Tax lien certificates offer investors a secured claim against property tax delinquencies, providing high returns through interest rates set by local governments, while municipal bonds represent debt securities issued by municipalities to fund public projects, typically offering lower risk and steady tax-exempt income. Understanding the distinct risk profiles, liquidity, and regulatory frameworks of tax lien certificates and municipal bonds is crucial for optimizing investment portfolios. Explore further insights to determine which investment aligns best with your financial goals and risk tolerance.

Why it is important

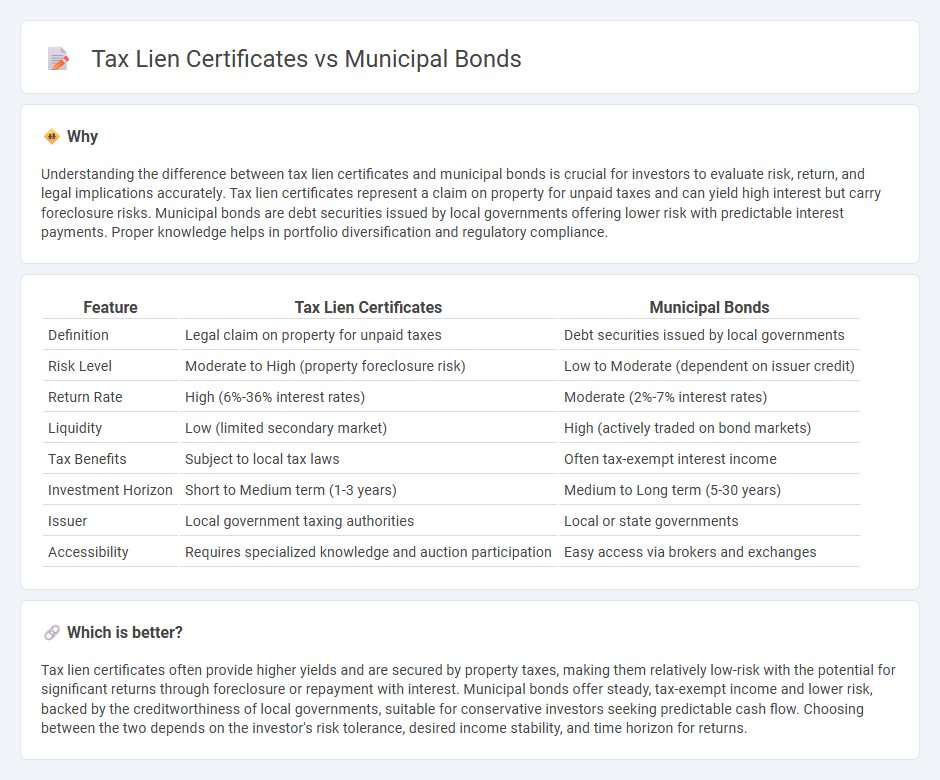

Understanding the difference between tax lien certificates and municipal bonds is crucial for investors to evaluate risk, return, and legal implications accurately. Tax lien certificates represent a claim on property for unpaid taxes and can yield high interest but carry foreclosure risks. Municipal bonds are debt securities issued by local governments offering lower risk with predictable interest payments. Proper knowledge helps in portfolio diversification and regulatory compliance.

Comparison Table

| Feature | Tax Lien Certificates | Municipal Bonds |

|---|---|---|

| Definition | Legal claim on property for unpaid taxes | Debt securities issued by local governments |

| Risk Level | Moderate to High (property foreclosure risk) | Low to Moderate (dependent on issuer credit) |

| Return Rate | High (6%-36% interest rates) | Moderate (2%-7% interest rates) |

| Liquidity | Low (limited secondary market) | High (actively traded on bond markets) |

| Tax Benefits | Subject to local tax laws | Often tax-exempt interest income |

| Investment Horizon | Short to Medium term (1-3 years) | Medium to Long term (5-30 years) |

| Issuer | Local government taxing authorities | Local or state governments |

| Accessibility | Requires specialized knowledge and auction participation | Easy access via brokers and exchanges |

Which is better?

Tax lien certificates often provide higher yields and are secured by property taxes, making them relatively low-risk with the potential for significant returns through foreclosure or repayment with interest. Municipal bonds offer steady, tax-exempt income and lower risk, backed by the creditworthiness of local governments, suitable for conservative investors seeking predictable cash flow. Choosing between the two depends on the investor's risk tolerance, desired income stability, and time horizon for returns.

Connection

Tax lien certificates and municipal bonds both represent investment vehicles linked to local government financing, providing investors with opportunities for income and portfolio diversification. Tax lien certificates offer returns through interest payments on delinquent property taxes, while municipal bonds fund public projects and pay interest over time. Both instruments carry varying degrees of risk influenced by the issuer's credit quality and market conditions, appealing to investors seeking tax-advantaged income streams.

Key Terms

Tax-exempt Interest

Municipal bonds offer tax-exempt interest income, making them attractive to investors seeking to reduce federal income tax liability. Tax lien certificates generate interest through penalties imposed on delinquent property taxes, but their interest may not always be federally tax-exempt. Explore detailed comparisons to understand the tax benefits of each investment type further.

Foreclosure Rights

Municipal bonds represent debt securities issued by local governments, offering investors regular interest payments without direct foreclosure rights over public assets. Tax lien certificates grant the certificate holder a legal claim on a property for unpaid taxes, enabling them to initiate foreclosure if the property owner fails to pay within a specified redemption period. Explore the distinct foreclosure rights and investment implications between municipal bonds and tax lien certificates to make informed financial decisions.

Credit Risk

Municipal bonds typically carry lower credit risk due to backing by local government entities with taxing authority, whereas tax lien certificates involve higher credit risk as repayment depends on property owners settling delinquent taxes. Investors in municipal bonds often benefit from credit ratings provided by agencies like Moody's or S&P, which assess the issuer's financial health. Explore further to understand how credit risk influences investment strategies in these financial instruments.

Source and External Links

Municipal bond - Municipal bonds, or munis, are bonds issued by state or local governments, including general obligation bonds secured by the issuer's taxing power and revenue bonds repaid from specific income streams like utilities or tolls.

Municipal Bonds - Municipal bonds are debt instruments used to finance public projects such as schools or hospitals, categorized mainly into general obligation bonds backed by taxing power and revenue bonds backed by project income, with tax treatment varying depending on the bond.

Municipal Bonds for America - Municipal bonds finance about 75% of U.S. infrastructure including roads and airports, and the tax-exemption of municipal bond interest is a critical federal infrastructure investment incentive.

dowidth.com

dowidth.com