - 12% annually | 6% - 15% annually |

| Regulation | Less regulated; depends on regional agriculture laws | Highly regulated; SEC compliance in many countries |

| Tax Benefits | Variable; depends on agriculture tax codes | Potential tax deductions and depreciation benefits |

| Management | Handled by livestock experts and platform operators | Managed by property developers and real estate professionals |

| Investor Involvement | Minimal; monitoring through platform dashboards | Minimal to moderate; options for investor updates and voting |

Which is better?

Livestock investment platforms offer direct ownership in tangible agricultural assets, providing potential for steady income through animal sales and byproducts, while crowdfunding real estate platforms enable diversified property investments with relatively lower capital and passive income potential via rental yields. Livestock platforms involve risks such as animal disease and market fluctuations, whereas real estate platforms face market volatility, regulatory changes, and liquidity challenges. Investment decisions depend on risk tolerance, desired involvement level, and investment horizon, with real estate crowdfunding being more suitable for passive investors seeking portfolio diversification.

Connection

Livestock investment platforms and crowdfunding real estate platforms both leverage digital technology to democratize access to previously exclusive asset classes, enabling investors to pool resources and share returns. These platforms utilize online ecosystems that facilitate fractional ownership, risk diversification, and passive income generation through collective investments. By integrating blockchain and smart contracts, they enhance transparency, liquidity, and security, bridging traditional investment models with innovative crowd-based funding solutions.

Key Terms

Crowdfunding real estate platforms:

Crowdfunding real estate platforms enable investors to pool capital for diversified property projects, offering access to residential, commercial, and industrial real estate with lower entry barriers and potential for steady rental income and capital appreciation. These platforms typically provide detailed investment data, including property location, market trends, projected returns, and risk assessments, fostering informed decision-making. Explore the advantages, top platforms, and investment strategies to maximize returns in real estate crowdfunding.

Equity ownership

Crowdfunding real estate platforms offer investors equity ownership in tangible property assets, providing potential rental income and capital appreciation. Livestock investment platforms grant equity stakes in agricultural ventures, allowing participants to benefit from livestock growth and production yields. Explore detailed comparisons to understand which equity investment aligns best with your financial goals.

Diversification

Crowdfunding real estate platforms enable investors to diversify their portfolios by pooling capital into various property types like residential, commercial, and industrial sectors, spreading risk across multiple geographic locations. Livestock investment platforms offer diversification through agricultural exposure, where investors participate in livestock breeding, health, and market cycles, distinguishing from traditional asset classes. Explore the dynamic benefits and risk profiles of both options to enhance your investment strategy.

Source and External Links

Fundrise - Provides an accessible platform for nonaccredited investors to participate in real estate crowdfunding with low minimum investment requirements.

RealtyMogul - Offers crowdfunding options for both nonaccredited and accredited investors, focusing on REITs and individual properties.

CrowdStreet - A platform exclusively for accredited investors, offering commercial and residential real estate investment opportunities with a high minimum investment threshold.

dowidth.com

dowidth.com