Vintage sneaker portfolios offer a tangible and culturally significant asset class that has seen rapid value appreciation, driven by limited supply and high collector demand. Private equity funds provide diversified investment opportunities in established businesses with the goal of generating long-term capital gains through strategic management and operational improvements. Explore the comparative benefits and risks of these alternative investment vehicles to make informed portfolio decisions.

Why it is important

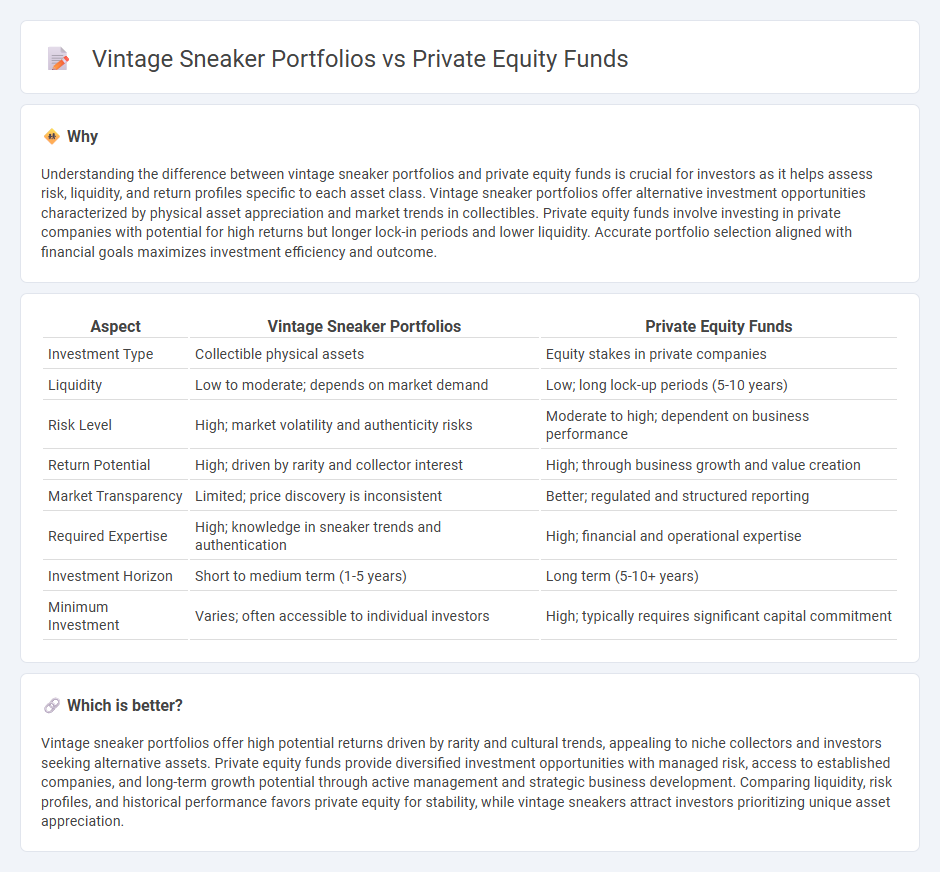

Understanding the difference between vintage sneaker portfolios and private equity funds is crucial for investors as it helps assess risk, liquidity, and return profiles specific to each asset class. Vintage sneaker portfolios offer alternative investment opportunities characterized by physical asset appreciation and market trends in collectibles. Private equity funds involve investing in private companies with potential for high returns but longer lock-in periods and lower liquidity. Accurate portfolio selection aligned with financial goals maximizes investment efficiency and outcome.

Comparison Table

| Aspect | Vintage Sneaker Portfolios | Private Equity Funds |

|---|---|---|

| Investment Type | Collectible physical assets | Equity stakes in private companies |

| Liquidity | Low to moderate; depends on market demand | Low; long lock-up periods (5-10 years) |

| Risk Level | High; market volatility and authenticity risks | Moderate to high; dependent on business performance |

| Return Potential | High; driven by rarity and collector interest | High; through business growth and value creation |

| Market Transparency | Limited; price discovery is inconsistent | Better; regulated and structured reporting |

| Required Expertise | High; knowledge in sneaker trends and authentication | High; financial and operational expertise |

| Investment Horizon | Short to medium term (1-5 years) | Long term (5-10+ years) |

| Minimum Investment | Varies; often accessible to individual investors | High; typically requires significant capital commitment |

Which is better?

Vintage sneaker portfolios offer high potential returns driven by rarity and cultural trends, appealing to niche collectors and investors seeking alternative assets. Private equity funds provide diversified investment opportunities with managed risk, access to established companies, and long-term growth potential through active management and strategic business development. Comparing liquidity, risk profiles, and historical performance favors private equity for stability, while vintage sneakers attract investors prioritizing unique asset appreciation.

Connection

Investment strategies involving vintage sneaker portfolios and private equity funds both capitalize on alternative asset markets characterized by high growth potential and limited liquidity. Vintage sneakers offer unique opportunities for diversification within alternative investments due to their collectible nature and increasing market demand, paralleling private equity funds that invest in private companies aiming for substantial returns through long-term value appreciation. Institutional investors often integrate these assets in portfolios to balance risk and enhance overall yield through exposure to non-traditional, high-value markets.

Key Terms

Liquidity

Private equity funds typically exhibit limited liquidity due to long lock-up periods, often spanning 7 to 10 years, restricting investor access to capital. In contrast, vintage sneaker portfolios offer higher liquidity with frequent secondary market sales enabling faster asset turnover. Explore detailed comparisons to understand how liquidity influences investment strategy and returns in both asset classes.

Valuation

Private equity funds primarily value assets through discounted cash flow analysis and comparable market transactions, emphasizing future earnings potential and exit strategies. Vintage sneaker portfolios use rarity, condition, provenance, and recent auction results as key valuation metrics, reflecting a niche market with high volatility and collector demand. Discover the intricate methods behind these valuation processes to better understand investment opportunities across diverse asset classes.

Due diligence

Due diligence in private equity funds involves comprehensive financial analysis, legal scrutiny, and market evaluation to mitigate risks and maximize returns, while vintage sneaker portfolios require assessing authenticity, condition, provenance, and market demand to ensure value preservation and growth. Both asset classes demand expertise and thorough research, but private equity emphasizes quantitative data, whereas sneaker investments rely heavily on qualitative factors and trend forecasting. Explore detailed strategies for due diligence in alternative asset management to enhance your investment decisions.

Source and External Links

Private equity fund - Wikipedia - A private equity fund is a collective investment vehicle, typically structured as a limited partnership with a 10-year term, that pools institutional investors' capital to invest in equity and occasionally debt securities, managed by a private equity firm acting as general partner.

Private Equity Funds - Know the Different Types of PE Funds - Private equity funds are pools of capital invested in companies with high return potential, usually having a fixed life of 4-7 years, and typically fall into categories such as venture capital or buyout funds, with investments often including a mix of equity and debt.

Private Equity Funds | Investor.gov - Private equity funds are pooled investment vehicles managed by private equity firms that invest in controlling or minority stakes in companies to increase their value over a long-term horizon, often 10 or more years, and are not registered with the SEC, limiting their public disclosure.

dowidth.com

dowidth.com