Esports franchises generate billions in global revenue driven by millions of active viewers and sponsors investing heavily in digital engagement, contrasting with casino enterprises that rely on physical locations and traditional betting models for consistent cash flow. The rapid growth of esports attracts younger demographics through online platforms and diversified content, whereas casinos benefit from established regulatory frameworks and high-stakes gambling. Explore how these distinct investment opportunities shape the future of entertainment and profit potential.

Why it is important

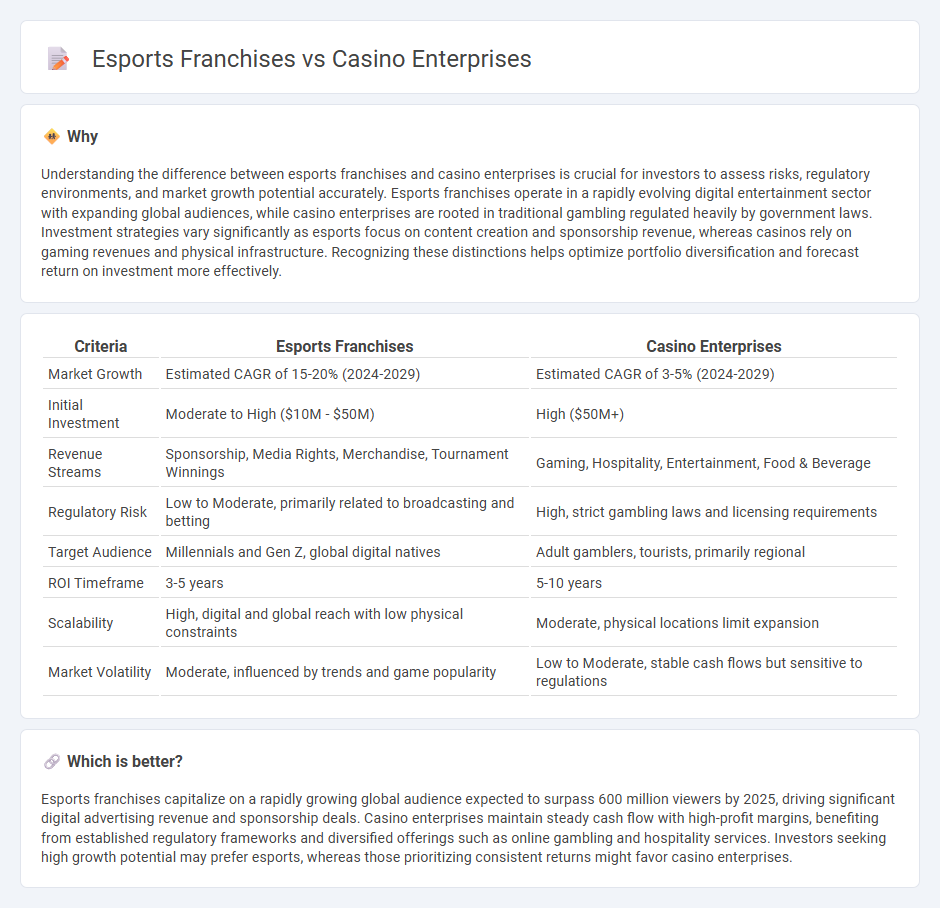

Understanding the difference between esports franchises and casino enterprises is crucial for investors to assess risks, regulatory environments, and market growth potential accurately. Esports franchises operate in a rapidly evolving digital entertainment sector with expanding global audiences, while casino enterprises are rooted in traditional gambling regulated heavily by government laws. Investment strategies vary significantly as esports focus on content creation and sponsorship revenue, whereas casinos rely on gaming revenues and physical infrastructure. Recognizing these distinctions helps optimize portfolio diversification and forecast return on investment more effectively.

Comparison Table

| Criteria | Esports Franchises | Casino Enterprises |

|---|---|---|

| Market Growth | Estimated CAGR of 15-20% (2024-2029) | Estimated CAGR of 3-5% (2024-2029) |

| Initial Investment | Moderate to High ($10M - $50M) | High ($50M+) |

| Revenue Streams | Sponsorship, Media Rights, Merchandise, Tournament Winnings | Gaming, Hospitality, Entertainment, Food & Beverage |

| Regulatory Risk | Low to Moderate, primarily related to broadcasting and betting | High, strict gambling laws and licensing requirements |

| Target Audience | Millennials and Gen Z, global digital natives | Adult gamblers, tourists, primarily regional |

| ROI Timeframe | 3-5 years | 5-10 years |

| Scalability | High, digital and global reach with low physical constraints | Moderate, physical locations limit expansion |

| Market Volatility | Moderate, influenced by trends and game popularity | Low to Moderate, stable cash flows but sensitive to regulations |

Which is better?

Esports franchises capitalize on a rapidly growing global audience expected to surpass 600 million viewers by 2025, driving significant digital advertising revenue and sponsorship deals. Casino enterprises maintain steady cash flow with high-profit margins, benefiting from established regulatory frameworks and diversified offerings such as online gambling and hospitality services. Investors seeking high growth potential may prefer esports, whereas those prioritizing consistent returns might favor casino enterprises.

Connection

Esports franchises and casino enterprises share a strategic connection through the integration of online gaming platforms and betting markets, capitalizing on the rapidly growing digital entertainment sector. Casinos leverage esports events to attract younger demographics, offering esports betting opportunities that enhance player engagement and diversify revenue streams. This synergy drives innovation in gamification and digital finance, positioning both industries at the forefront of interactive entertainment investment.

Key Terms

Revenue Streams

Casino enterprises generate significant revenue primarily through gambling activities including slot machines, table games, and sports betting, with ancillary income from hospitality and entertainment services. Esports franchises derive their revenues mainly from sponsorship deals, media rights, merchandise sales, and tournament winnings, capitalizing on digital viewership and community engagement. Explore deeper insights into how these sectors optimize their distinct revenue streams and market strategies.

Risk Management

Casino enterprises prioritize comprehensive risk management strategies involving regulatory compliance, financial audits, and player security to minimize operational risks and ensure legal adherence. Esports franchises focus on managing risks related to player performance, sponsorship deals, intellectual property rights, and cybersecurity threats to safeguard brand integrity and revenue streams. Explore detailed risk management practices to optimize stability and growth in both industries.

Scalability

Casino enterprises leverage physical infrastructure and regulatory compliance, which often limit rapid scalability compared to esports franchises that operate primarily in digital environments with global reach. Esports franchises benefit from scalable online platforms, dynamic content delivery, and growing virtual audiences, enabling exponential growth with lower physical investment. Explore deeper insights into scalability strategies and market potential of casino enterprises versus esports franchises.

Source and External Links

TLC Casino Enterprises - A holding company owned by Terry L. Caudill, operating several casinos including Four Queens and Binion's Gambling Hall in Las Vegas.

Caesars Entertainment - Offers upscale casinos, hotels, shows, and gourmet dining, providing a comprehensive entertainment experience.

Bally's Corporation - A leading entertainment company with a focus on digital gaming and traditional casino venues, known for innovative gaming experiences.

dowidth.com

dowidth.com