Carbon credits trading involves buying and selling permits that allow companies to emit a certain amount of carbon dioxide, providing a market-driven approach to reducing greenhouse gas emissions. Circular economy investments focus on sustainable resource management by promoting reuse, recycling, and waste minimization to create a closed-loop system. Explore how these innovative investment strategies contribute to environmental sustainability and financial growth.

Why it is important

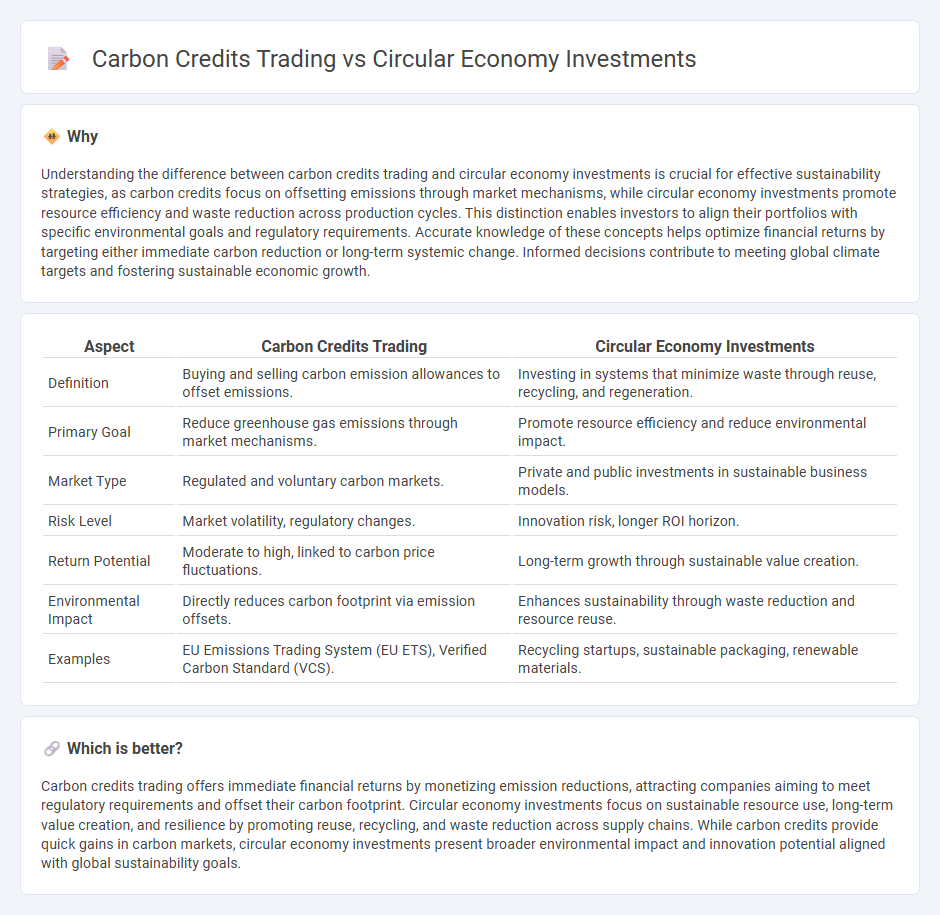

Understanding the difference between carbon credits trading and circular economy investments is crucial for effective sustainability strategies, as carbon credits focus on offsetting emissions through market mechanisms, while circular economy investments promote resource efficiency and waste reduction across production cycles. This distinction enables investors to align their portfolios with specific environmental goals and regulatory requirements. Accurate knowledge of these concepts helps optimize financial returns by targeting either immediate carbon reduction or long-term systemic change. Informed decisions contribute to meeting global climate targets and fostering sustainable economic growth.

Comparison Table

| Aspect | Carbon Credits Trading | Circular Economy Investments |

|---|---|---|

| Definition | Buying and selling carbon emission allowances to offset emissions. | Investing in systems that minimize waste through reuse, recycling, and regeneration. |

| Primary Goal | Reduce greenhouse gas emissions through market mechanisms. | Promote resource efficiency and reduce environmental impact. |

| Market Type | Regulated and voluntary carbon markets. | Private and public investments in sustainable business models. |

| Risk Level | Market volatility, regulatory changes. | Innovation risk, longer ROI horizon. |

| Return Potential | Moderate to high, linked to carbon price fluctuations. | Long-term growth through sustainable value creation. |

| Environmental Impact | Directly reduces carbon footprint via emission offsets. | Enhances sustainability through waste reduction and resource reuse. |

| Examples | EU Emissions Trading System (EU ETS), Verified Carbon Standard (VCS). | Recycling startups, sustainable packaging, renewable materials. |

Which is better?

Carbon credits trading offers immediate financial returns by monetizing emission reductions, attracting companies aiming to meet regulatory requirements and offset their carbon footprint. Circular economy investments focus on sustainable resource use, long-term value creation, and resilience by promoting reuse, recycling, and waste reduction across supply chains. While carbon credits provide quick gains in carbon markets, circular economy investments present broader environmental impact and innovation potential aligned with global sustainability goals.

Connection

Carbon credits trading incentivizes companies to reduce emissions by providing a financial reward for sustainable practices, aligning closely with circular economy investments focused on resource efficiency and waste minimization. Circular economy projects promote the reuse, recycling, and regeneration of materials, which lowers carbon footprints and increases the value of carbon credits in emissions markets. Both investment types drive innovation in sustainable technologies and foster a systemic shift towards low-carbon, resource-efficient economic models.

Key Terms

**Circular Economy Investments:**

Circular economy investments prioritize resource efficiency, waste reduction, and sustainable lifecycle management to drive long-term environmental and economic benefits. These investments support innovations in recycling technologies, renewable materials, and product design that minimize ecological footprints and promote closed-loop systems. Explore how circular economy initiatives can transform industries and enhance sustainability outcomes.

Resource Efficiency

Circular economy investments drive resource efficiency by promoting the reuse, recycling, and sustainable design of materials to minimize waste and reduce environmental impact. Carbon credits trading offers a market-based approach to offset greenhouse gas emissions but may not directly enhance resource efficiency in production processes. Explore the synergies and distinctions between these strategies to understand their roles in achieving sustainable development goals.

Product Lifecycle

Circular economy investments enhance product lifecycle sustainability by promoting resource efficiency, waste reduction, and product reuse, which directly minimizes environmental impact throughout production, use, and disposal stages. Carbon credits trading, while incentivizing emission reductions, primarily targets carbon offsetting rather than improving core product design or material cycles. Explore how integrating circular economy principles with carbon credit strategies can optimize environmental and economic benefits in product lifecycle management.

Source and External Links

The CGR Finance: circular economy investment has surged since ... - Businesses engaging the circular economy raised nearly US$164 billion between 2018 and 2023, with an 87% increase in investment since 2021, though high-impact innovations still remain underfunded.

The Investors Accelerating the Shift to a Circular Economy - Key investors like EIT InnoEnergy, SOSV, Breakthrough Energy, Speedinvest, and Katapult are actively funding circular economy startups to drive innovation and growth in the sector.

Why consider a circular economy? | J.P. Morgan Private Bank EMEA - Circular economy investments include public equity and debt markets as well as private venture capital and private equity funding that support sustainable business models and technologies designed to eliminate waste.

dowidth.com

dowidth.com