Rare whisky bottles trading offers a dynamic investment option characterized by limited supply, increasing global demand, and significant appreciation in value over time, often outperforming traditional assets. Vintage wine investment, steeped in historical prestige and collectible appeal, benefits from maturation enhancing quality and rarity, driving robust market interest. Explore the comparative benefits and potential returns of these unique investment avenues to make informed decisions.

Why it is important

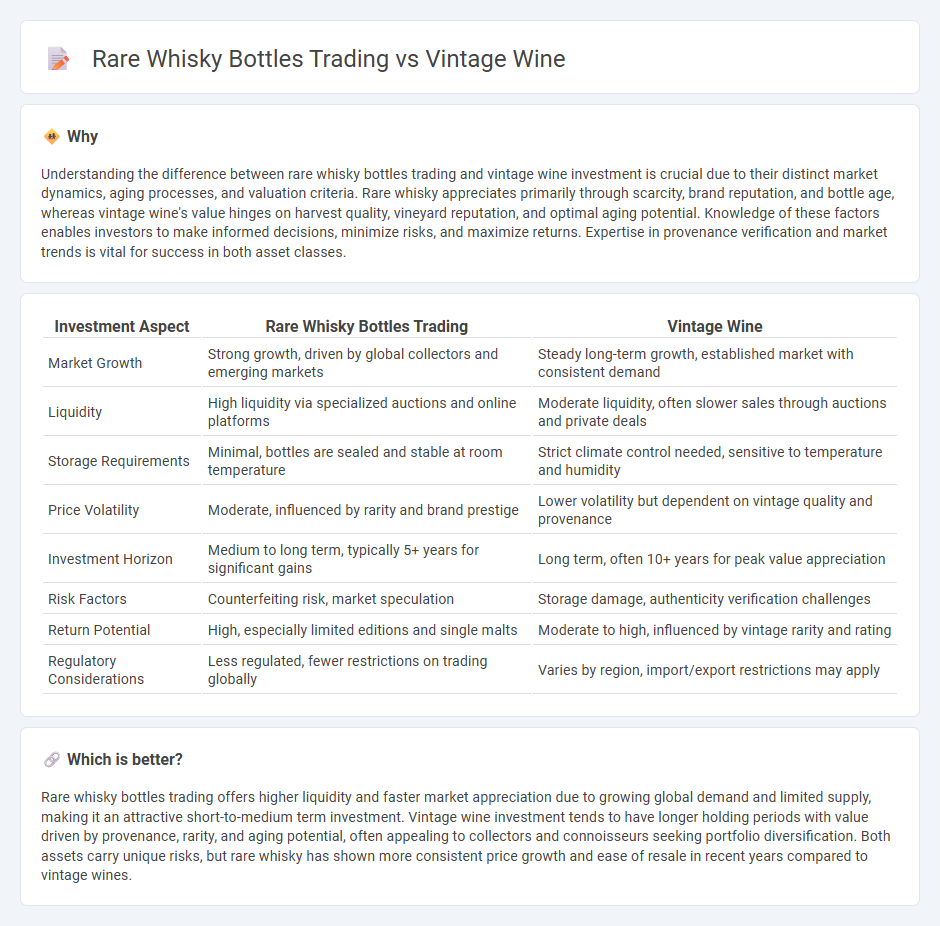

Understanding the difference between rare whisky bottles trading and vintage wine investment is crucial due to their distinct market dynamics, aging processes, and valuation criteria. Rare whisky appreciates primarily through scarcity, brand reputation, and bottle age, whereas vintage wine's value hinges on harvest quality, vineyard reputation, and optimal aging potential. Knowledge of these factors enables investors to make informed decisions, minimize risks, and maximize returns. Expertise in provenance verification and market trends is vital for success in both asset classes.

Comparison Table

| Investment Aspect | Rare Whisky Bottles Trading | Vintage Wine |

|---|---|---|

| Market Growth | Strong growth, driven by global collectors and emerging markets | Steady long-term growth, established market with consistent demand |

| Liquidity | High liquidity via specialized auctions and online platforms | Moderate liquidity, often slower sales through auctions and private deals |

| Storage Requirements | Minimal, bottles are sealed and stable at room temperature | Strict climate control needed, sensitive to temperature and humidity |

| Price Volatility | Moderate, influenced by rarity and brand prestige | Lower volatility but dependent on vintage quality and provenance |

| Investment Horizon | Medium to long term, typically 5+ years for significant gains | Long term, often 10+ years for peak value appreciation |

| Risk Factors | Counterfeiting risk, market speculation | Storage damage, authenticity verification challenges |

| Return Potential | High, especially limited editions and single malts | Moderate to high, influenced by vintage rarity and rating |

| Regulatory Considerations | Less regulated, fewer restrictions on trading globally | Varies by region, import/export restrictions may apply |

Which is better?

Rare whisky bottles trading offers higher liquidity and faster market appreciation due to growing global demand and limited supply, making it an attractive short-to-medium term investment. Vintage wine investment tends to have longer holding periods with value driven by provenance, rarity, and aging potential, often appealing to collectors and connoisseurs seeking portfolio diversification. Both assets carry unique risks, but rare whisky has shown more consistent price growth and ease of resale in recent years compared to vintage wines.

Connection

Rare whisky bottles and vintage wine share a niche in the investment market due to their limited availability, aging potential, and cultural value, driving high demand among collectors and investors. Both assets appreciate over time as they mature, with provenance and rarity significantly impacting their market prices. Investment in these luxury consumables offers portfolio diversification, benefiting from global trends in alternative assets and luxury goods consumption.

Key Terms

Provenance

Provenance plays a critical role in trading vintage wine and rare whisky bottles, directly impacting their value and authenticity. Detailed documentation of each bottle's origin, storage conditions, and ownership history ensures trust and transparency among collectors and investors. Explore deeper insights on how provenance shapes market dynamics and investment strategies in these luxury beverage markets.

Market Liquidity

Vintage wine markets typically exhibit higher liquidity due to faster turnover and greater buyer diversity compared to rare whisky bottles, which often involve niche collectors and longer holding periods. Market liquidity for vintage wines benefits from established auction platforms and broad international demand, while rare whisky trading is influenced by limited editions and provenance verification challenges. Explore further to understand how market dynamics affect trading strategies and investment potential in these luxury liquid assets.

Storage Conditions

Proper storage conditions are critical for preserving the quality and value of vintage wine and rare whisky bottles, with vintage wines requiring consistently cool temperatures around 55degF (13degC), high humidity near 70%, and minimal light exposure to maintain flavor and prevent cork deterioration. Rare whisky bottles, in contrast, are less sensitive to humidity but must be stored upright in stable temperatures between 15-20degC (59-68degF), away from direct sunlight to avoid chemical alterations and label damage. Explore detailed storage techniques to optimize your investments in both vintage wine and rare whisky collections.

Source and External Links

Vintage - Vintage wine refers to wine made from grapes harvested in a single specified year, often denoting quality and indicating a consistent style.

What Does 'Vintage' Mean in Wine? - This article explains that vintage in wine refers to the year grapes were harvested, often implying a superior quality and production standards.

What is the Difference Between a Vintage and Non-Vintage Wine? - This webpage discusses how vintage wines are made from grapes of the same year, contrasting with non-vintage wines that blend multiple years.

dowidth.com

dowidth.com