Sports memorabilia funds offer investors a unique asset class by fractionalizing ownership in rare collectibles, potentially yielding high returns driven by market demand and rarity. Mutual funds, by contrast, pool money from multiple investors to invest in diversified portfolios of stocks, bonds, or other securities, providing risk mitigation and liquidity. Explore the advantages and challenges of investing in sports memorabilia funds versus mutual funds to make an informed financial decision.

Why it is important

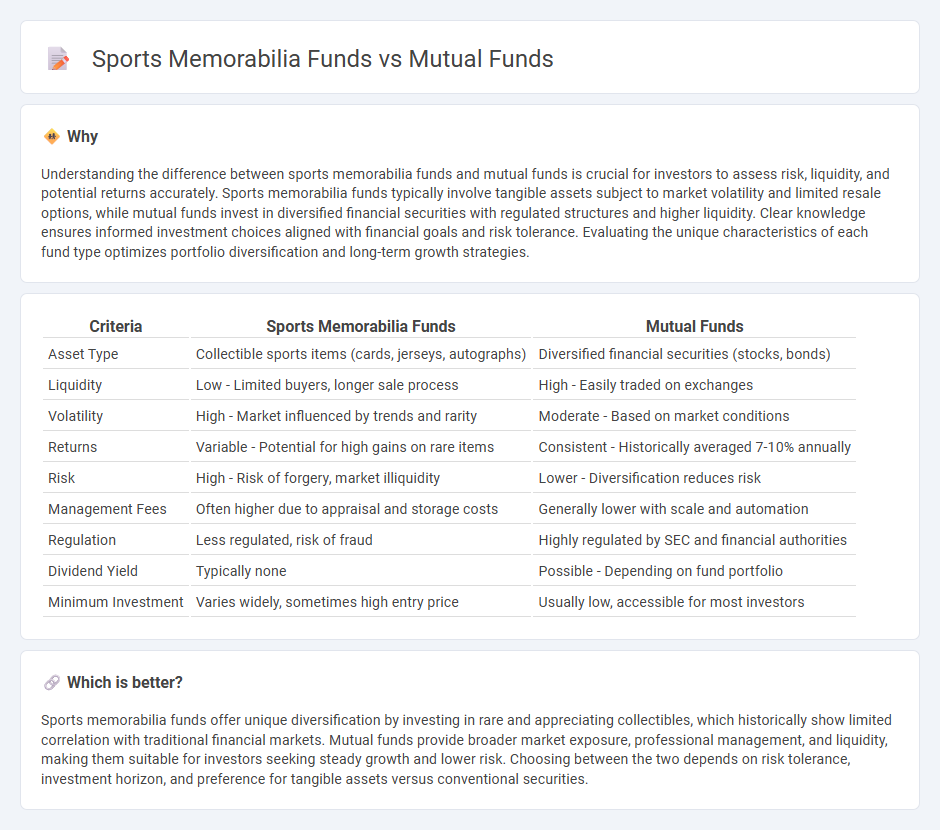

Understanding the difference between sports memorabilia funds and mutual funds is crucial for investors to assess risk, liquidity, and potential returns accurately. Sports memorabilia funds typically involve tangible assets subject to market volatility and limited resale options, while mutual funds invest in diversified financial securities with regulated structures and higher liquidity. Clear knowledge ensures informed investment choices aligned with financial goals and risk tolerance. Evaluating the unique characteristics of each fund type optimizes portfolio diversification and long-term growth strategies.

Comparison Table

| Criteria | Sports Memorabilia Funds | Mutual Funds |

|---|---|---|

| Asset Type | Collectible sports items (cards, jerseys, autographs) | Diversified financial securities (stocks, bonds) |

| Liquidity | Low - Limited buyers, longer sale process | High - Easily traded on exchanges |

| Volatility | High - Market influenced by trends and rarity | Moderate - Based on market conditions |

| Returns | Variable - Potential for high gains on rare items | Consistent - Historically averaged 7-10% annually |

| Risk | High - Risk of forgery, market illiquidity | Lower - Diversification reduces risk |

| Management Fees | Often higher due to appraisal and storage costs | Generally lower with scale and automation |

| Regulation | Less regulated, risk of fraud | Highly regulated by SEC and financial authorities |

| Dividend Yield | Typically none | Possible - Depending on fund portfolio |

| Minimum Investment | Varies widely, sometimes high entry price | Usually low, accessible for most investors |

Which is better?

Sports memorabilia funds offer unique diversification by investing in rare and appreciating collectibles, which historically show limited correlation with traditional financial markets. Mutual funds provide broader market exposure, professional management, and liquidity, making them suitable for investors seeking steady growth and lower risk. Choosing between the two depends on risk tolerance, investment horizon, and preference for tangible assets versus conventional securities.

Connection

Sports memorabilia funds and mutual funds are connected through their shared investment principles, focusing on portfolio diversification and capital appreciation. Both types of funds pool investors' money to acquire assets--sports memorabilia funds target rare collectibles while mutual funds invest in stocks, bonds, or other securities. This connection allows investors to benefit from professional management and risk mitigation strategies across distinct asset classes.

Key Terms

Diversification

Mutual funds offer broad diversification by pooling investments across various asset classes, reducing risk through exposure to stocks, bonds, and other securities. Sports memorabilia funds, while potentially lucrative, concentrate investments in collectible items like rare cards and autographed merchandise, leading to higher volatility and niche market risk. Explore the distinct advantages and risks of each fund type to make an informed investment choice.

Liquidity

Mutual funds offer high liquidity, allowing investors to buy and sell shares quickly on public exchanges, which provides easy access to capital. Sports memorabilia funds typically exhibit lower liquidity due to the niche market and the time required to appraise, value, and sell physical collectibles. Explore the differences in liquidity further to determine which investment aligns best with your financial goals.

Valuation

Mutual funds derive their valuation from the daily net asset value (NAV) calculated based on the market prices of underlying securities, providing transparency and liquidity for investors. Sports memorabilia funds rely on appraisals of collectible items, where valuation hinges on rarity, condition, and market demand, leading to less frequent and more subjective price assessments. Discover how these distinct valuation methods impact investor decisions and fund performance by exploring in-depth analyses.

Source and External Links

Mutual Funds - Investor.gov - A mutual fund pools money from many investors to buy a diversified portfolio of stocks, bonds, or other securities, managed by a professional investment adviser, and allows investors to buy or sell shares directly from the fund on any business day.

Mutual fund - Wikipedia - Mutual funds are investment vehicles that collect money from multiple investors to purchase a diversified portfolio of securities, often categorized by asset type (stocks, bonds, money market) and management style (active or passive), and are regulated to provide transparency on performance and fees.

Understanding mutual funds - Charles Schwab - Mutual funds offer a convenient and affordable way for individual investors to gain exposure to a wide range of investments, benefit from professional management, and enjoy diversification and potential cost savings through pooled investing.

dowidth.com

dowidth.com