Wine cask aging enhances flavor complexity through controlled oxidation and interaction with oak, increasing wine's market value and appeal to collectors. Forestry investment offers long-term asset growth by capitalizing on timber price appreciation and sustainable land management, diversifying portfolios with environmental benefits. Discover how these unique investment strategies can optimize your asset allocation and financial returns.

Why it is important

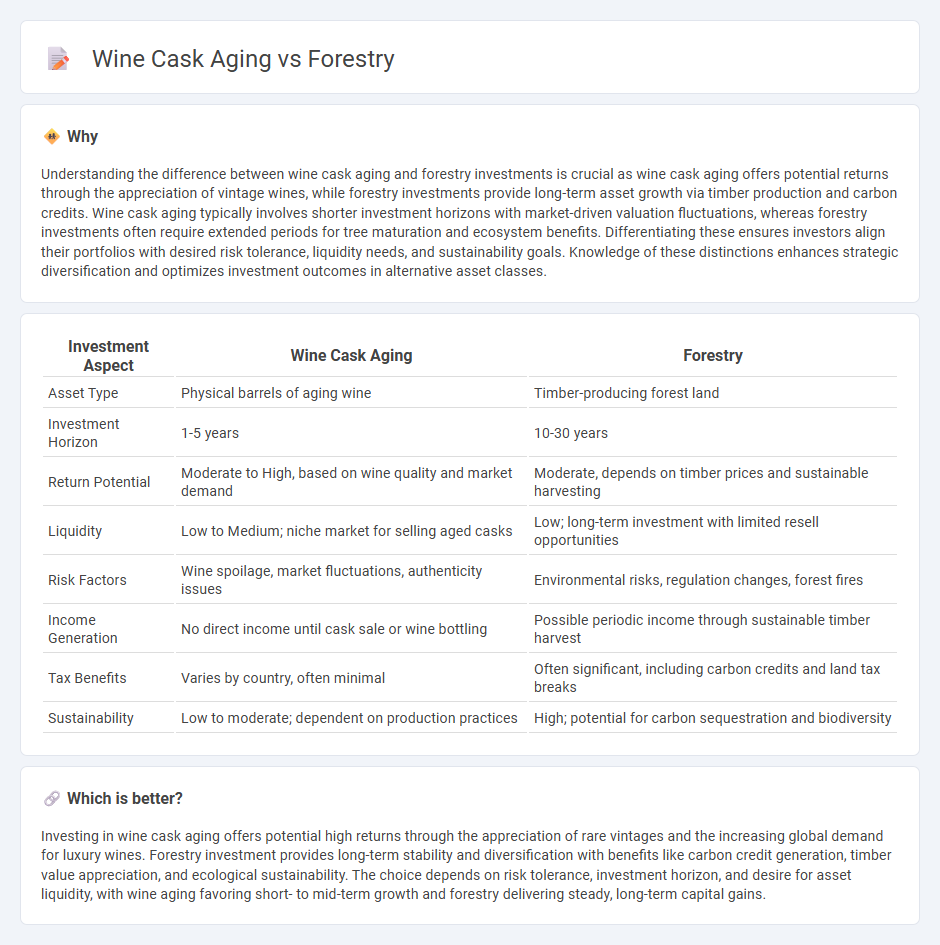

Understanding the difference between wine cask aging and forestry investments is crucial as wine cask aging offers potential returns through the appreciation of vintage wines, while forestry investments provide long-term asset growth via timber production and carbon credits. Wine cask aging typically involves shorter investment horizons with market-driven valuation fluctuations, whereas forestry investments often require extended periods for tree maturation and ecosystem benefits. Differentiating these ensures investors align their portfolios with desired risk tolerance, liquidity needs, and sustainability goals. Knowledge of these distinctions enhances strategic diversification and optimizes investment outcomes in alternative asset classes.

Comparison Table

| Investment Aspect | Wine Cask Aging | Forestry |

|---|---|---|

| Asset Type | Physical barrels of aging wine | Timber-producing forest land |

| Investment Horizon | 1-5 years | 10-30 years |

| Return Potential | Moderate to High, based on wine quality and market demand | Moderate, depends on timber prices and sustainable harvesting |

| Liquidity | Low to Medium; niche market for selling aged casks | Low; long-term investment with limited resell opportunities |

| Risk Factors | Wine spoilage, market fluctuations, authenticity issues | Environmental risks, regulation changes, forest fires |

| Income Generation | No direct income until cask sale or wine bottling | Possible periodic income through sustainable timber harvest |

| Tax Benefits | Varies by country, often minimal | Often significant, including carbon credits and land tax breaks |

| Sustainability | Low to moderate; dependent on production practices | High; potential for carbon sequestration and biodiversity |

Which is better?

Investing in wine cask aging offers potential high returns through the appreciation of rare vintages and the increasing global demand for luxury wines. Forestry investment provides long-term stability and diversification with benefits like carbon credit generation, timber value appreciation, and ecological sustainability. The choice depends on risk tolerance, investment horizon, and desire for asset liquidity, with wine aging favoring short- to mid-term growth and forestry delivering steady, long-term capital gains.

Connection

Investment in wine cask aging and forestry share a sustainable asset management approach that enhances value through natural maturation and growth processes. Wine cask aging relies on oak barrels sourced from managed forests, linking forestry practices directly to the quality and characteristics of aged wine. Sustainable forestry ensures a continuous supply of high-quality oak, supporting investment in premium wine production and long-term ecological balance.

Key Terms

Asset Longevity

Forestry-aged assets benefit from natural, slow oxidation processes in wood casks that enhance durability and value over time, while wine cask aging imparts unique tannins and flavors that accelerate maturation and asset refinement. Both methods influence asset longevity through distinct environmental interactions and chemical transformations within the wood matrix. Discover deeper insights into how aging mediums impact long-term asset preservation and market performance.

Yield Variability

Yield variability in forestry is influenced by factors such as tree species, soil quality, climate conditions, and forest management practices, resulting in fluctuating timber volumes and wood properties. In wine cask aging, yield variability pertains to the wine's maturation rate, influenced by cask type, wood origin, size, and environmental conditions like temperature and humidity. Explore how understanding yield variability in both contexts can optimize resource quality and production efficiency.

Market Liquidity

Forestry asset-backed tokens and wine cask aging investment shares present unique market liquidity profiles, with forestry assets typically offering longer lock-in periods and less frequent trading opportunities due to their natural growth cycles and regulatory frameworks. Wine cask aging investments benefit from shorter maturation timelines, enabling relatively faster turnover and potentially higher market liquidity as casks can be bottled and sold within a few years. Explore further insights on how these differences impact investor strategies and market dynamics.

Source and External Links

Forestry - Wikipedia - Forestry is the science and craft of creating, managing, planting, using, conserving, and repairing forests for environmental and economic benefits, involving practices such as silviculture and multiple-use management to support timber production, biodiversity, and ecosystem services.

Forestry | Home - USDA - The USDA promotes sustainable forestry practices including agroforestry, forest research, healthy forest initiatives, and landowner assistance programs to conserve and manage forest resources for economic, environmental, and social benefits.

Home - forests.org - forests.org supports sustainable forestry practices in North America, focusing on community engagement, Indigenous relations, climate-smart forestry, and advancing forest stewardship through education, standards, and strategic initiatives.

dowidth.com

dowidth.com