Wine investing platforms offer access to fine wine markets with potential for high returns through asset appreciation and portfolio diversification, leveraging the growing demand for rare vintages. Farmland investment platforms provide opportunities to invest in agricultural land, benefiting from long-term land value appreciation, crop yield revenue, and inflation hedge properties. Discover how these distinct asset classes compare and which investment strategy aligns with your financial goals.

Why it is important

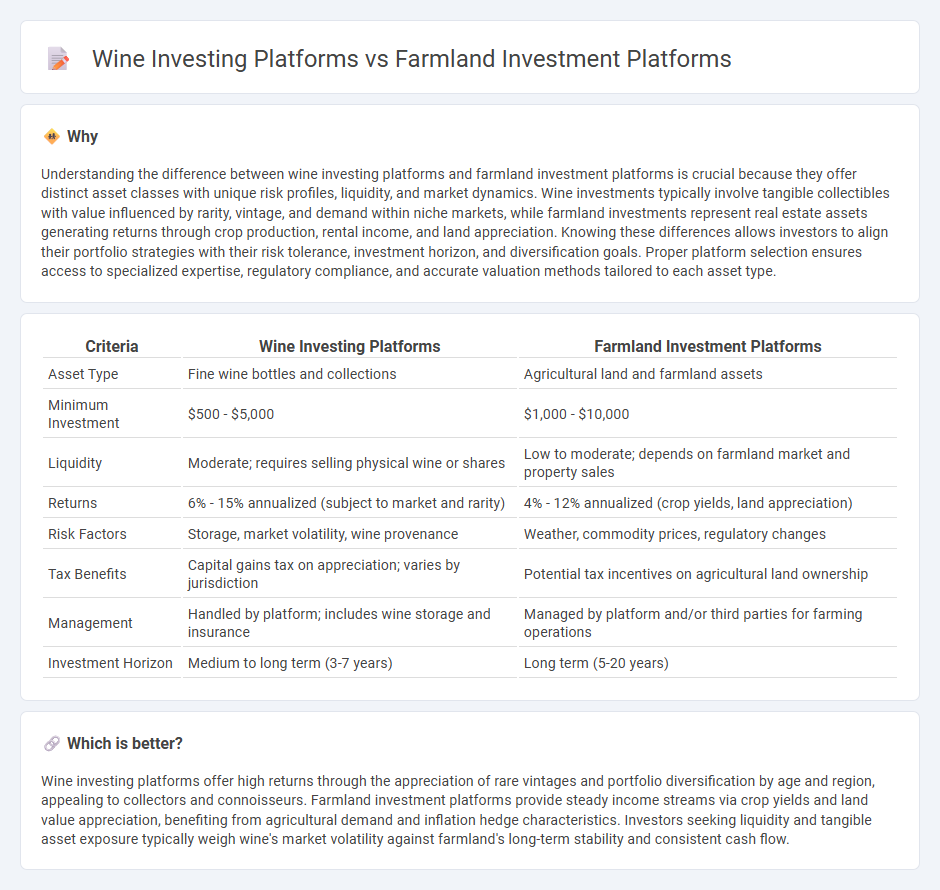

Understanding the difference between wine investing platforms and farmland investment platforms is crucial because they offer distinct asset classes with unique risk profiles, liquidity, and market dynamics. Wine investments typically involve tangible collectibles with value influenced by rarity, vintage, and demand within niche markets, while farmland investments represent real estate assets generating returns through crop production, rental income, and land appreciation. Knowing these differences allows investors to align their portfolio strategies with their risk tolerance, investment horizon, and diversification goals. Proper platform selection ensures access to specialized expertise, regulatory compliance, and accurate valuation methods tailored to each asset type.

Comparison Table

| Criteria | Wine Investing Platforms | Farmland Investment Platforms |

|---|---|---|

| Asset Type | Fine wine bottles and collections | Agricultural land and farmland assets |

| Minimum Investment | $500 - $5,000 | $1,000 - $10,000 |

| Liquidity | Moderate; requires selling physical wine or shares | Low to moderate; depends on farmland market and property sales |

| Returns | 6% - 15% annualized (subject to market and rarity) | 4% - 12% annualized (crop yields, land appreciation) |

| Risk Factors | Storage, market volatility, wine provenance | Weather, commodity prices, regulatory changes |

| Tax Benefits | Capital gains tax on appreciation; varies by jurisdiction | Potential tax incentives on agricultural land ownership |

| Management | Handled by platform; includes wine storage and insurance | Managed by platform and/or third parties for farming operations |

| Investment Horizon | Medium to long term (3-7 years) | Long term (5-20 years) |

Which is better?

Wine investing platforms offer high returns through the appreciation of rare vintages and portfolio diversification by age and region, appealing to collectors and connoisseurs. Farmland investment platforms provide steady income streams via crop yields and land value appreciation, benefiting from agricultural demand and inflation hedge characteristics. Investors seeking liquidity and tangible asset exposure typically weigh wine's market volatility against farmland's long-term stability and consistent cash flow.

Connection

Wine investing platforms and farmland investment platforms share a connection through their focus on alternative assets that offer portfolio diversification and inflation hedge benefits. Both platforms provide investors access to tangible, appreciating assets--wine through collectible bottles with increasing rarity and farmland through productive agricultural land generating steady income. These investments appeal to those seeking long-term value outside traditional stocks and bonds, leveraging assets tied to global demand trends in fine wines and agricultural commodities.

Key Terms

Asset Liquidity

Farmland investment platforms typically offer higher asset liquidity due to the ability to buy and sell shares more frequently, often supported by established secondary markets. Wine investing platforms usually involve longer holding periods and limited exit opportunities, as fine wine market transactions are less standardized and dependent on auction or private sales. Explore the detailed liquidity profiles of each asset class to optimize your investment strategy.

Yield Potential

Farmland investment platforms typically offer stable annual returns averaging 6-8% through crop production and land appreciation, while wine investing platforms can yield higher returns, often exceeding 10% due to the rarity and aging potential of fine wines. Farmland investments benefit from tangible assets and diversification into agricultural commodities, whereas wine investments carry market volatility but promise portfolio diversification through alternative assets. Discover more about maximizing yield potential by exploring both farmland and wine investment opportunities.

Regulatory Compliance

Regulatory compliance for farmland investment platforms involves adherence to agricultural land use laws, environmental regulations, and securities laws governing investment offerings. Wine investing platforms must comply with alcohol distribution laws, tax regulations, and securities laws relevant to collectible asset transactions. Explore detailed regulatory frameworks to understand the risks and legal requirements in each investment type.

Source and External Links

Here Are 5 Interesting Farmland Investing Platforms For 2025 - Details popular platforms such as AcreTrader, FarmTogether, Steward, Harvest Returns, and Farmfolio, highlighting their accessibility, minimum investments, types of investments, and fees for farmland investing.

FarmTogether vs Acretrader | Which Farm Crowdfunding Platform is ... - Compares FarmTogether and AcreTrader, two major farmland crowdfunding platforms mainly for accredited investors with minimum investments ranging from $10,000 to $15,000, focusing on their fees, investment offerings, and investor requirements.

FarmFundr | Agriculture Crowdfunding Investment Farms - Introduces FarmFundr, a farmer-owned equity crowdfunding platform offering fractional farmland ownership primarily in specialty crop operations across the U.S., with management handled by the platform and profits distributed annually to investors.

dowidth.com

dowidth.com