Sneakers flipping generates quick returns by capitalizing on limited-edition releases and high resale demand, often requiring minimal upfront investment and lower risk compared to traditional markets. Private equity involves long-term capital commitments in private companies, focusing on value creation through operational improvements and strategic growth for substantial financial gains. Explore the advantages and challenges of both investment strategies to determine which aligns with your financial goals.

Why it is important

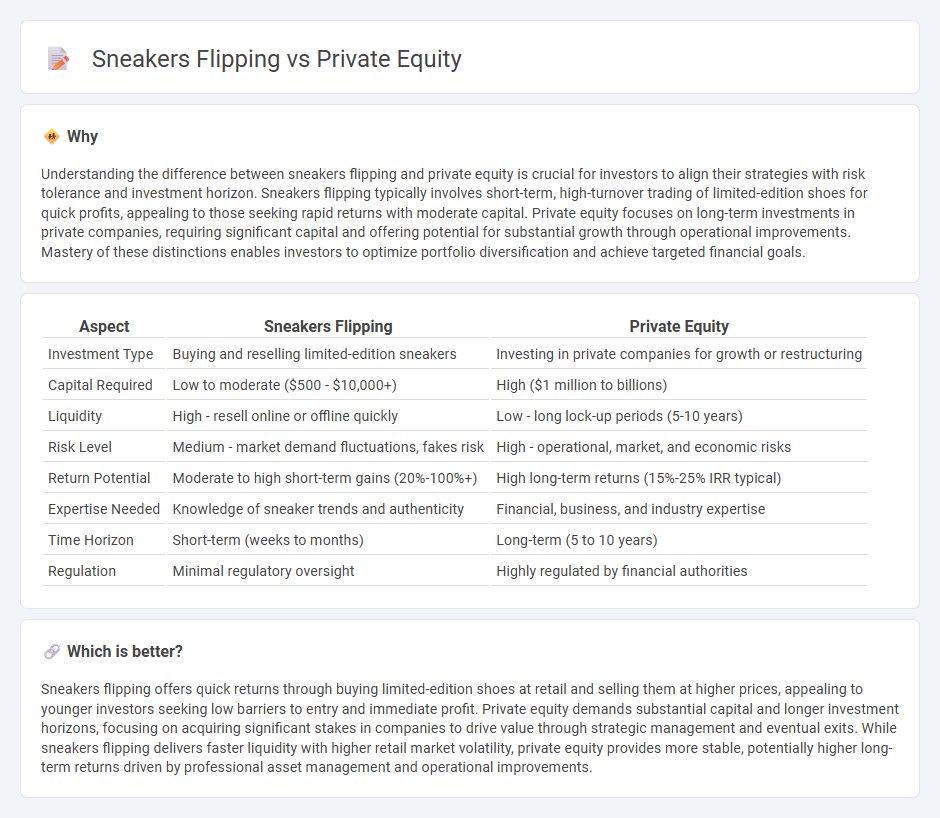

Understanding the difference between sneakers flipping and private equity is crucial for investors to align their strategies with risk tolerance and investment horizon. Sneakers flipping typically involves short-term, high-turnover trading of limited-edition shoes for quick profits, appealing to those seeking rapid returns with moderate capital. Private equity focuses on long-term investments in private companies, requiring significant capital and offering potential for substantial growth through operational improvements. Mastery of these distinctions enables investors to optimize portfolio diversification and achieve targeted financial goals.

Comparison Table

| Aspect | Sneakers Flipping | Private Equity |

|---|---|---|

| Investment Type | Buying and reselling limited-edition sneakers | Investing in private companies for growth or restructuring |

| Capital Required | Low to moderate ($500 - $10,000+) | High ($1 million to billions) |

| Liquidity | High - resell online or offline quickly | Low - long lock-up periods (5-10 years) |

| Risk Level | Medium - market demand fluctuations, fakes risk | High - operational, market, and economic risks |

| Return Potential | Moderate to high short-term gains (20%-100%+) | High long-term returns (15%-25% IRR typical) |

| Expertise Needed | Knowledge of sneaker trends and authenticity | Financial, business, and industry expertise |

| Time Horizon | Short-term (weeks to months) | Long-term (5 to 10 years) |

| Regulation | Minimal regulatory oversight | Highly regulated by financial authorities |

Which is better?

Sneakers flipping offers quick returns through buying limited-edition shoes at retail and selling them at higher prices, appealing to younger investors seeking low barriers to entry and immediate profit. Private equity demands substantial capital and longer investment horizons, focusing on acquiring significant stakes in companies to drive value through strategic management and eventual exits. While sneakers flipping delivers faster liquidity with higher retail market volatility, private equity provides more stable, potentially higher long-term returns driven by professional asset management and operational improvements.

Connection

Sneaker flipping and private equity both involve capitalizing on undervalued assets to generate significant returns through strategic buying and selling. Sneaker flipping focuses on limited-edition sneakers' resale market dynamics, leveraging supply scarcity and brand hype to maximize profits. Private equity employs similar principles by acquiring companies or assets, optimizing their value, and exiting at a higher valuation to achieve substantial investment gains.

Key Terms

**Private Equity:**

Private equity involves investing substantial capital in private companies with the goal of improving operations and increasing value before eventually exiting through sales or IPOs, offering potential high returns but requiring significant expertise and long-term commitment. It contrasts with sneakers flipping, which is a shorter-term, lower capital, retail-oriented market focused on buying and reselling limited-edition sneakers for profit. Discover how private equity can strategically build wealth beyond consumer markets.

Buyout

Private equity buyouts involve acquiring a controlling stake in established companies to drive operational improvements and long-term value, leveraging extensive capital and industry expertise. Sneakers flipping, while capitalizing on limited edition releases and market demand, relies on short-term transactions with higher price volatility and lower barriers to entry. Explore the detailed strategies and risks of buyouts versus sneaker flipping to understand which investment path suits your financial goals.

Fundraising

Private equity fundraising involves securing capital from institutional investors, high-net-worth individuals, and pension funds through structured offerings, often raising millions to billions of dollars. Sneakers flipping fundraising primarily consists of individual capital or small group pooling, focusing on acquiring limited-edition sneakers at retail prices for resale at a profit, with typical investments ranging from hundreds to thousands of dollars. Explore the distinct fundraising dynamics and strategies that define these two investment approaches.

Source and External Links

Private equity - Wikipedia - Private equity (PE) involves investment managers raising funds from institutional investors to buy equity stakes in private companies, aiming to generate returns through revenue growth, margin expansion, debt paydown, and valuation multiple expansion over a typical horizon of 4-7 years.

What is Private Equity? - BVCA - Private equity provides medium to long-term finance in exchange for equity in high-growth unquoted companies, working closely with company management to improve operations and governance, typically holding investments for 4-7 years before exiting through sale or public offering.

Private Equity: What You Need to Know - KKR - Private equity fund managers invest in non-public companies aiming to increase value by strengthening management, acquiring businesses, shaping strategy, launching products, improving operations, and optimizing capital structure, providing diversification beyond shrinking public markets.

dowidth.com

dowidth.com