Sports memorabilia funds offer investors exposure to rare collectible items such as autographed jerseys, trading cards, and vintage sports equipment, which often appreciate due to scarcity and fan demand. Wine investment funds focus on acquiring fine wines from renowned vineyards, leveraging market trends and aging potential to generate returns. Explore detailed comparisons and performance insights to determine which investment aligns best with your portfolio goals.

Why it is important

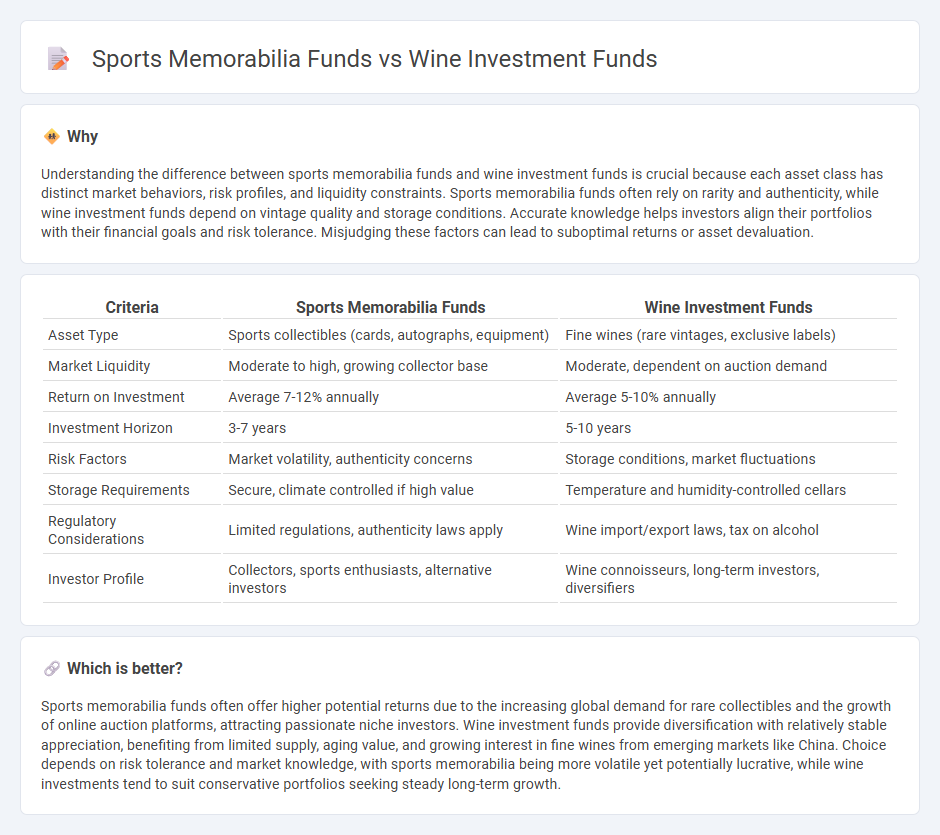

Understanding the difference between sports memorabilia funds and wine investment funds is crucial because each asset class has distinct market behaviors, risk profiles, and liquidity constraints. Sports memorabilia funds often rely on rarity and authenticity, while wine investment funds depend on vintage quality and storage conditions. Accurate knowledge helps investors align their portfolios with their financial goals and risk tolerance. Misjudging these factors can lead to suboptimal returns or asset devaluation.

Comparison Table

| Criteria | Sports Memorabilia Funds | Wine Investment Funds |

|---|---|---|

| Asset Type | Sports collectibles (cards, autographs, equipment) | Fine wines (rare vintages, exclusive labels) |

| Market Liquidity | Moderate to high, growing collector base | Moderate, dependent on auction demand |

| Return on Investment | Average 7-12% annually | Average 5-10% annually |

| Investment Horizon | 3-7 years | 5-10 years |

| Risk Factors | Market volatility, authenticity concerns | Storage conditions, market fluctuations |

| Storage Requirements | Secure, climate controlled if high value | Temperature and humidity-controlled cellars |

| Regulatory Considerations | Limited regulations, authenticity laws apply | Wine import/export laws, tax on alcohol |

| Investor Profile | Collectors, sports enthusiasts, alternative investors | Wine connoisseurs, long-term investors, diversifiers |

Which is better?

Sports memorabilia funds often offer higher potential returns due to the increasing global demand for rare collectibles and the growth of online auction platforms, attracting passionate niche investors. Wine investment funds provide diversification with relatively stable appreciation, benefiting from limited supply, aging value, and growing interest in fine wines from emerging markets like China. Choice depends on risk tolerance and market knowledge, with sports memorabilia being more volatile yet potentially lucrative, while wine investments tend to suit conservative portfolios seeking steady long-term growth.

Connection

Sports memorabilia funds and wine investment funds both offer alternative asset classes that diversify traditional investment portfolios by tapping into niche markets with strong collector demand. These funds leverage rarity, provenance, and market trends to generate returns, capitalizing on the appreciation potential of tangible, high-value items. Institutional investors increasingly recognize their uncorrelated performance to stocks and bonds, enhancing risk-adjusted portfolio growth.

Key Terms

Wine Investment Funds:

Wine investment funds offer a unique opportunity to diversify portfolios by capitalizing on the appreciating value of rare and vintage wines, often outperforming traditional asset classes. These funds leverage expert knowledge in vineyard selection, storage conditions, and market trends to maximize returns while mitigating risks associated with wine provenance and authenticity. Discover how wine investment funds can enhance your investment strategy with potential long-term growth and portfolio diversification.

Provenance

Provenance plays a critical role in both wine investment funds and sports memorabilia funds, ensuring authenticity and value retention over time. Wine investment funds rely on documented origin and storage conditions, while sports memorabilia funds emphasize verified chain of ownership and certification by recognized authorities. Discover more about how provenance impacts the valuation and security of these niche investment opportunities.

Vintage

Vintage wine investment funds offer the advantage of tangible, historically valued assets with potential appreciation tied to rare vintages and well-documented provenance. Sports memorabilia funds, while also investing in vintage items, typically focus on collectibles with emotional and cultural significance, which may have higher market volatility and subjective valuation. Discover more about the comparative benefits and risks between these unique investment opportunities.

Source and External Links

Wine as Liquid Asset: Do Wine Investment Funds Deliver? - Wine investment funds like the London-based Wine Investment Fund focus on ageworthy Bordeaux vintages and adopt a risk-averse strategy, avoiding volatile early-stage purchases and emphasizing wines with established secondary markets to aim for reliable returns.

Should You Invest in Wine ETFs? (What Are They + Alternatives) - Wine funds operate similarly to private equity and are managed by institutional investors targeting high returns, but require long lock-up periods (5+ years) and carry risks such as valuation and regulatory concerns; examples include WineFortune Premium Selection, The Wine Capital Wine Fund, and The InVino Fund.

Wine Investment Fund by SOMMELIER CAPITAL - This fund offers wine asset management with access to proprietary trading exchanges, targeting accredited institutional investors with substantial assets, emphasizing wine as a long-term alternative asset class (minimum five years) and ensuring proper wine provenance and storage to maintain value.

dowidth.com

dowidth.com