Investing in music royalties offers unique cash flow opportunities through royalty payments generated by song usage, providing potentially steady income with lower entry costs compared to traditional assets. Real estate investment involves acquiring property for rental income or capital appreciation, often requiring higher initial capital and ongoing management responsibilities. Explore the advantages and risks of music royalties versus real estate investments to determine the best fit for your portfolio goals.

Why it is important

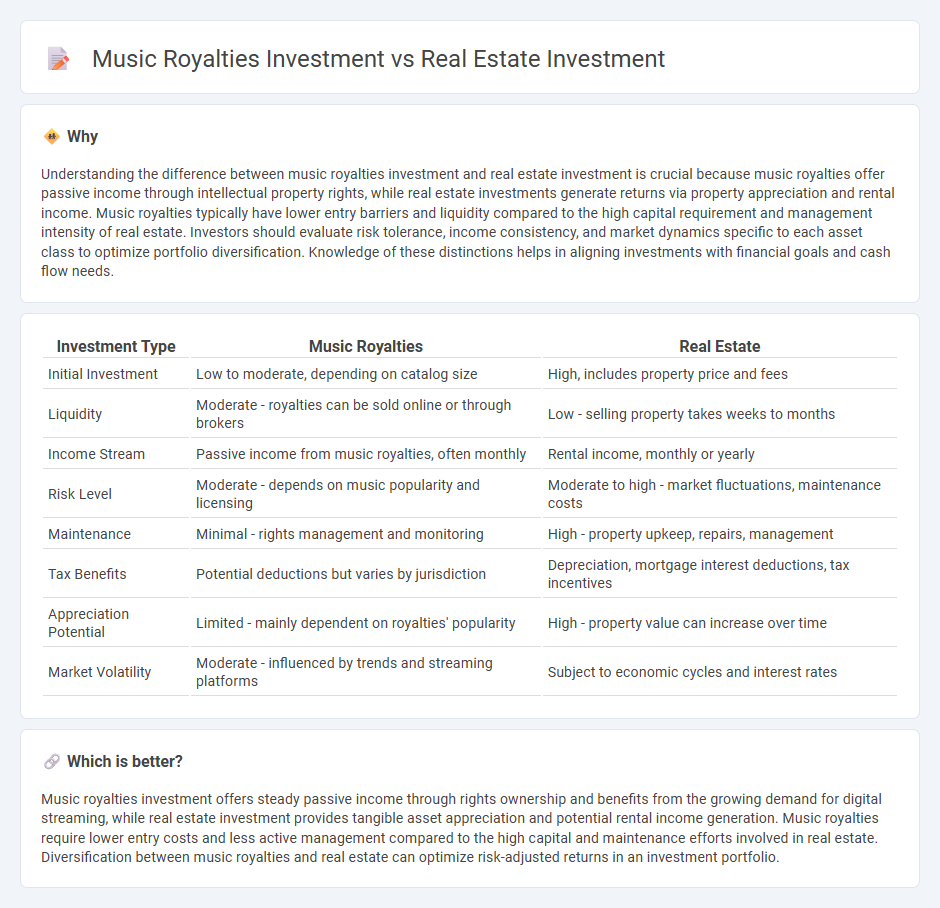

Understanding the difference between music royalties investment and real estate investment is crucial because music royalties offer passive income through intellectual property rights, while real estate investments generate returns via property appreciation and rental income. Music royalties typically have lower entry barriers and liquidity compared to the high capital requirement and management intensity of real estate. Investors should evaluate risk tolerance, income consistency, and market dynamics specific to each asset class to optimize portfolio diversification. Knowledge of these distinctions helps in aligning investments with financial goals and cash flow needs.

Comparison Table

| Investment Type | Music Royalties | Real Estate |

|---|---|---|

| Initial Investment | Low to moderate, depending on catalog size | High, includes property price and fees |

| Liquidity | Moderate - royalties can be sold online or through brokers | Low - selling property takes weeks to months |

| Income Stream | Passive income from music royalties, often monthly | Rental income, monthly or yearly |

| Risk Level | Moderate - depends on music popularity and licensing | Moderate to high - market fluctuations, maintenance costs |

| Maintenance | Minimal - rights management and monitoring | High - property upkeep, repairs, management |

| Tax Benefits | Potential deductions but varies by jurisdiction | Depreciation, mortgage interest deductions, tax incentives |

| Appreciation Potential | Limited - mainly dependent on royalties' popularity | High - property value can increase over time |

| Market Volatility | Moderate - influenced by trends and streaming platforms | Subject to economic cycles and interest rates |

Which is better?

Music royalties investment offers steady passive income through rights ownership and benefits from the growing demand for digital streaming, while real estate investment provides tangible asset appreciation and potential rental income generation. Music royalties require lower entry costs and less active management compared to the high capital and maintenance efforts involved in real estate. Diversification between music royalties and real estate can optimize risk-adjusted returns in an investment portfolio.

Connection

Music royalties investment and real estate investment both offer alternative income streams that generate passive cash flow through tangible assets--intellectual property rights in the case of royalties, and physical property in real estate. Both markets benefit from long-term appreciation, portfolio diversification, and potential tax advantages, appealing to investors seeking stable, recurring revenue. Leveraging digital platforms for royalty tracking and real estate management technologies aids in optimizing returns and enhancing asset liquidity.

Key Terms

Capital Appreciation

Real estate investment offers capital appreciation through property value increases driven by location, market trends, and development potential. Music royalties investment generates capital appreciation as an asset class by earning income from historical or future song streams, licensing, and performance rights, with value influenced by catalog popularity and market demand. Explore further to understand which asset aligns best with your capital growth goals.

Cash Flow

Real estate investment generates consistent rental income and potential property value appreciation, providing reliable monthly cash flow. Music royalties investment offers passive income through streaming, licensing, and airplay, with cash flow often dependent on the hit's popularity and longevity. Explore the benefits and risks of both to determine which cash flow source suits your financial goals.

Intellectual Property Rights

Real estate investment offers tangible asset ownership with property rights providing a clear legal framework for transactions, while music royalties investment centers on intellectual property rights, enabling investors to earn passive income through copyright royalties generated by song usage. Intellectual property rights in music protect creators' works and create revenue streams from streaming, licensing, and performance rights, differing fundamentally from real estate's physical asset management. Explore the nuanced benefits and risks of each investment type to make informed decisions about diversifying your portfolio.

Source and External Links

Real Estate Investing: 5 Ways to Get Started - NerdWallet - Covers five accessible methods for investing in real estate, including REITs, real estate platforms, rental properties, and flipping, with insights into passive income potential for those who prefer not to manage properties directly.

Real Estate Investment Trusts (REITs) | Investor.gov - Explains that REITs are companies that own and operate income-producing real estate, allowing individuals to invest in large-scale commercial properties without directly buying or managing them.

Fundrise - Offers direct access to private real estate investments through an online platform, aiming to democratize access to private market opportunities traditionally available only to institutions.

dowidth.com

dowidth.com