Sports memorabilia funds offer a unique investment avenue by capitalizing on the growing market for rare collectibles, often yielding higher returns through asset appreciation compared to traditional fixed income funds, which provide stable, predictable income streams through bonds and other debt instruments. While fixed income funds focus on preserving capital and generating regular interest payments, sports memorabilia funds carry higher risk but potential for significant capital gains driven by market demand and rarity. Explore the differences between these investment types to determine the best fit for your portfolio goals.

Why it is important

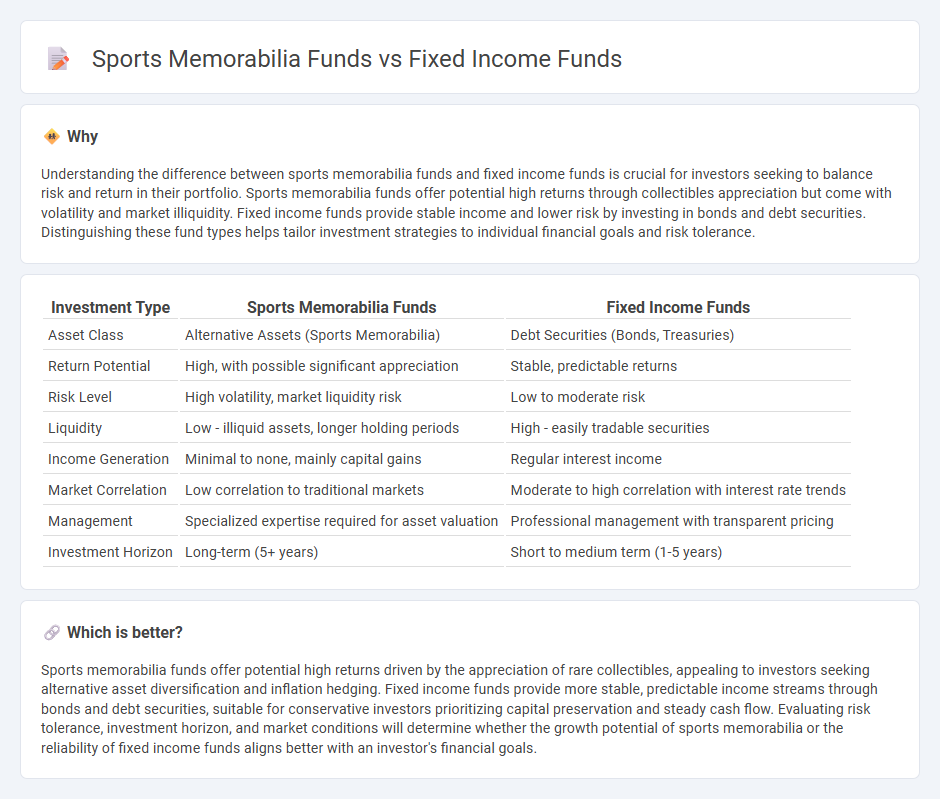

Understanding the difference between sports memorabilia funds and fixed income funds is crucial for investors seeking to balance risk and return in their portfolio. Sports memorabilia funds offer potential high returns through collectibles appreciation but come with volatility and market illiquidity. Fixed income funds provide stable income and lower risk by investing in bonds and debt securities. Distinguishing these fund types helps tailor investment strategies to individual financial goals and risk tolerance.

Comparison Table

| Investment Type | Sports Memorabilia Funds | Fixed Income Funds |

|---|---|---|

| Asset Class | Alternative Assets (Sports Memorabilia) | Debt Securities (Bonds, Treasuries) |

| Return Potential | High, with possible significant appreciation | Stable, predictable returns |

| Risk Level | High volatility, market liquidity risk | Low to moderate risk |

| Liquidity | Low - illiquid assets, longer holding periods | High - easily tradable securities |

| Income Generation | Minimal to none, mainly capital gains | Regular interest income |

| Market Correlation | Low correlation to traditional markets | Moderate to high correlation with interest rate trends |

| Management | Specialized expertise required for asset valuation | Professional management with transparent pricing |

| Investment Horizon | Long-term (5+ years) | Short to medium term (1-5 years) |

Which is better?

Sports memorabilia funds offer potential high returns driven by the appreciation of rare collectibles, appealing to investors seeking alternative asset diversification and inflation hedging. Fixed income funds provide more stable, predictable income streams through bonds and debt securities, suitable for conservative investors prioritizing capital preservation and steady cash flow. Evaluating risk tolerance, investment horizon, and market conditions will determine whether the growth potential of sports memorabilia or the reliability of fixed income funds aligns better with an investor's financial goals.

Connection

Sports memorabilia funds and fixed income funds share a connection through their role in portfolio diversification and risk management. Sports memorabilia funds invest in valuable collectibles that may offer unique growth potential, while fixed income funds provide steady, predictable returns through bonds and other debt instruments. Together, these asset classes balance high-risk, high-reward opportunities with stable income streams, appealing to investors seeking both capital appreciation and income stability.

Key Terms

**Fixed Income Funds:**

Fixed income funds primarily invest in bonds and other debt securities, offering steady interest income with lower risk compared to equities. These funds are ideal for investors seeking capital preservation and predictable cash flow through government, municipal, or corporate bonds. Explore detailed comparisons to understand how fixed income funds can balance your investment portfolio effectively.

Yield

Fixed income funds offer stable returns through interest payments from bonds and other debt instruments, with yields typically ranging from 2% to 5% annually. Sports memorabilia funds, on the other hand, rely on the appreciation of collectible assets, making their yield highly variable and often tied to market trends and rarity of items. Explore detailed comparisons to understand which fund aligns better with your investment goals and risk tolerance.

Maturity

Fixed income funds prioritize maturity dates as a key factor affecting interest rate risk and income predictability, offering investors clearly defined time horizons and potential capital preservation at maturity. In contrast, sports memorabilia funds lack a fixed maturity, relying on market demand and asset appreciation that are less predictable and can vary widely over time. Explore the distinct maturity dynamics to better understand how each fund type aligns with your investment strategy.

Source and External Links

What Are Fixed-Income Investments | Edward Jones - Fixed-income funds invest in bonds or similar securities that pay regular fixed interest payments, providing stable income and principal repayment at maturity, making them less volatile than stocks.

Fixed Income Investments | Charles Schwab - Fixed income funds offer consistent income, portfolio diversification, and capital preservation with products like bond mutual funds, ETFs, CDs, and individual bonds, but they still carry risks like interest rate and inflation risk.

Fixed income & bonds | Investment account options | Fidelity - Fixed income funds include a variety of bonds, CDs, and annuities, providing options for principal preservation, regular income, and potential tax benefits, with tools and professional support to help build diversified fixed income portfolios.

dowidth.com

dowidth.com