The secondaries market offers investors opportunities to buy and sell pre-existing private equity interests, providing liquidity and portfolio diversification. In contrast, the debt market primarily involves borrowing and lending activities with fixed income securities, focusing on interest income and credit risk management. Explore these distinct investment avenues to understand their unique advantages and strategic roles in wealth building.

Why it is important

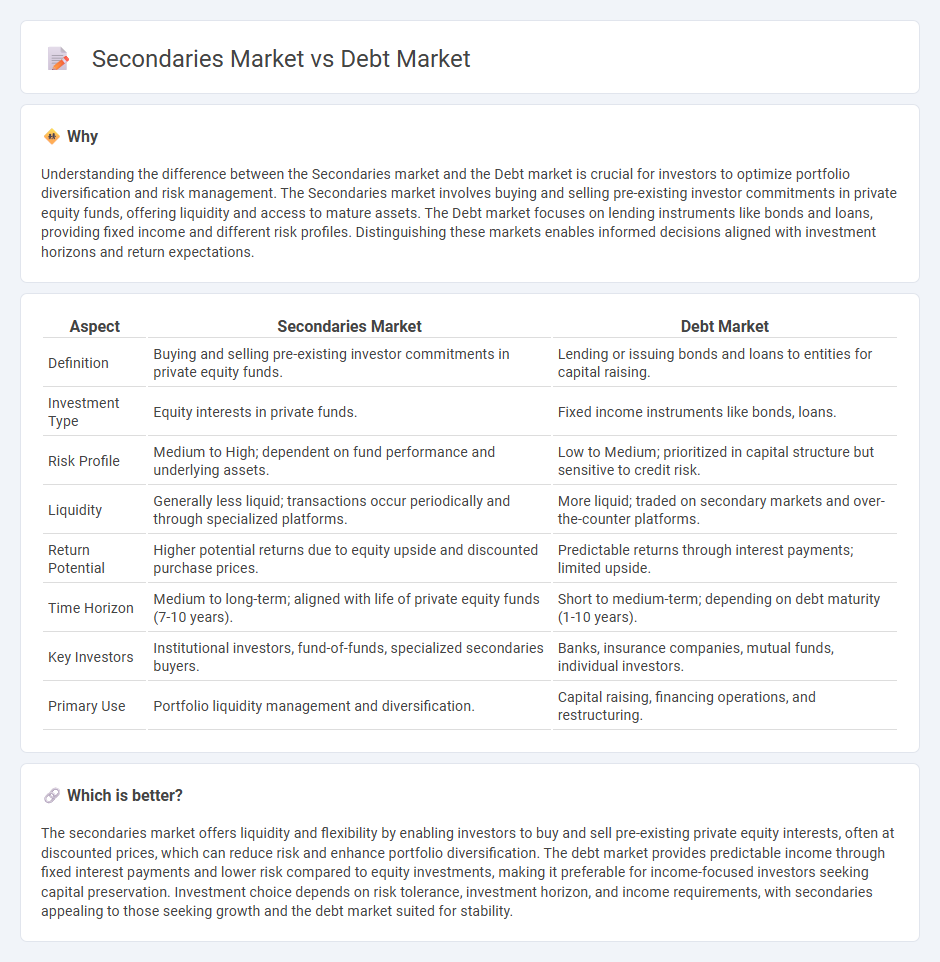

Understanding the difference between the Secondaries market and the Debt market is crucial for investors to optimize portfolio diversification and risk management. The Secondaries market involves buying and selling pre-existing investor commitments in private equity funds, offering liquidity and access to mature assets. The Debt market focuses on lending instruments like bonds and loans, providing fixed income and different risk profiles. Distinguishing these markets enables informed decisions aligned with investment horizons and return expectations.

Comparison Table

| Aspect | Secondaries Market | Debt Market |

|---|---|---|

| Definition | Buying and selling pre-existing investor commitments in private equity funds. | Lending or issuing bonds and loans to entities for capital raising. |

| Investment Type | Equity interests in private funds. | Fixed income instruments like bonds, loans. |

| Risk Profile | Medium to High; dependent on fund performance and underlying assets. | Low to Medium; prioritized in capital structure but sensitive to credit risk. |

| Liquidity | Generally less liquid; transactions occur periodically and through specialized platforms. | More liquid; traded on secondary markets and over-the-counter platforms. |

| Return Potential | Higher potential returns due to equity upside and discounted purchase prices. | Predictable returns through interest payments; limited upside. |

| Time Horizon | Medium to long-term; aligned with life of private equity funds (7-10 years). | Short to medium-term; depending on debt maturity (1-10 years). |

| Key Investors | Institutional investors, fund-of-funds, specialized secondaries buyers. | Banks, insurance companies, mutual funds, individual investors. |

| Primary Use | Portfolio liquidity management and diversification. | Capital raising, financing operations, and restructuring. |

Which is better?

The secondaries market offers liquidity and flexibility by enabling investors to buy and sell pre-existing private equity interests, often at discounted prices, which can reduce risk and enhance portfolio diversification. The debt market provides predictable income through fixed interest payments and lower risk compared to equity investments, making it preferable for income-focused investors seeking capital preservation. Investment choice depends on risk tolerance, investment horizon, and income requirements, with secondaries appealing to those seeking growth and the debt market suited for stability.

Connection

The Secondaries market and Debt market intersect through the trading of privately-held debt instruments and distressed debt assets, providing liquidity opportunities for investors outside the primary issuance phase. Secondary market transactions often involve the sale of debt securities initially acquired in private placements, enabling portfolio rebalancing and risk management. This connection enhances market efficiency by facilitating price discovery and capital allocation within private credit and leveraged finance sectors.

Key Terms

Debt market:

The debt market, also known as the bond market, is a marketplace where investors buy and sell debt securities, primarily government and corporate bonds, providing issuers with access to capital through fixed income instruments. It plays a crucial role in the global financial ecosystem by facilitating liquidity, interest rate discovery, and risk management for investors and issuers alike. Explore further insights into how the debt market impacts investment strategies and economic growth.

Bonds

The debt market primarily involves the issuance and trading of bonds, enabling governments and corporations to raise capital through fixed-income securities that offer regular interest payments and principal repayment at maturity. In contrast, the secondaries market refers to the trading of existing debt instruments, including bonds, where investors buy and sell previously issued securities, providing liquidity and price discovery. Explore further to understand how these markets affect bond valuation and investment strategies.

Yield

Debt markets primarily offer fixed returns through instruments such as bonds and debentures, where yield is influenced by interest rates, credit risk, and maturity period. Secondaries markets, dealing with pre-owned securities and private equity stakes, provide yield opportunities driven by market liquidity, asset valuation adjustments, and investor demand. Explore further to understand how yield dynamics differ between debt and secondaries markets.

Source and External Links

Debt Market: Meaning, Benefits, Types and How it Works? - The debt market is a financial marketplace where investors buy and sell debt securities issued by governments or corporations, providing lenders with periodic interest and principal repayment at maturity, broadly divided into government securities and corporate bonds.

Debt Capital Markets (DCM) Explained: Definitive Guide - Debt Capital Markets are platforms where companies and governments raise funds by issuing debt securities, with DCM professionals advising clients on issuing debt to refinance or raise capital at favorable interest rates.

Bond market - The bond market or debt market is a large financial market for issuing new debt or trading existing bonds, with government bonds serving as benchmarks for risk and interest rates and bonds being more regulated and frequently traded compared to bank loans.

dowidth.com

dowidth.com