Sports card fractionalization allows investors to own a share of high-value collectible cards, providing access to an alternative asset class with the potential for significant appreciation. Unlike the stock market, which offers liquidity and regulatory oversight, fractional ownership in sports cards combines tangible asset investment with portfolio diversification. Discover how sports card fractionalization compares to traditional stock market investing and the unique opportunities it presents.

Why it is important

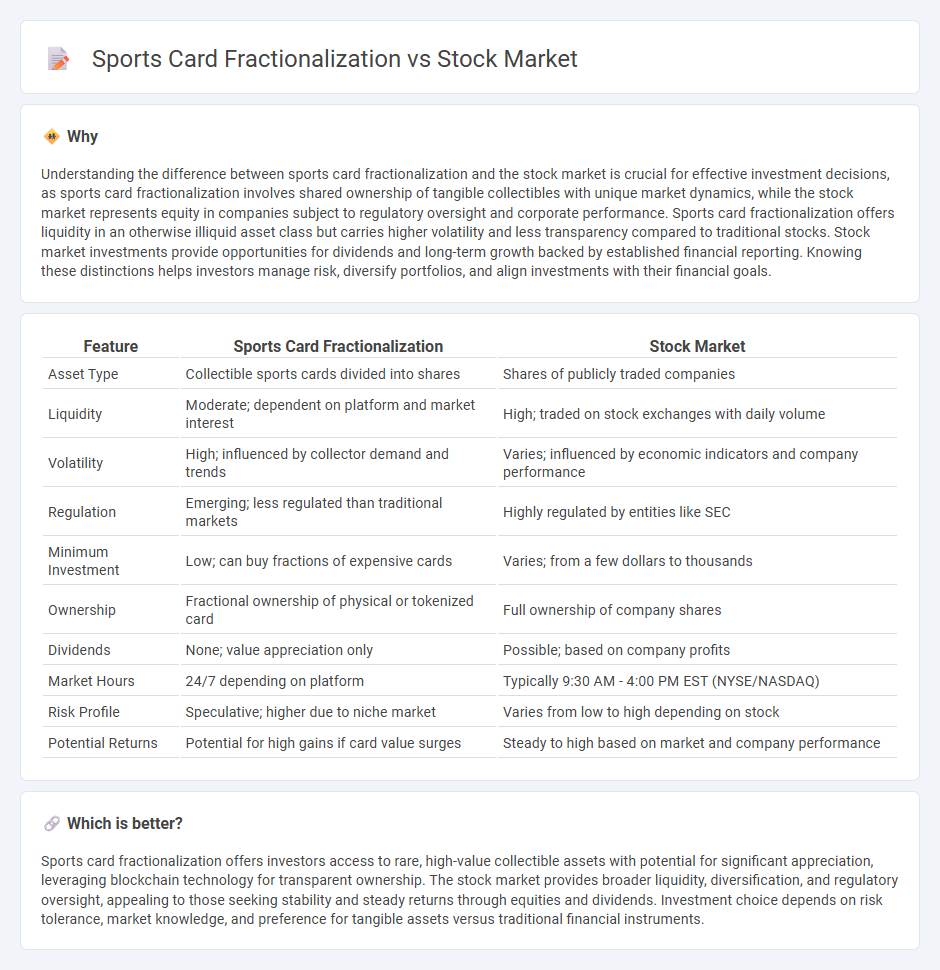

Understanding the difference between sports card fractionalization and the stock market is crucial for effective investment decisions, as sports card fractionalization involves shared ownership of tangible collectibles with unique market dynamics, while the stock market represents equity in companies subject to regulatory oversight and corporate performance. Sports card fractionalization offers liquidity in an otherwise illiquid asset class but carries higher volatility and less transparency compared to traditional stocks. Stock market investments provide opportunities for dividends and long-term growth backed by established financial reporting. Knowing these distinctions helps investors manage risk, diversify portfolios, and align investments with their financial goals.

Comparison Table

| Feature | Sports Card Fractionalization | Stock Market |

|---|---|---|

| Asset Type | Collectible sports cards divided into shares | Shares of publicly traded companies |

| Liquidity | Moderate; dependent on platform and market interest | High; traded on stock exchanges with daily volume |

| Volatility | High; influenced by collector demand and trends | Varies; influenced by economic indicators and company performance |

| Regulation | Emerging; less regulated than traditional markets | Highly regulated by entities like SEC |

| Minimum Investment | Low; can buy fractions of expensive cards | Varies; from a few dollars to thousands |

| Ownership | Fractional ownership of physical or tokenized card | Full ownership of company shares |

| Dividends | None; value appreciation only | Possible; based on company profits |

| Market Hours | 24/7 depending on platform | Typically 9:30 AM - 4:00 PM EST (NYSE/NASDAQ) |

| Risk Profile | Speculative; higher due to niche market | Varies from low to high depending on stock |

| Potential Returns | Potential for high gains if card value surges | Steady to high based on market and company performance |

Which is better?

Sports card fractionalization offers investors access to rare, high-value collectible assets with potential for significant appreciation, leveraging blockchain technology for transparent ownership. The stock market provides broader liquidity, diversification, and regulatory oversight, appealing to those seeking stability and steady returns through equities and dividends. Investment choice depends on risk tolerance, market knowledge, and preference for tangible assets versus traditional financial instruments.

Connection

Sports card fractionalization and the stock market are connected through the concept of asset tokenization, which allows high-value sports cards to be divided into smaller, tradable shares similar to stocks. This process enhances liquidity and accessibility, enabling more investors to participate in the collectibles market without purchasing entire cards. Platforms facilitating sports card fractionalization often leverage blockchain technology, mirroring stock market mechanisms to ensure transparency and secure ownership transfer.

Key Terms

**Stock Market:**

The stock market offers liquidity, regulatory oversight, and diversified investment opportunities through fractional shares, enabling investors to own portions of high-value companies. Fractional stock trading platforms like Robinhood and Schwab have democratized access, allowing small investors to build portfolios efficiently with minimal capital. Explore how fractional stock investing can transform your portfolio strategy and financial growth prospects.

Shares

Stock market shares represent ownership in publicly traded companies, offering liquidity, regulatory oversight, and price transparency. Sports card fractionalization divides ownership of high-value collectible cards into shares, enabling smaller investments and access to rare assets with varying liquidity. Explore the dynamics of shares in both markets to understand investment opportunities and risks.

Dividends

Unlike the stock market where dividends are regularly distributed to shareholders as a share of company profits, sports card fractionalization typically does not offer dividend returns. Investors in fractionalized sports cards mainly seek capital appreciation based on the card's market value rather than income generation. Explore how dividends impact investment strategies across different asset classes to make informed decisions.

Source and External Links

United States Stock Market Index - Quote - Chart - The main US stock market index (US500) rose to 6306 points on July 21, 2025, gaining 0.15% with a 13.31% increase year-over-year, reflecting recent positive market performance.

Stock market - The stock market is a marketplace where buyers and sellers trade shares representing company ownership, providing companies with capital for growth and investors with liquidity, and it acts as a key economic indicator and influence on financial stability.

How Stock Markets Work - Stocks are traded through public companies involving various market participants and order types, with transactions executed via brokerage accounts facilitating buying and selling of shares.

dowidth.com

dowidth.com