Digital real estate offers tangible virtual assets within metaverse platforms, providing stable, long-term value through scarcity and location-based demand. Cryptocurrency delivers high liquidity and potential for rapid gains, driven by blockchain technology and market volatility. Explore the unique opportunities and risks of digital real estate and cryptocurrency investments to make informed decisions.

Why it is important

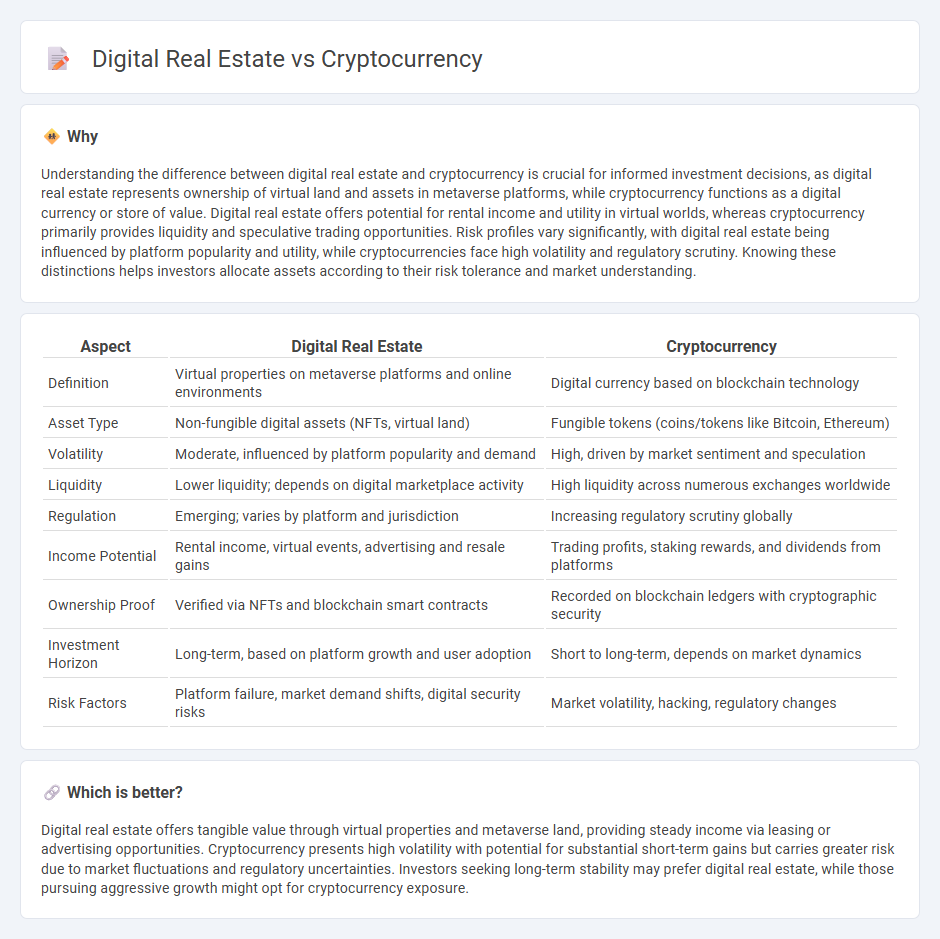

Understanding the difference between digital real estate and cryptocurrency is crucial for informed investment decisions, as digital real estate represents ownership of virtual land and assets in metaverse platforms, while cryptocurrency functions as a digital currency or store of value. Digital real estate offers potential for rental income and utility in virtual worlds, whereas cryptocurrency primarily provides liquidity and speculative trading opportunities. Risk profiles vary significantly, with digital real estate being influenced by platform popularity and utility, while cryptocurrencies face high volatility and regulatory scrutiny. Knowing these distinctions helps investors allocate assets according to their risk tolerance and market understanding.

Comparison Table

| Aspect | Digital Real Estate | Cryptocurrency |

|---|---|---|

| Definition | Virtual properties on metaverse platforms and online environments | Digital currency based on blockchain technology |

| Asset Type | Non-fungible digital assets (NFTs, virtual land) | Fungible tokens (coins/tokens like Bitcoin, Ethereum) |

| Volatility | Moderate, influenced by platform popularity and demand | High, driven by market sentiment and speculation |

| Liquidity | Lower liquidity; depends on digital marketplace activity | High liquidity across numerous exchanges worldwide |

| Regulation | Emerging; varies by platform and jurisdiction | Increasing regulatory scrutiny globally |

| Income Potential | Rental income, virtual events, advertising and resale gains | Trading profits, staking rewards, and dividends from platforms |

| Ownership Proof | Verified via NFTs and blockchain smart contracts | Recorded on blockchain ledgers with cryptographic security |

| Investment Horizon | Long-term, based on platform growth and user adoption | Short to long-term, depends on market dynamics |

| Risk Factors | Platform failure, market demand shifts, digital security risks | Market volatility, hacking, regulatory changes |

Which is better?

Digital real estate offers tangible value through virtual properties and metaverse land, providing steady income via leasing or advertising opportunities. Cryptocurrency presents high volatility with potential for substantial short-term gains but carries greater risk due to market fluctuations and regulatory uncertainties. Investors seeking long-term stability may prefer digital real estate, while those pursuing aggressive growth might opt for cryptocurrency exposure.

Connection

Digital real estate and cryptocurrency are intrinsically connected through blockchain technology, which ensures secure ownership and transparent transactions. Cryptocurrency serves as a medium of exchange and investment tool within digital real estate markets, facilitating NFT-based property sales and virtual land trading on platforms like Decentraland and The Sandbox. This integration creates innovative financial ecosystems that blend decentralized finance (DeFi) with virtual asset management.

Key Terms

Blockchain

Blockchain technology underpins both cryptocurrency and digital real estate, offering decentralized, transparent, and secure transaction frameworks. Cryptocurrencies utilize blockchain for peer-to-peer digital currency exchange, while digital real estate leverages smart contracts and non-fungible tokens (NFTs) to verify ownership and facilitate virtual property trading. Explore the evolving intersection of blockchain applications in finance and virtual asset markets to understand their transformative potential better.

Tokenization

Tokenization in cryptocurrency allows digital assets to be divided into smaller units, enabling fractional ownership and efficient trading on blockchain platforms. In digital real estate, tokenization transforms property ownership into tradeable tokens, increasing liquidity and reducing entry barriers for investors. Explore how tokenization bridges these markets to unlock innovative investment opportunities.

Asset Ownership

Cryptocurrency represents digital assets secured by blockchain technology, offering decentralized ownership and easy transferability without intermediaries. Digital real estate refers to virtual properties situated within metaverse platforms or blockchain-based environments, granting users exclusive rights similar to physical property ownership. Explore how these distinct asset classes shape future investment strategies and individual control over digital wealth.

Source and External Links

What is Cryptocurrency and How Does it Work? - Cryptocurrency is a digital payment system operating on a decentralized blockchain, secured by cryptography, allowing peer-to-peer transactions without banks, with Bitcoin as the first and most known example.

Cryptocurrency - Cryptocurrencies are digital currencies functioning through decentralized networks using blockchain and consensus mechanisms like proof of work or proof of stake, with over 25,000 types existing and a market cap of about $2.76 trillion as of April 2025.

Digital Currencies | Explainer | Education - Cryptocurrencies like Bitcoin use blockchain technology to securely record transactions verified by network users called miners, who solve complex cryptographic problems to validate and add transaction blocks to the ledger.

dowidth.com

dowidth.com