Investment in song catalogs offers potential for steady royalty income and portfolio diversification, contrasting with gold bullion's traditional role as a tangible asset and inflation hedge. Song catalogs can generate recurring cash flows through licensing and streaming revenues, while gold bullion primarily provides value retention and liquidity. Explore the benefits and risks of each asset class to determine the best fit for your investment goals.

Why it is important

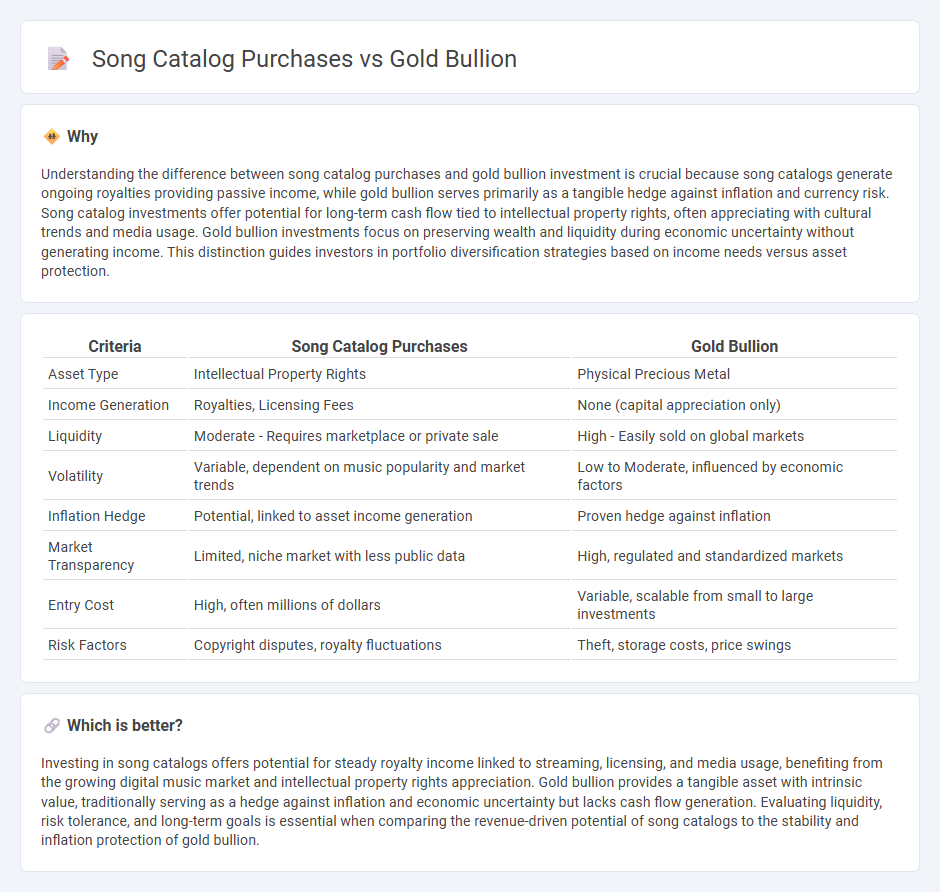

Understanding the difference between song catalog purchases and gold bullion investment is crucial because song catalogs generate ongoing royalties providing passive income, while gold bullion serves primarily as a tangible hedge against inflation and currency risk. Song catalog investments offer potential for long-term cash flow tied to intellectual property rights, often appreciating with cultural trends and media usage. Gold bullion investments focus on preserving wealth and liquidity during economic uncertainty without generating income. This distinction guides investors in portfolio diversification strategies based on income needs versus asset protection.

Comparison Table

| Criteria | Song Catalog Purchases | Gold Bullion |

|---|---|---|

| Asset Type | Intellectual Property Rights | Physical Precious Metal |

| Income Generation | Royalties, Licensing Fees | None (capital appreciation only) |

| Liquidity | Moderate - Requires marketplace or private sale | High - Easily sold on global markets |

| Volatility | Variable, dependent on music popularity and market trends | Low to Moderate, influenced by economic factors |

| Inflation Hedge | Potential, linked to asset income generation | Proven hedge against inflation |

| Market Transparency | Limited, niche market with less public data | High, regulated and standardized markets |

| Entry Cost | High, often millions of dollars | Variable, scalable from small to large investments |

| Risk Factors | Copyright disputes, royalty fluctuations | Theft, storage costs, price swings |

Which is better?

Investing in song catalogs offers potential for steady royalty income linked to streaming, licensing, and media usage, benefiting from the growing digital music market and intellectual property rights appreciation. Gold bullion provides a tangible asset with intrinsic value, traditionally serving as a hedge against inflation and economic uncertainty but lacks cash flow generation. Evaluating liquidity, risk tolerance, and long-term goals is essential when comparing the revenue-driven potential of song catalogs to the stability and inflation protection of gold bullion.

Connection

Song catalog purchases and gold bullion serve as alternative investment assets that offer portfolio diversification and protection against inflation. Both asset classes have shown resilience during economic downturns, with song catalogs generating steady royalty income while gold bullion maintains intrinsic value. Investors leverage these tangible and intangible assets to hedge risks and achieve long-term financial stability.

Key Terms

Tangible vs. Intangible Assets

Gold bullion represents a tangible asset with intrinsic value, physical form, and the ability to be stored or traded as a commodity. In contrast, song catalog purchases involve intangible assets that generate revenue through royalties, licensing, and intellectual property rights without physical ownership. Explore the benefits and risks of tangible versus intangible investments to optimize your asset portfolio.

Liquidity

Gold bullion offers high liquidity due to its global market presence and standardized pricing, allowing for quick conversion into cash with minimal transaction costs. Song catalog purchases can provide recurring revenue streams, but liquidity varies greatly depending on the popularity of the catalog and the terms of the rights agreement, often requiring longer sales processes. Explore the nuances of liquidity in asset types to make informed investment decisions.

Income Generation

Gold bullion offers stable, inflation-resistant value with limited direct income generation, primarily yielding returns through price appreciation. Song catalog purchases generate consistent royalty income streams from licensing, streaming, and performance rights, often providing higher cash flow and potential for long-term income growth. Explore these investment options in detail to determine which income-generating asset aligns best with your financial goals.

Source and External Links

Buy Gold Bullion | Gold Bars & Coins Online - Gold bullion refers to bars, rounds, and coins made of highly pure gold (.999+), commonly available in various sizes and weights; bars and rounds have values close to their melt value while coins carry face value and often a premium due to collector demand and official recognition by sovereign governments.

Bullion - Wikipedia - Bullion is highly refined precious metal, especially gold or silver, held as an investment with purity standards often set by market bodies; gold bullion bars must have at least 99.5% purity and bullion serves as a hedge against economic risks and portfolio diversifications.

Buy Gold Bullion Bars and Coins Online - Gold bullion bars and coins are investment-grade products available from private and government mints worldwide, with bars offering greater diversity and lower premiums than coins, and coins recognized for their official backing and legal tender status.

dowidth.com

dowidth.com