Wine investing and fine whisky investing both offer unique opportunities for portfolio diversification and potential high returns. Fine wines appreciate based on vintage, rarity, and provenance, while whisky value is driven by distillery reputation, age, and limited editions. Explore the nuances of these luxury asset classes to determine which aligns best with your investment strategy.

Why it is important

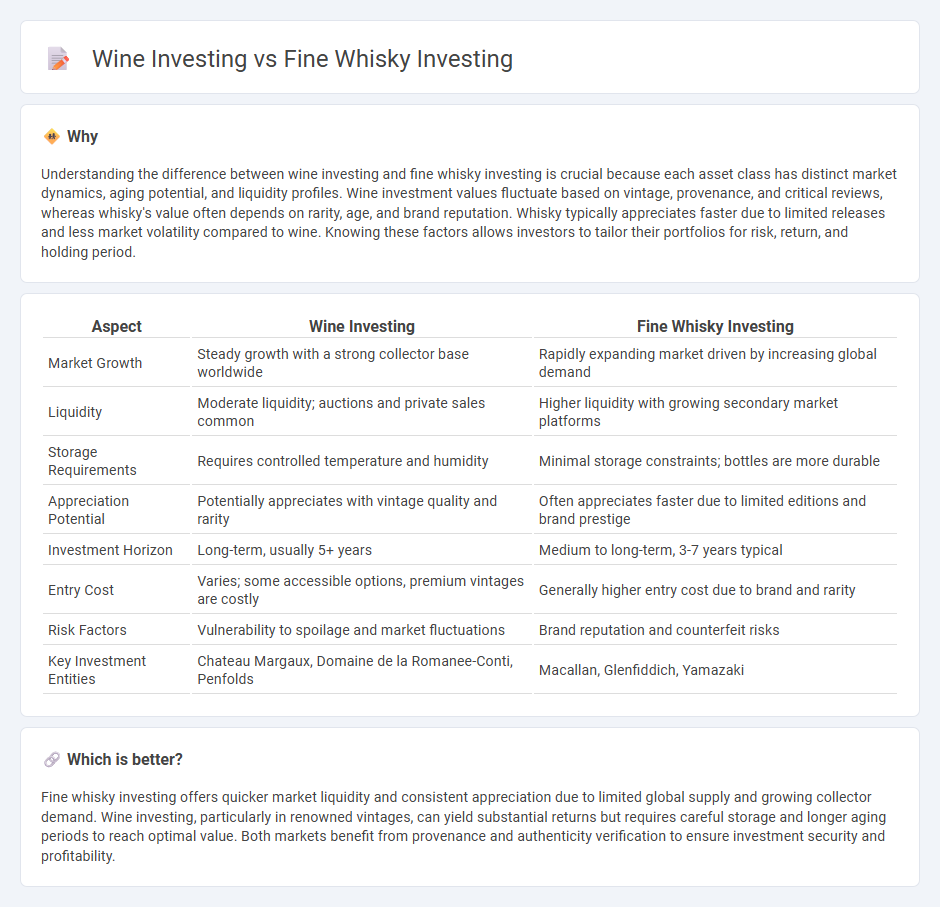

Understanding the difference between wine investing and fine whisky investing is crucial because each asset class has distinct market dynamics, aging potential, and liquidity profiles. Wine investment values fluctuate based on vintage, provenance, and critical reviews, whereas whisky's value often depends on rarity, age, and brand reputation. Whisky typically appreciates faster due to limited releases and less market volatility compared to wine. Knowing these factors allows investors to tailor their portfolios for risk, return, and holding period.

Comparison Table

| Aspect | Wine Investing | Fine Whisky Investing |

|---|---|---|

| Market Growth | Steady growth with a strong collector base worldwide | Rapidly expanding market driven by increasing global demand |

| Liquidity | Moderate liquidity; auctions and private sales common | Higher liquidity with growing secondary market platforms |

| Storage Requirements | Requires controlled temperature and humidity | Minimal storage constraints; bottles are more durable |

| Appreciation Potential | Potentially appreciates with vintage quality and rarity | Often appreciates faster due to limited editions and brand prestige |

| Investment Horizon | Long-term, usually 5+ years | Medium to long-term, 3-7 years typical |

| Entry Cost | Varies; some accessible options, premium vintages are costly | Generally higher entry cost due to brand and rarity |

| Risk Factors | Vulnerability to spoilage and market fluctuations | Brand reputation and counterfeit risks |

| Key Investment Entities | Chateau Margaux, Domaine de la Romanee-Conti, Penfolds | Macallan, Glenfiddich, Yamazaki |

Which is better?

Fine whisky investing offers quicker market liquidity and consistent appreciation due to limited global supply and growing collector demand. Wine investing, particularly in renowned vintages, can yield substantial returns but requires careful storage and longer aging periods to reach optimal value. Both markets benefit from provenance and authenticity verification to ensure investment security and profitability.

Connection

Wine investing and fine whisky investing share similar market dynamics, both relying on rarity, provenance, and aging potential to drive value appreciation. Collectors and investors benefit from the tangible asset classes' historical performance, where limited production and global demand create profitable opportunities. These markets often attract enthusiasts who leverage specialized knowledge and auction platforms to maximize returns.

Key Terms

Authentication

Authentication plays a critical role in fine whisky investing, where provenance is verified through batch numbers, distillery records, and expert appraisals to prevent counterfeit bottles from entering the market. Wine investing relies heavily on vintage verification, vineyard documentation, and bottle condition assessments to ensure authenticity and maintain value over time. Explore the nuanced authentication methods in both markets to make informed investment decisions.

Maturity/Ageing Potential

Fine whisky investing leverages the unique aging process in oak casks, which enhances flavor complexity and value over decades, making older bottles exceptionally sought after by collectors. Wine investing depends heavily on varietal-specific maturation potential, with certain vintages peaking within a defined timeframe before quality declines, requiring precise knowledge of optimal drinking windows. Explore detailed guides on maturation science and market trends to master investment strategies in both fine whisky and wine.

Market Liquidity

Fine whisky investing often benefits from higher market liquidity due to its growing global demand and the emergence of specialized auction platforms that facilitate quick transactions. Wine investing, while historically established with a robust secondary market, can face longer holding periods and price fluctuations influenced by vintage quality and storage conditions. Explore the nuances of market liquidity in both assets to make informed investment decisions.

Source and External Links

WhiskyInvestDirect - Invest in maturing Scotch whisky casks at wholesale prices and trade them on a transparent exchange, with average annualized returns over 15% after costs.

Whisky Partners - Buy and store whisky casks with minimized risk, benefitting from a booming global market where rare whiskies have appreciated 582% over the past decade.

Vinovest: Guide to Whiskey Investment - Focus on major brands and rare bottles for long-term gains, with whisky cask investments growing 33% in 2024 and top bottles selling for hundreds of thousands.

dowidth.com

dowidth.com