Sports memorabilia funds offer investors the opportunity to diversify portfolios with tangible, collectible assets often correlated with cultural trends and athlete popularity, providing potential for high returns through rarity and historical significance. Index funds, conversely, provide broad market exposure, liquidity, and lower fees by tracking the performance of specific market indices like the S&P 500. Explore the unique advantages and risks of each investment type to determine which aligns best with your financial goals.

Why it is important

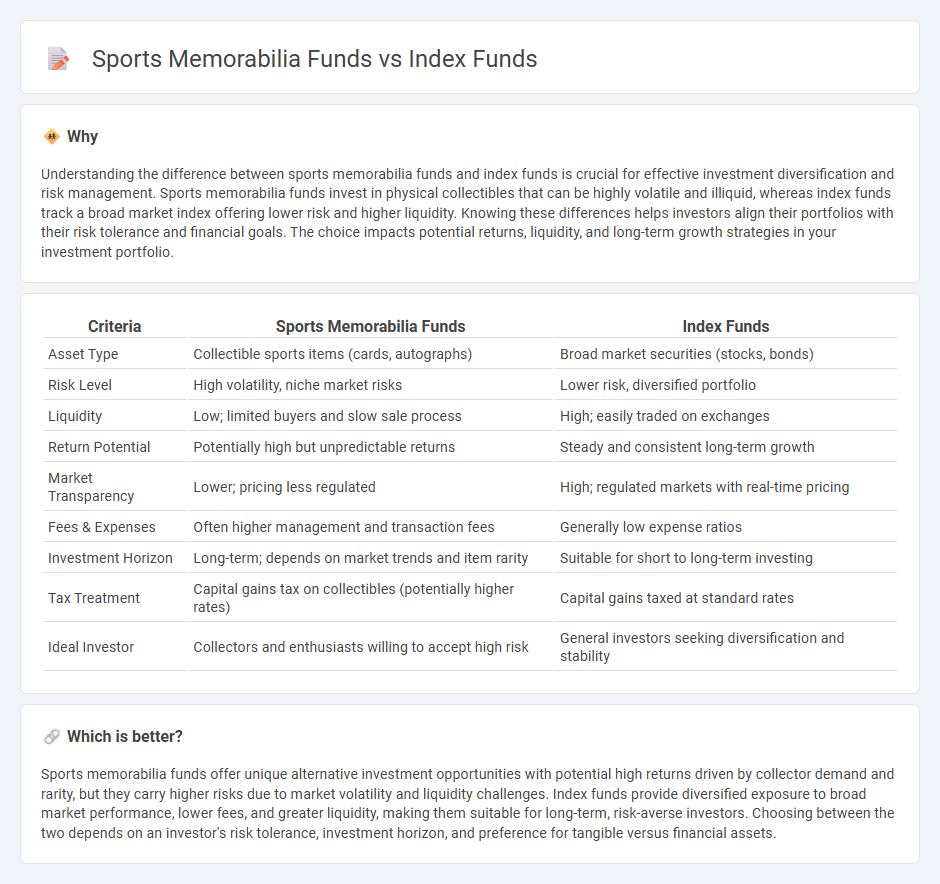

Understanding the difference between sports memorabilia funds and index funds is crucial for effective investment diversification and risk management. Sports memorabilia funds invest in physical collectibles that can be highly volatile and illiquid, whereas index funds track a broad market index offering lower risk and higher liquidity. Knowing these differences helps investors align their portfolios with their risk tolerance and financial goals. The choice impacts potential returns, liquidity, and long-term growth strategies in your investment portfolio.

Comparison Table

| Criteria | Sports Memorabilia Funds | Index Funds |

|---|---|---|

| Asset Type | Collectible sports items (cards, autographs) | Broad market securities (stocks, bonds) |

| Risk Level | High volatility, niche market risks | Lower risk, diversified portfolio |

| Liquidity | Low; limited buyers and slow sale process | High; easily traded on exchanges |

| Return Potential | Potentially high but unpredictable returns | Steady and consistent long-term growth |

| Market Transparency | Lower; pricing less regulated | High; regulated markets with real-time pricing |

| Fees & Expenses | Often higher management and transaction fees | Generally low expense ratios |

| Investment Horizon | Long-term; depends on market trends and item rarity | Suitable for short to long-term investing |

| Tax Treatment | Capital gains tax on collectibles (potentially higher rates) | Capital gains taxed at standard rates |

| Ideal Investor | Collectors and enthusiasts willing to accept high risk | General investors seeking diversification and stability |

Which is better?

Sports memorabilia funds offer unique alternative investment opportunities with potential high returns driven by collector demand and rarity, but they carry higher risks due to market volatility and liquidity challenges. Index funds provide diversified exposure to broad market performance, lower fees, and greater liquidity, making them suitable for long-term, risk-averse investors. Choosing between the two depends on an investor's risk tolerance, investment horizon, and preference for tangible versus financial assets.

Connection

Sports memorabilia funds and index funds both offer diversified investment opportunities, though they target different asset classes--tangible collectibles versus broad market securities. Sports memorabilia funds aggregate valuable items like signed jerseys and rare cards, providing exposure to niche, alternative assets, while index funds track a basket of stocks representing market indices, delivering broad market index performance and liquidity. Both fund types enable investors to reduce individual asset risk through portfolio diversification, but sports memorabilia funds typically exhibit higher volatility and lower liquidity compared to traditional index funds.

Key Terms

Diversification

Index funds offer broad market diversification by investing in a wide array of stocks or bonds, reducing individual asset risk and enhancing portfolio stability. Sports memorabilia funds, by contrast, concentrate on a niche market with limited asset variety, which can increase volatility and risk exposure due to reliance on the performance and demand of collectible items. Explore the benefits and risks of diversification strategies in both fund types to make informed investment decisions.

Liquidity

Index funds offer high liquidity, allowing investors to buy or sell shares quickly on stock exchanges with minimal price impact. Sports memorabilia funds tend to have lower liquidity due to the niche market and the time required to appraise, market, and sell collectible items. Explore more about how liquidity affects your investment choices between index funds and sports memorabilia funds.

Valuation

Index funds offer transparent valuation based on daily market prices of underlying securities, providing liquidity and ease of assessment. Sports memorabilia funds rely on appraisals and market demand, resulting in subjective valuation and higher volatility due to rarity and collector interest. Explore detailed comparisons to understand which fund aligns better with your investment goals and risk tolerance.

Source and External Links

Index Funds | Investor.gov - An index fund is a type of mutual fund or ETF designed to track the returns of a market index by investing in either all or a sample of the securities in that index, often weighted by market capitalization.

What is an index fund? - Vanguard - An index fund tracks a specific benchmark like the S&P 500 by owning a proportionate share of all or some stocks in the index, offering broad market exposure and diversification.

Index fund - Wikipedia - Index funds are passively managed mutual funds or ETFs that replicate the performance of a specified basket of securities, generally outperforming actively managed funds due to low management needs and fees.

dowidth.com

dowidth.com